This section provides a look at the main issues raised in each of the topics covered in this report, giving special attention to new issues and the coming impact of the new proxy rules.

Environment

Climate change remains the dominant environmental topic. Climate-related concerns lay beneath the surface of many other proposals, particularly those about sustainable governance, covered separately in this report. In all, there are 91 proposals about the environment.

Climate change: The tally of 66 proposals specifically concerned with climate change is about even with last year’s total, but down from a peak of 83 in 2018. Climate change comes up frequently in other proposals about sustainability disclosure and lobbying; an expanded set of 13 proposals about climate lobbying is discussed below. Proponents seek information about how companies plan to address carbon asset risks, but not many address other issues such as clean energy and deforestation on their own.

Carbon asset risk—Proponents have filed about 10 more carbon asset risk proposals this year, with 29 asking for greenhouse gas (GHG) emissions reduction targets—or reporting—in the context of the Paris climate treaty; all but four of these simply ask for reports. Notable this year is the consistency of the requests for reporting—18 proposals use nearly the same language, which has passed muster at the SEC after many earlier proposals fell afoul of the commission’s new “ordinary business rule” interpretation that disproportionately found after 2018 that emissions goals were “micromanagement,” despite earlier precedents to the contrary. Proponents already have withdrawn 11 of the “Paris-compliant” goals proposals.

New are proposals about cutting Scope 3 emissions from products (at Chevron and Occidental Petroleum). An early win for the California Public Employees’ Retirement System (CalPERS) came when ExxonMobil agreed to report on its full carbon footprint. Another new angle comes from As You Sow and Mercy Investments, seeking reports on how four companies will achieve net-zero GHG emissions by 2050.

Proposals asking for better disclosure on how climate-related extreme weather such as flooding that produces contamination from petrochemical plants, first raised in 2019, are back, with one pending at ExxonMobil but withdrawn at Dow.

Eight proposals express skepticism about whether natural gas and methane are truly climate-friendly, but four have been withdrawn and just one—on flaring at Hess—may see a vote.

Proponents have withdrawn two new proposals about drilling for oil and gas in the Arctic Natural Wildlife Refuge.

“Say on climate”—The biggest new development on climate change is an effort that seeks climate transition assessment and investor feedback—in the form of annual shareholder advisory votes, akin to “say on pay” vote for executive compensation. Skeptics of this approach suggest it may prove an ineffectual way to trim emissions, allowing companies to vaunt shareholder approval while not affecting their damaging trajectory. The effort has now adopted benchmarks set by the Ceres Climate Action 100+ initiative, and supporters think this will become the standard for holding companies’ feet to the fire. A prominent supporter is activist British hedge fund magnate Sir Chris Hohn and his firm, The Children’s Investment Fund (TCI). The campaign began in the United States with filings in November 2020. Proponents have engaged 75 companies to date and plan to file hundreds of proposals at the end of 2021, escalating globally in partnership with proponents in Australia, Asia, Europe, and Canada.

A new related idea comes from Christian Brothers Investment Fund (CBIS) and asks that Chevron and ExxonMobil’s strategic climate plans undergo a formal audit, although they face SEC challenges.

High carbon finance—Investor advocates increasingly are looking at the role banks play in facilitating carbon intensive projects and four proposals are pending on this subject at Bank of America, Citigroup, Goldman Sachs and Wells Fargo.

Clean energy—Proponents and companies have found so much agreement about the merits of saving money through green energy that few proposals have been filed on the subject this year. Proponents withdrew all 13 resolutions they filed last year and in 2021 the New York State Common Retirement Fund has filed just four. New is a proposal from As You Sow about how DTE Energy might facilitate more electrification of “the built environment” and thus trim emissions.

Deforestation—Green Century Funds, which seeks to reduce harms caused by deforestation, is again seeking reports from food companies about how these risks affect commodity supply chains; the proposal is pending at Bloomin Brands and Bunge. Also pending is a new proposal from the group about financing deforestation, at JPMorgan Chase.

Environmental management: The number of environmental management proposals has fallen from earlier highs 10 years ago and in 2021 there are two dozen proposals. Half are about plastics pollution (by plastic manufacturers and makers and those that use it for product packaging) and the other half about various aspects of industrial agriculture. Eleven of the plastics/waste proposals are pending, as are two on pesticides, three about antibiotics and one on water use.

Waste—Green Century withdrew its plastics proposal after Coca-Cola agreed to cut its virgin plastic use by 3 million metric tons by 2025, in a significant move. In another shift, Eastman Chemical agreed to start reporting on its plastics pellet spills in a report due out by the end of the year, in response to As You Sow’s proposal. But seven more plastics proposals are still pending.

