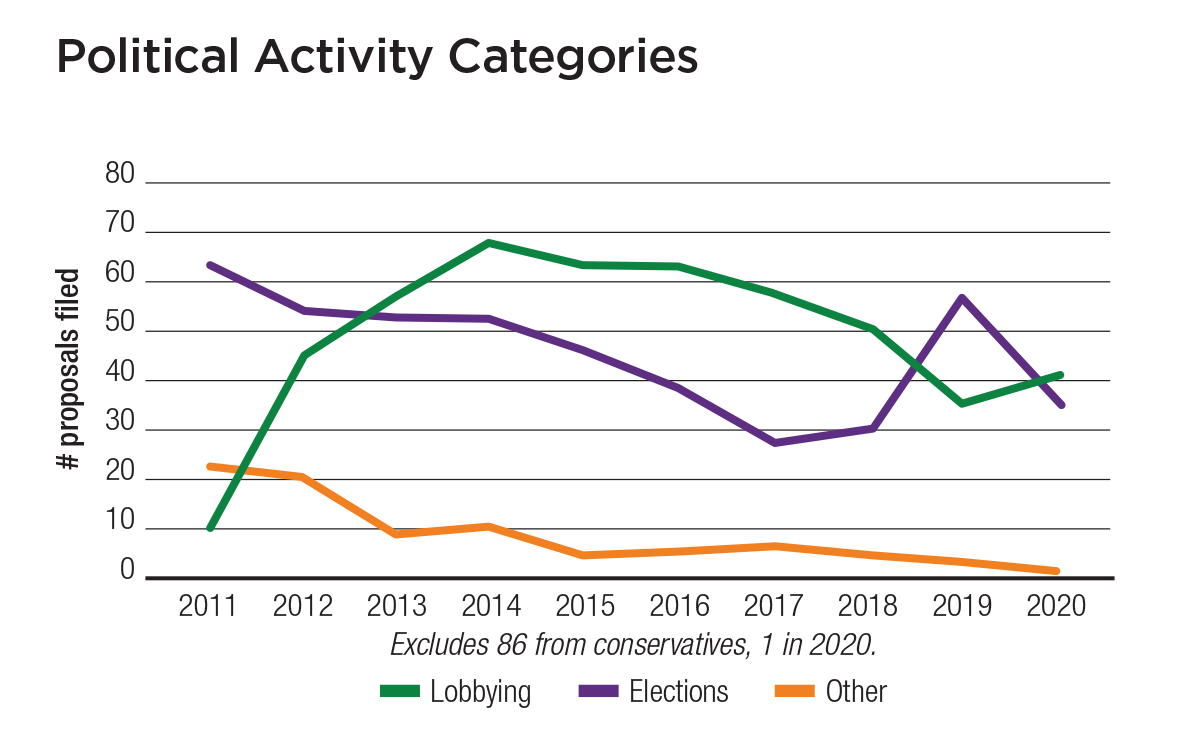

The volume of proposals filed about corporate political activity—election spending and lobbying, as well as other corporate influence issues—is down from a high point in 2014, but remains the biggest single topic of shareholder resolution interest, as it has for many years. High-scoring proposals about lobbying and election spending would be significantly affected by the proposal changes to the Shareholder Proposal Rule, as discussed in the introduction to this report (see p. 11). Proponents have filed 77 proposals thus far, down from 93 at this point in 2019, and around the same level as the previous two years. Last year saw a bump-up in election spending resolutions, but in 2020 lobbying is again transcendent; each of these main types seek more oversight and disclosure. (Only a few other issues about political activity come up, as noted on the graph next page.) Proponents are less likely to withdraw proposals on political spending. (See graph right.)

In response to the campaigns for more corporate accountability, a growing number of companies now have oversight in place, but most remain reluctant to disclose expenditure amounts in public reports for investors, as requested, and very few are willing to report on money they give to trade associations that makes its way into the political system, through “dark money” channels that shield funders and play an outsized role in elections and policymaking.

Proponents include social investment and religious organizations, leading pension funds such as the New York City’s and the New York State Common Retirement Fund (NYSCRF), trade unions and some individuals. Investor concern about corporate election spending began in 2003 with the advent of the Center for Political Accountability (CPA) and intensified after the Citizens United U.S. Supreme Court decision in 2010. The CPA’s model oversight and disclosure approach is the standard template for lobbying transparency, too, and forms the basis for the lobbying disclosure campaign run by Boston Trust Walden and the American Federation of State, County and Municipal Employees (AFSCME). The umbrella Corporate Reform Coalition supports shareholder activity on corporate spending and includes other reformers.

Key references for investors are the CPA’s CPA-Zicklin Index, most recently updated in October 2019, covering the S&P 500. The Conference Board’s Committee on Corporate Political Spending offers a more corporate but generally supportive perspective on accountability, but has had little recent activity.

Multiple proposals: Since 2013, proponents have been able to file separate election spending and lobbying proposals at the same company; before that the SEC judged them to be too similar and allowed the omission of the second one received. This year, only Duke Energy, ExxonMobil and Nucor have both.

Conservative “free market” proponents have borrowed the resolved clauses written by disclosure advocates, in successful efforts to block the main campaign proposals, since SEC rules still allow the exclusion of the second-received proposal on the same subject. While the supporting statements make clear the different goals of the proponents of the two types of proposals, investors do not seem to differentiate between the two in their voting. This year, one omission at Chevron has occurred so far because of such a competing conservative proposal. (See Conservatives, p. 66.)