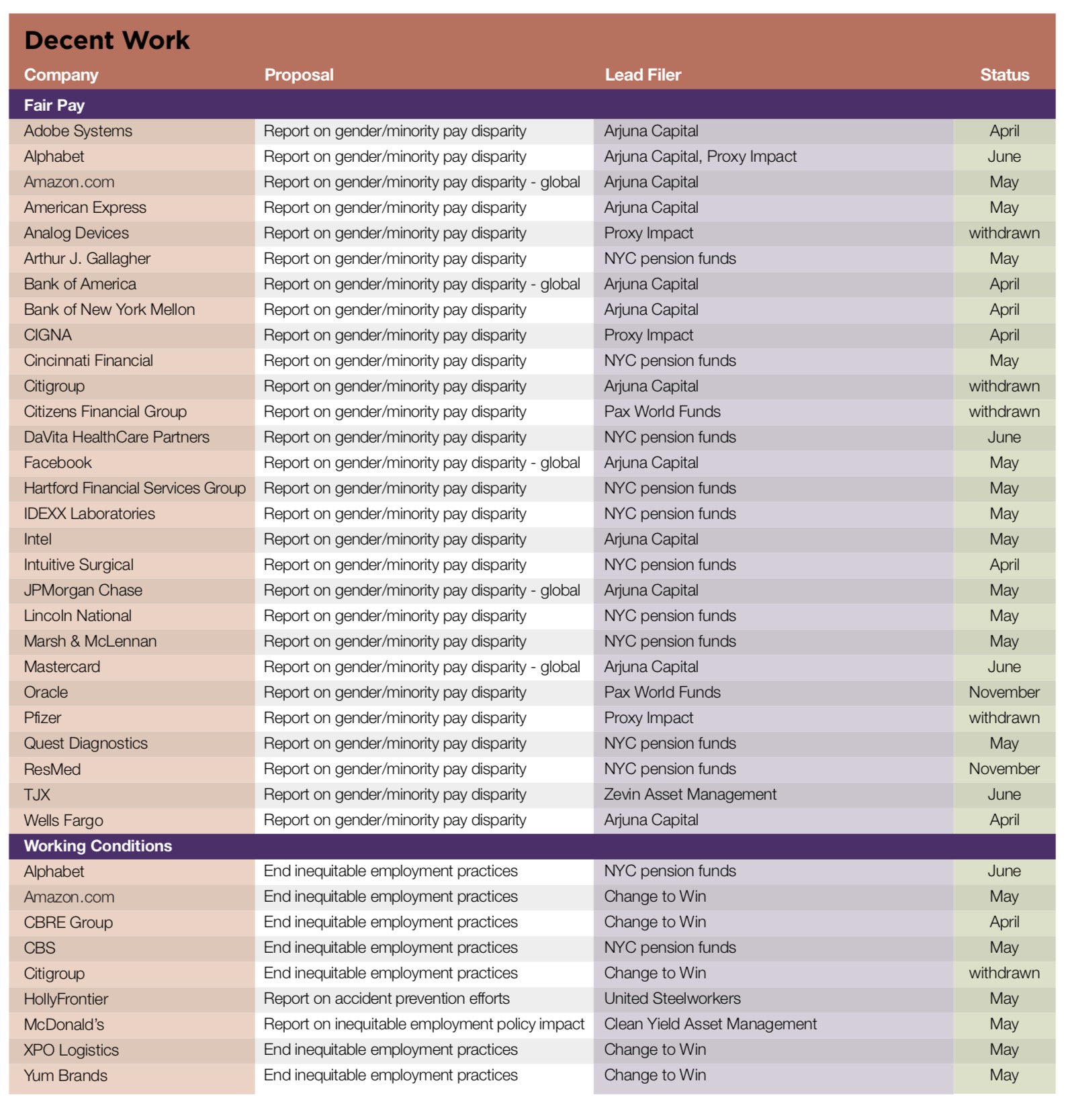

As economic inequality gapes ever wider in the United States, shareholder proponents have turned their attention to fair pay as well as the working conditions provided by companies. Women and people of color continue to earn less than their white male counterparts and the campaign to rectify these differences continues in 2019. (Workplace diversity is covered separately in this report, p. 45.) So far, proponents have filed 37 proposals. As in the last several years (see graph, page 42), most ask for more data on pay disparities. Seven from the New York City pension funds and the trade union consortium Change to Win take up the new issue of the inequitable impact of non-disclosure agreements, while HollyFrontier faces a question about accident prevention.