New is another proposal from As You Sow and First Affirmative Financial Network about the use of potentially harmful substances in food packaging (poly and perfluoroalkyl, known as “PFAs”); it seeks a report from McDonald’s.

Agriculture—Two pesticide reporting proposals are pending (out of four), at Home Depot regarding Roundup, and at PepsiCo about Roundup/glyphosate use in the supply chain. A new proposal asking about the externalized cost of antibiotics appears headed for a vote at McDonald’s and Yum Brands.

Social Issues

Animal welfare: A resubmitted proposal from Harrington Investments seeking an animal welfare policy, inspired by fur used in some of the apparel sold by TJX, is pending. Votes will not occur on two new proposals from People for the Ethical Treatment of Animals, concerning horse racetracks and ExxonMobil’s sponsorship of the famous Iditarod dogsled race in Alaska. PETA withdrew both after SEC challenges, but noted Exxon will end its sponsorship.)

Corporate political activity: After supporters of ex-President Trump attacked the U.S. Capitol on January 6, many companies announced they would “pause” their corporate political spending and re-evaluate how they spend, a move applauded by critics of company spending. Proponents continue to seek explicit board oversight and reporting about companies’ spending to influence the outcome of elections and shape policy afterwards through lobbying, although with a somewhat lower number of proposals than several years ago.

The 78 proposals filed to date include 13 that seek more specific information about how companies try to affect climate change choices by governments; last year this proposal earned 53 percent at Chevron, in a significant development; the company is now working with proponents on a new report.

New this year is a proposal from the Nathan Cummings Foundation asking Best Buy about lobbying specifically connected to racial justice, in the context of retailers’ support for laws that “criminalize poverty” and feed mass incarceration that disproportionately affects people of color.

While most companies do not bother to lodge SEC challenges about proposals about political spending and lobbying, this year Citigroup is trying to persuade the commission that its lobbying proposal is not significantly related to its business, in what may prove to be an important early test of the Biden SEC’s stance on this provision of the shareholder proposal rule.

Political spending and lobbying proposals use the same resolved clause and often run for several years, making them particularly vulnerable to the much higher resubmission thresholds set by the new SEC rules. How this plays out as the proxy season progresses is a key trend to watch.

Decent work: Proposals seeking fair pay and equitable working conditions blossomed in the Trump era and in the wake of the #MeToo movement. Their number has fallen by half in 2021, however, in favor of a big expansion of workplace representation proposals (covered in the Diversity at Work section).

Fair Pay—Proposals address pay equity from both extremes. The United Steelworkers and Trillium Asset Management argue that peer group benchmarking feeds an unsustainable and inequitable CEO pay differential compared to low wage employees. One new angle this year for executive pay is a resolution from Myra Young concerned about the overall societal impact of executive pay differentials, in a resolution at Marriott International. There are seven proposals about executive pay differentials.

From a different perspective, Arjuna Capital and Proxy Impact continue to press for better disclosure about gender- and race- based pay differentials. Support for many of the gender pay equity proposals fell in 2020, however, since investors appeared to be largely satisfied with some reporting on pay differentials, even though they largely eschewed disclosure of the global median pay data the proponents wanted. The number of proposals is down to just seven for 2021.

Benefits—The SEC decided that new proposals about paid sick leave, filed at seven companies and inspired by the pandemic are an ordinary business matter and none seem likely to go to votes. On a related subject, still pending are proposals at Amazon.com and Wendy’s that ask for an accounting of how they ensure workers remain safe during the pandemic, with the New York City Comptroller’s office offering a litany of well-documented problems at Amazon. Both these proposal face SEC challenges, however. But a Walmart worker’s proposal for a Pandemic Worker Advisory Council survived a challenge.

Diversity in the workplace: Shareholder proponents have responded to the Black Lives Matter movement sparked by the May 25th murder of George Floyd in Minnepolis by filing twice as many proposals as they did last year about diversity. The resolutions seek better disclosure about fair representation in the workforce and more information about programs for employees of color. Companies were quick to highlight their efforts during the BLM demonstrations over the summer, but proponents want to see proof these commitments have real impact. All but two of the companies facing these proposals are doing so for the first time.

After facing requests to report on how employees are represented throughout the company for some two decades, Home Depot finally acceded to the release of its EEO-1 form that it files annually with the Equal Employment Opportunity Commission. So far, the New York City Comptroller-led expanded campaign for EEO-1 disclosure has prompted 16 withdrawals; the city is joined by Trillium and Calvert Investments and at least a dozen more proposals are pending. Company moves to disclose are likely influenced by support from leading investment firms BlackRock and State Street, which both say they will vote against corporate boards whose firms do not provide EEO-1 data.

