This section of the report presents information on the 386 shareholder proposals investors have filed as of February 15, 2019 for the 2019 proxy season. Additional proposals for spring votes will show up as the season progresses and a dozen or so more are likely to be filed for meetings that occur after June. Six proposals are included in the aggregate totals but not described in detail since they have yet to be made public by the proponents. The numbers this year are likely lower than normal because of the six-week government shutdown, which included the Securities and Exchange Commission (SEC). The commission is a key source of information about resolutions from new proponents and those not affiliated with known shareholder proponent filers. As noted above, the delay in SEC decisions about company challenges, caused by the government shutdown, means little information has come to light about how the SEC’ shifting interpretation of the Shareholder Proposal Rule will play out this proxy season. Nonetheless, Proxy Preview encompasses all known environmental and social shareholder proposals filed to date, to the best of our knowledge.

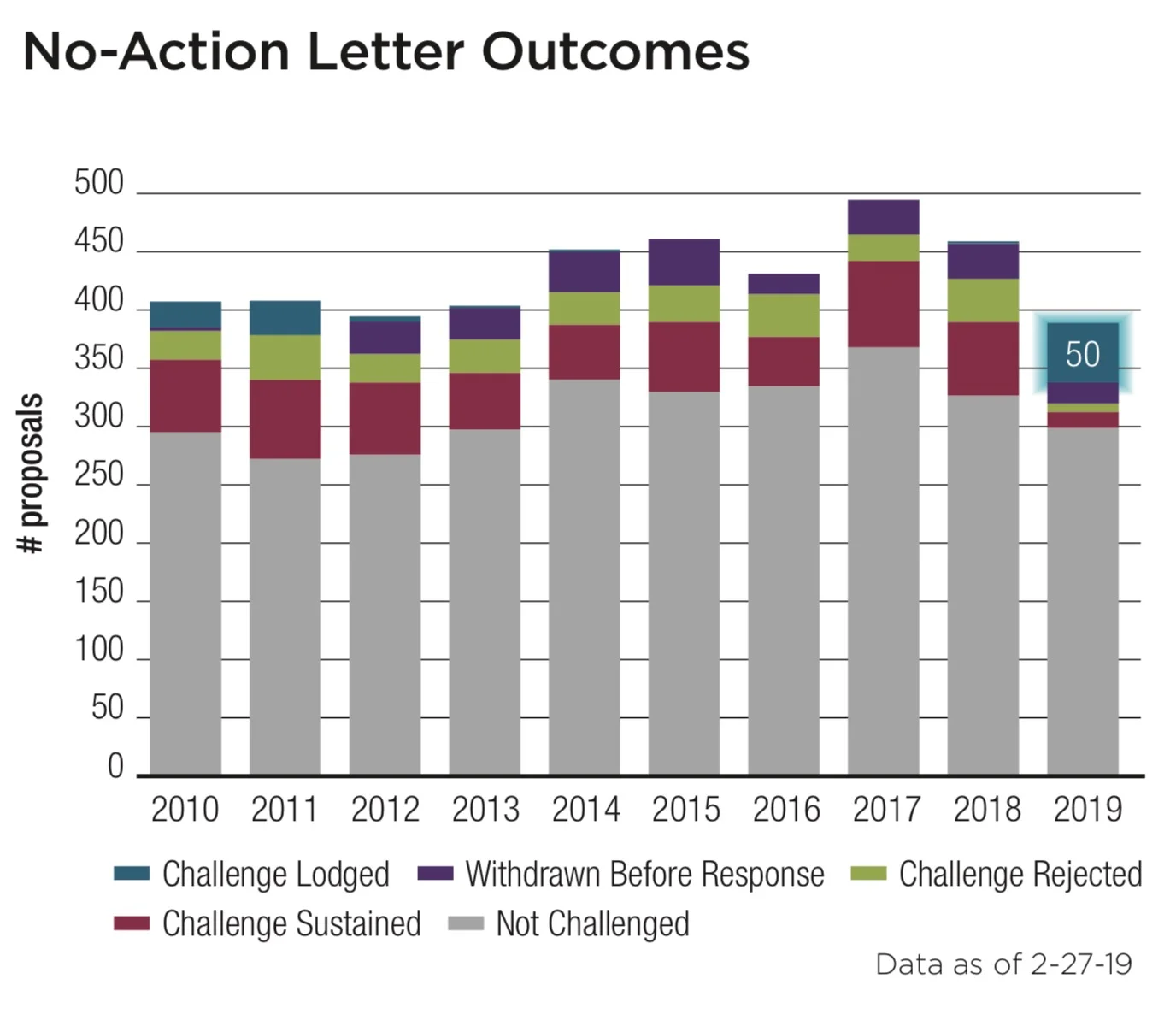

Structure of the report: Information is presented in three main areas—Environment, Social and Sustainable Governance. A separate section covers Conservatives. We note how many proposals have been filed in each category, which are now pending, how many have been withdrawn for tactical or substantive reasons after negotiated agreements with companies, and the disposition of challenges to the proposals at the SEC under its Shareholder Proposal Rule. Rule 14a-8 of the 1934 Securities and Exchange Act allows companies to omit proposals from their proxy statements if they fall into certain categories such as dealing with mundane, “ordinary business” issues. (visit www.proxypreview.org for more details on the rule.)

Analysis in this report focuses on the resolved clauses and how these compare to previous proposals, as well as previous support for resubmitted resolutions and new developments. We pay special attention in 2019 to potential reinterpretations of the omission rules, given the release of two guidance documents from the SEC, Staff Legal Bulletin 14I from Nov. 1, 2017, which set out a new approach now being taken by the commission’s Division of Corporation Finance about whether a resolution concerns “ordinary business” or is “significantly related” to company business. Staff Legal Bulletin 14J, issued on October 23, 2018, further clarified the SEC’s views. (More on p. 14 and 15.)

Key information—Within each section, tables present key data: each company, the resolution, the primary sponsor and the current status of the proposal, alongside its status and the estimated meeting month.

Voting eligibility—To vote on proposals, investors must own the stock as of the “record date” set by the company, about eight weeks before the meeting. It is noted in each proxy statement.