Gender and Minority Pay Equity

Women: Arjuna Capital remains the most prolific of the proponents in this area; the New York City pension funds is a key player, too. Additional proposals on pay equity are from Proxy Impact, a shareholder advocacy advisor, and Pax World Funds submitted and withdrew one proposal.

Arjuna is asking 11 companies, eight of them for the second year running to report on gender pay disparity:

• At six companies—Adobe Systems, American

Express, Bank of New York Mellon, Citigroup, Intel and

Wells Fargo—it wants a description of “the risks to the

company associated with emerging public policies

addressing the gender pay gap, including associated

reputational, competitive, and operational risks, and risks related to recruiting and retaining female talent.” It says the gender pay gap is “the difference between male and female median earnings expressed as a percentage of male earnings,” as defined by the Organization for Economic Cooperation and Development. The proposal this year is somewhat more specific than last year, when it simply asked for policies and goals “to reduce the gender pay gap.”

• At the other six—Alphabet, Amazon.com, Bank of America, Facebook, JPMorganChase and Mastercard—it seeks a“report on the company’s global median gender pay gap” as well as the information requested in the other resolution on risks.

GENDER PAY GAP IS MORE THAN JUST SALARY – IT IS ALSO ABOUT OPPORTUNITY

Michael Passoff

CEO, Proxy Impact

Numerous studies show women are paid less than their male counterparts. This is a key challenge for companies as they face reputational risk, consumer backlash, new legislation and governmental and employee lawsuits. Just the perception of a gender pay gap can make it hard to recruit or keep top talent.

Votes last year for Arjuna on pay equity were 15.7 percent at Alphabet, 15.1 percent at Express Scripts and 10 percent at Facebook. The group withdrew most of its 2018 filings after reaching agreements with major banks about actions they planned to take to close their pay gaps.

At 10 companies, the New York City pension funds want to know “whether there exists a gender pay gap among the company’s employees, and if so, the measures being taken (policies, programs, goals etc.) to eliminate any such pay disparities and to facilitate an environment that promotes opportunities for equal advancement for women.” It asks for the report by December 2019.

Proxy Impact has asked Analog Devices, CIGNA and Pfizer to report “identifying whether a gender pay gap exists among its employees, and if so, outline the steps being taken to reduce the gap.” It also uses the OECD pay gap definition.

Withdrawals—Arjuna has withdrawn following an agreement at Citigroup. Pax World Funds withdrew after Citizens Financial agreed to enhance its pay equity disclosures. It has asked the same things as Proxy Impact—about whether a pay gap exists and any corrective steps underway.

Proxy Impact withdrew after a significant commitment from Pfizer. The company will hire outside experts to assess in the first half of 2019 whether it has a global gender pay gap and a U.S. race pay gap, and the sources for any gaps, and report publicly on the results by no later than early 2020. The company says, “we believe we pay our US colleagues fairly and equitably,” but it found a 14.5 percentage point pay gap in the U.K. and a 24.8 percentage point bonus gap.

SEC action—Two company challenges have emerged so far. Bank of America and Wells Fargo both are contending the resolution impermissibly consists of multiple proposals and relates to ordinary business by seeking to “micromanage” the company.

Gender, race and ethnicity: Zevin Asset Management is reprising its proposal to TJX that earned 26.2 percent last year. It asks for a report “on the Company’s policies and goals to identify and reduce inequities in compensation due to gender, race, or ethnicity within its workforce. Gender-, race-, or ethnicity-based inequities are defined as the difference, expressed as a percentage, between the earnings of each demographic group in comparable roles.”

