Proponents have filed at least 435 shareholder resolutions on environmental, social and sustainability issues for the 2021 proxy season, with 313 pending as of February 19. Securities and Exchange Commission (SEC) staff have allowed the omission of 24 proposals so far in the face of company challenges; companies have lodged objections to at least 74 more that have yet to be decided—12 more than at this time last year. Proponents have already withdrawn about 90 proposals, however, up from 78 at this time last year and 71 in mid-February 2019.

Annual totals are down from a bit from the

all-time high of just under 500 in 2017.

About 40 percent of filed resolutions have gone

to votes each year since 2018, around 45 percent have been withdrawn and between 13 and 16 percent omitted. (Bar chart, right)

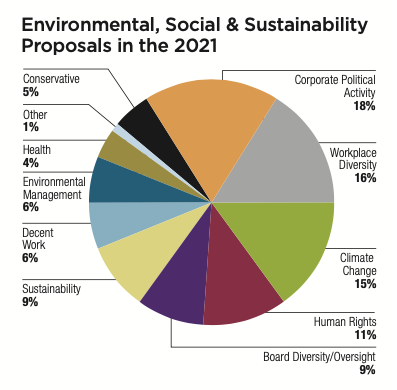

The tumultuous events of 2020 prompted a slew of new shareholder proposals investors will consider in 2021. New angles are most apparent in the big increase in resolutions about racial justice and equal opportunity, but proponents also are raising fresh ideas about worker safety, climate transition planning and lobbying. (Pie chart, right)

Key Recent Developments

New SEC rules: On September 23, 2020, the Securities and Exchange Commission (SEC) approved new rules that make it harder to file and resubmit shareholder resolutions. Earlier, on July 22, the commission issued a final rule imposing new strictures on proxy advisory firms, as well.

The rulemaking process in each case prompted substantial pushback from investors who see the shareholder proposal process as central to their engagement with companies. Business groups largely supported the changes, which they had long sought. Many mainstream players in the investment community perceive key material risks and opportunities in environmental and social issues that surface in shareholder proposals, which has driven votes up and increased the number of withdrawn proposals. The new rules do not go into effect until the 2022 proxy season.

Proponents opposed to the shareholder proposal changes are contemplating their legal options and Institutional Investor Services (ISS), the largest proxy advisory firm, is suing to block the rule that requires it to give more voice to companies that disagree with its recommendations. In a related development, just before President Trump left office, in December, the Department of Labor finalized rules that make it harder for some pension funds to vote on ESG shareholder resolutions, although the strictures are not as harsh as those initially proposed. Both shareholder proponents and companies continue to jockey for position under the much more shareholder-friendly administration of President Biden.

Changing SEC interpretations: The SEC has been shifting its interpretation of what may be included in shareholder resolutions and issued interpretive bulletins in 2017, 2018 and 2019. These changes have had their most significant impact on climate change proposals that ask companies to measure and report on their greenhouse gas emissions.

Mutual fund voting: The huge mutual funds that have influential stakes in nearly every corner of the American financial markets continue to pay more attention to proxy voting on environmental, social and sustainability issues, which has pushed the overall support levels ever higher, with 21 majority votes in 2020. But critics continue to press these market movers to vote for more shareholder resolutions and make their environmental, social and governance (ESG) policies consistent with investment management practices.