The AFL-CIO has brought to the table the idea that companies should ensure their employee hiring pools include women and people of color, using the same idea employed in board diversity proposals; the resolution is pending at three companies.

The emphasis on a more diverse executive suite continues, with three proposals still pending seeking reports on representation from Trillium, and four others from New York City that also are pending.

As You Sow is focused on more granular reporting on how diversity and inclusion programs work and have impact, with metrics-based reporting. Its proposal, also filed by Nia Impact Capital and the Nathan Cummings Foundation, was filed at 22 companies and has been withdrawn at one.

NorthStar Asset Management addresses representation and racism directly in a new proposal at Home Depot and PayPal, seeking a report on how each confront “unwritten norms” that “reinforce racism in company culture.” (Similar proposals about racism are covered in the Human Rights section.)

Ethical finance: Trillium wants KeyCorp to report on the differential impact of its overdraft and insufficient funds fees on people of color. The pending proposal notes the company’s reliance on fee-based income that it says comes from charges imposed by “aggressive or deceptive” marketing.

Health: Members of the Interfaith Center on Corporate Responsibility (ICCR) are seeking information on drugs for treating Covid-19, and the extent to which prices reflect the level of government aid that went into the drugs’ development. But both Eli Lilly and Johnson & Johnson have challenged the proposal at the SEC, which has yet to respond to arguments the proposal is false and misleading, ordinary business or moot.

Other public health issues also are on the agenda, with resubmitted proposals about sugary beverages made and sold by three companies, while a new resolution seeks a report on the public health costs of the food business of CVS Health and PepsiCo. In addition, Clean Yield Asset Management would like Walmart to report on risks it faces for employees in need of reproductive health services in states where laws restrict access to abortion, contraception and other care. (This issue was first raised last year and work on the subject is coordinated by a group called Rhia Ventures.)

Human rights: Investors voting on proposals about human rights face a panoply of new proposals about racism both at work and more generally, all inspired by the Black Lives Matter movement. The focus is on systemic racism and the extent to which companies can and should combat it. Older proposals about supply chain risks like child labor continue, as do those that scrutinize the implications of electronic media platforms and how they can perpetuate hate speech and be used by governments to violate privacy. There are 46 proposals on human rights this year.

Racism—Eighteen new proposals ask about mitigating racism. The trade unions Change to Win and Service Employees International Union (SEIU) introduce the idea of a racial equity audit of their operations and offerings at eight financial institutions. Two similar proposals at drug companies zero in on the need for more people of color in drug trials. One at Amazon.com highlights problematic practices in the company’s warehouses and in its platforms. Six companies have challenged the proposal at the SEC, but the commission denied Johnson & Johnson’s challenge, in a positive harbinger for the others. Another new idea is for companies to report on their affirmative plans “to promote racial justice,” referencing As You Sow’s new Racial Justice Scorecard that features comparable data on corporate performance.

Several other racism proposals are new. One asks about environmental racism by Chevron, but it faces a challenge at the SEC. Arjuna Capital wants a report from Chubb about underwriting police insurance, and the Nathan Cummings Foundation seeks a report on community policing partnerships from Target. Yet another new angle is the question of prison labor and the racist history of mass incarceration; NorthStar Asset Management wants to hear more about how TJX monitors compliance with its policy to avoid prison labor.

Risk policies and reporting—More familiar to proxy season voters are the longstanding requests for assessments of human rights risks. So far there have been three withdrawals and one procedural omission, but five of these resolutions remain, at food and defense companies.

Particularly relevant to this year’s proxy season are proposals asking meat processing companies to explain how the human rights of their workers are protected. A third-year proposal to Tyson Foods earned 18.4 percent, not enough to qualify for the new 25 percent resubmission threshold, which is particularly hard to meet at dual class stock companies like Tyson. Oxfam America withdrew after agreements at fellow chicken companies Pilgrim’s Pride and Sanderson Farms, however.

Media—With the January 6 attack on the U.S. Capitol fresh in the nation’s mind, investors will again vote on proposals asking social media companies how they moderate content on their platforms, how surveillance technology is deployed with appropriate caution (or not), and what can be sold online. All but two of the 12 proposals filed on media issues have been challenged and two have been omitted.

One new proposal asked three companies to study and report on any connections between their advertising policies and violations of civil or human rights, but none appears likely to see a vote given SEC challenges.

Other human rights—Proxy Impact has resubmitted its request for a report on child sexual exploitation on Facebook; it earned 12.4 percent last year and must get 15 percent to be resubmitted, a high bar for a dual class stock company.

The final human rights proposal unearths opposition to nuclear weapons and asks PNC Financial to stop “banking the bomb” by financing nuclear weapons makers.