Working Conditions

Mandatory arbitration and non-disclosure agreements: A new campaign from the New York City pension funds and comptroller Scott Stringer, joined by the federation of labor unions Change to Win, seeks an end to what they term “inequitable employment practices.” They have asked Alphabet, Amazon.com, CBRE Group, CBS, Citigroup, XPO Logistics and Yum Brands to adopt a policy not to

engage in any Inequitable Employment Practice. “Inequitable Employment Practices” are mandatory arbitration of employment-related claims, non-compete agreements with employees, agreements with other companies not to recruit one another’s employees, and involuntary non-disclosure agreements (“NDAs”) that employees are required to sign in connection with settlement of claims that any [company] employee engaged in unlawful discrimination or harassment.

In a December 14 press release, Stringer said a hostile working environment at Alphabet/Google and CBS has prompted “public lawsuits and mass employee walk-outs,” with practices that have “wide-ranging impacts on the broader economy as well as workers’ rights.” The release said the targeted practices have been “pinpointed as drivers behind corporate cover-up of harassment and tools used to retaliate against whistleblowers.” It said the consequences are damaging to workers, investors and the public.

Taking a similar approach, Clean Yield wants McDonald’s to report “on the potential impact on the company of emerging state and federal policies described in this proposal to prevent harassment and discrimination against any EEO-protected classes of employees by restricting nondisclosure and compulsory arbitration agreements.” The resolution takes note of a February 2018 letter from all 50 state attorneys general to Congress seeking an end to mandatory arbitration in sexual harassment cases, which said this would help end “the culture of silence that protects perpetrators at the cost of their victims.” It also points to related bills in 16 states and laws in seven states, while noting that several large companies have ended the practice. Companies face legal risks, damage to employee morale and productivity and other problems because of secret handling of problems, which are more acute for African Americans and Hispanics, according to the proposal.

The proposals have come out of work from a group of 25 large institutional investors called the Human Capital Management Coalition (HCMC), sponsored by the UAW Retirees Medical Benefits Trust, which in 2017, petitioned the SEC to require more disclosure of information about a company’s workforce and human resources policies. Members of HCMC include the Nathan Cummings Foundation (NCF), Trillium Asset Management, the Office of the NY State Comptroller, and the AFL-CIO Office of Investment, among others. NCF has not filed any proposals yet but is engaging at least ten companies in dialogue on this issue.

Laura Campos

Director, Corporate & Political Accountability, Nathan Cummings Foundation

Meredith Benton

Principal, Whistle Stop Capital

“KEEP IT SECRET” POLICIES ENABLE CULTURES OF HARASSMENT AND DISCRIMINATION

Thanks to Tarana Burke’s Me Too movement, TIME’S UP and others, it’s no longer possible to ignore the devastating impacts of discrimination, harassment and sexual assault in the workplace. In the business world, we’ve seen many alleged harassers removed from positions of power. But while Les Moonves and his ilk may be gone, it’s not always clear whether companies are taking steps to eliminate not just the alleged harassers, but the policies and practices that helped shield them from accountability in the first place.

SEC action—McDonald’s has challenged the proposal at the SEC on the grounds that Clean Yield was not specifically authorized by a company stockholder to file the proposal, invoking SEC Staff Legal Bulletin 14I from November 2017.

In its challenge, Yum Brands is contending the resolution concerns ordinary business because it deals with its management of the workforce and is not a significant social issue. The challenge also says the board executive committee examined the issue and found only 0.2 percent of its workforce has a non-compete agreement and that even if they exist, they relate narrowly to potentially forfeited incentive compensation. It says only a “small number” of employees submit to mandatory arbitration at Yum, but that arbitration is “widely accepted” as a means to keep legal costs lower. Further, it says Yum has not settled “a significant number” of sexual harassment claims—whether or not they might be subject to non-disclosure agreements, and that such agreements can prevent reputational damage if employees are subject to baseless claims. In any event, the company’s sexual misconduct policy training addresses the concerns of the proposal, Yum says. Finally, the company says the proposal seeks to micromanage it.

Worker safety: The United Steelworkers have filed several proposals over the years about worker safety and this year the union is approaching HollyFrontier, asking it to “prepare a report to shareholders by the 2020 annual meeting...on process safety incidents, environmental violations, and worker fatigue risk management policies for the Company’s refineries.” The resolution will not go to a vote, however, because the SEC staff concurred with the company’s point that it was filed too late.