Proponents have filed 529 shareholder resolutions on environmental, social and related sustainable governance issues for the 2022 proxy season, up more than 20 percent from last year at this time. Securities and Exchange Commission (SEC) staff have allowed the omission of only 11 proposals so far in response to company challenges, but 103 challenges remain to be decided (up from 74 in late February 2021). Proponents have already withdrawn 106 resolutions, and 412 were slated for votes as of late February, although this number will drop. (Bar chart, right.)

Even though total filings are up dramatically, how many will go to votes remains uncertain for two key reasons. Last year’s unprecedented number of high votes, including 39 majorities, could prompt more agreements and thus withdrawals. Further, because the SEC in November rescinded interpretative guidance that boosted omissions during the Trump era, fewer proposals may be omitted.

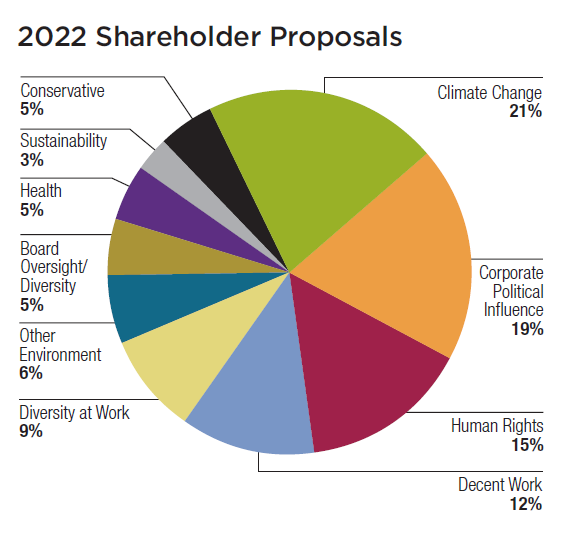

This year heralds significant shifts in the topics proponents raise, with many more on climate change and racial justice. Corporate political influence resolutions also increasingly focus on the viewpoints that receive company-connected money for elections and lobbying. New topics abound about decent work, including pay and working conditions. But resolutions on general approaches to sustainable corporate governance have fallen dramatically, given advances in board diversity and ubiquitous sustainability disclosures from companies. (Pie chart, right.)

Regulatory shift: In addition to the SEC’s November 3 Staff Legal Bulletin 14L that rescinds three previous interpretive bulletins, SEC Chair Gary Gensler also has shifted course on proxy advisory firms. On November 17, the SEC proposed a new rule about the advisory firms that aims to address concerns that the controversial restrictions imposed in the Trump era might “impede and impair the timeliness and independence of proxy voting advice” and impose “undue litigation risks and compliance costs.”

Nonetheless, proponents this year are grappling with the impact of a new rule from September 2020 that makes it harder to file and resubmit shareholder resolutions. A lawsuit from the Interfaith Center on Corporate Responsibility, As You Sow and James McRitchie seeks to set aside the rule and a decision may come in late May. (Sidebars, p. 11.)