Sustainable Governance

Board diversity: A diminished complement of board diversity and oversight proposals is on the agenda for sustainable governance; the total has fallen to the lowest level in five years (30 proposals) as more companies agree to diversify their boards. Included in this are eight filings, mostly from the New York City pension funds, that ask for diversity in CEO searches.

Board oversight: Also diminished in number are proposals seeking specific types of board oversight, with just eight filings— down from two dozen three years ago. A new variant is a proposal that asks four companies to report on board oversight of workplace equity issues. It is pending at Chipotle, Lyft and Southwest Airlines.

Sustainability: The gradual erosion of sustainability reporting proposals is now nearly complete. In its place are a slew of new proposals that try to use corporate support for the 2019 Business Roundtable (BRT) Statement on the Purpose of a Corporation to force a wholesale reimagining of business.

Corporate purpose—The Shareholder Commons is coordinating proposals asking companies to reincorporate as public benefit corporations (PBCs). The core argument the proponents of 14 resolutions assert is that long-term investors would benefit if the corporate governance structure of companies is fundamentally altered. This would give companies the legal room to address the broad needs of society, not just the pecuniary interests of shareholders, the argument goes. Four companies have lodged challenges at the SEC, which has yet to weigh in. Harrington Investments withdrew its proposal after a challenge by JPMorgan Chase, which also released a report explaining why it would not reincorporate as a PBC.

Four pending related proposals ask financial institutions about what their BRT affirmation means in practice; the proposals are resubmissions and earned modest support last year of less than 10 percent; under the new rules they will need at least 15 percent to survive for another round in 2022.

ESG pay links—The number of resolutions seeking links of sustainability metrics to pay fell by half this year, after holding steady at around 20 for three years. They ask for ESG links generally on a panoply of specific issues—drug prices, executive diversity, climate change and privacy. Votes last year on drug pricing links were relatively strong, in the 20-percent range. Companies are contesting the inclusion of the three legal cost proposals; these resolutions, notably, come from pension funds in jurisdictions hard hit by opioids—Vermont and Philadelphia.

ESG proxy voting—Proponents have been urging large mutual funds to integrate ESG concerns into their proxy voting policies for several years; three are pending and another is planned. One of the proposals is new and asks State Street to consider factors beyond profitability in its proxy voting policy.

Conservatives

The field of proposals from politically conservative groups, chief among them the National Center for Public Policy Research (NCPPR), has always focused heavily on social policy, but NCPPR has joined the debate over the BRT statement’s implications this year. It also has proposed several charitable contributions proposals. It is not clear that any will go to votes given pending SEC challenges that have worked already this year.

BRT: NCPPR has asked at least seven companies to report on the meanings of their CEOs’ sign-on to the BRT statement of purpose. The SEC has agreed the proposal can be excluded at two companies.

Charitable giving: NCPPR has proposed that six companies provide detailed reports on their charitable giving. The SEC already has agreed this is an ordinary business matter at four companies so far.

Board diversity: Proposals ask for reporting on “ideological diversity” on corporate boards, although votes in 2020 were around 1 percent, aside from an anomalous 13 percent at Boeing, where discontent with management in the wake of the 737 MAX disasters may have influenced the vote. This year, two have been omitted so far.

Diversity at work: NCPPR is continuing its campaign to get companies to report on how they protect persecuted conservatives in the workplace, by including “ideology” in non-discrimination policies, but one company knocked it out at the SEC to date.

Other issues: Two proposals seek to exclude foreign-made products from company inventories or allow customers to know where products are made to filter out foreign ones. A final proposal calls into question Exelon’s work to facilitate electric vehicle charging by questioning child labor in the cobalt supply chain, but uses as its source a website questioning the reality of climate change. All three face SEC challenges.

Proposal Trends

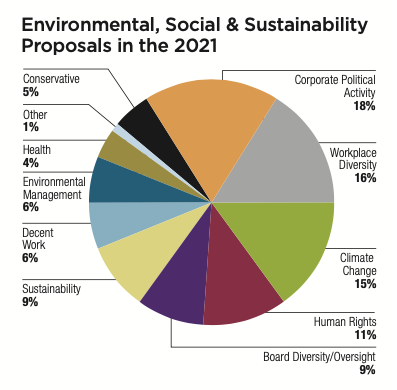

The charts below illustrate long-term trends for proposal filings, showing the dominance of political activity and the rise of diversity resolutions over time, and shifts in the types of shareholder proponents who are lead filers of proposals. (Because many of the faith-based investors who are members of the Interfaith Center on Corporate Responsibility co-file with other proponents and may not be lead filers, the chart undercounts their participation.)