The convergence between more traditional concerns about how companies are governed and social and environmental topics continues. This interest is expressed in proxy season in resolutions about how companies make their overarching social and environmental policy decisions—and who is on the board to do so—as well as in proposals about how companies make themselves accountable to their investors on strategic sustainability issues. This section examines these issues, looking at board diversity, board oversight and sustainability disclosure. We also include discussion of proposals about executive pay links to ESG issues, which continue to increase in number, and those about ESG proxy voting policies at mutual funds.

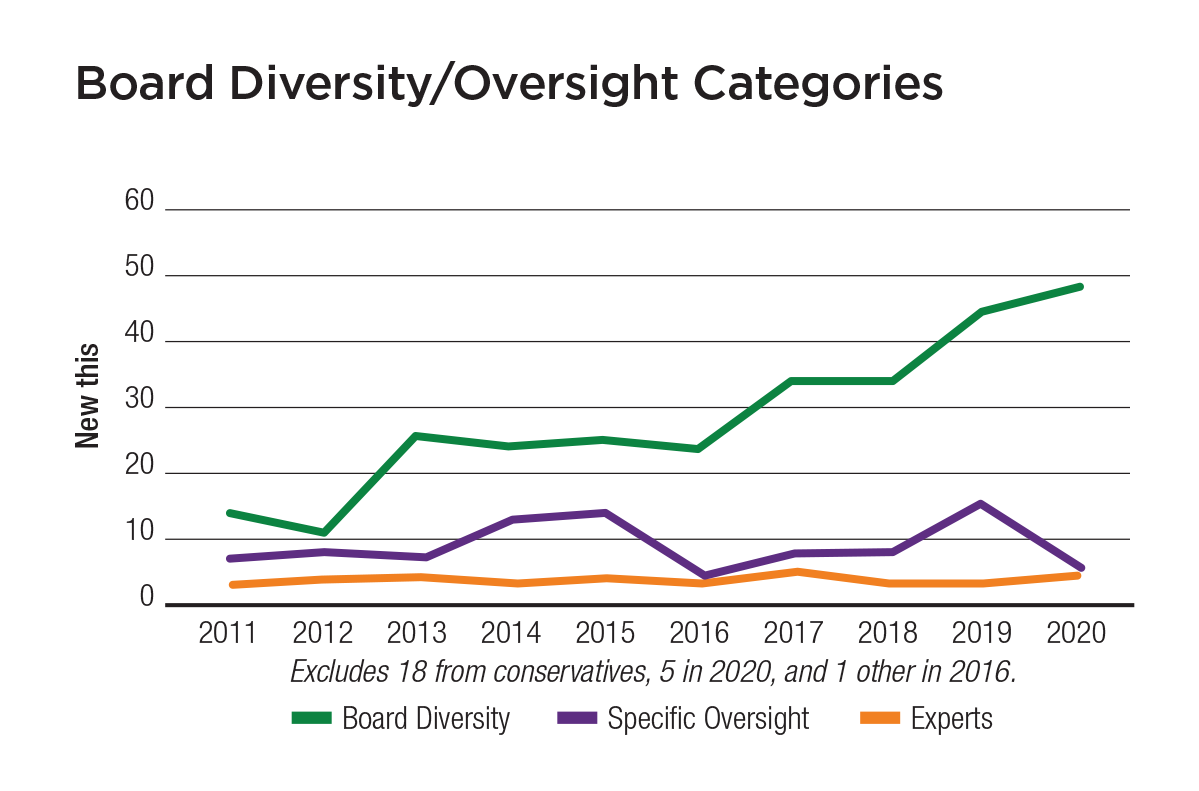

There are 59 resolutions about boards, nearly as many as the 64 filed on these issues in 2019; 49 focus on board diversity and another 10 address a variety of board oversight matters. But this year shows a big drop in sustainability reporting resolutions (five, down from two dozen last year), although the number asking for links between various ESG issues and executive pay is about the same as last year (23). Four are on proxy voting and seven new resolutions ask companies about their support for new Business Roundtable Statement of Purpose that expands the definition of the stakeholders companies say are relevant.