Proposals about seeking more disclosure about fair pay and working conditions have risen from almost nothing 10 years ago to become a mainstay of proxy season. They blossomed during the Trump administration, dipped sharply last year, and now have surged to their highest level ever. Related proposals about diversity (covered in the next section) also have ballooned with the Black Lives Matter movement.

Context: The SEC is poised, by all acounts, to release a proposal soon about new disclosure requirements regarding human capital, some of which were initially set out by the Human Capital Management Coalition, representing 35 institutional investors who manage more than $6.6 trillion in assets. The group petitioned the SEC in 2017 to require more disclosure of information about a company’s workforce and human resources policies, which it says is needed to evaluate investment risks.

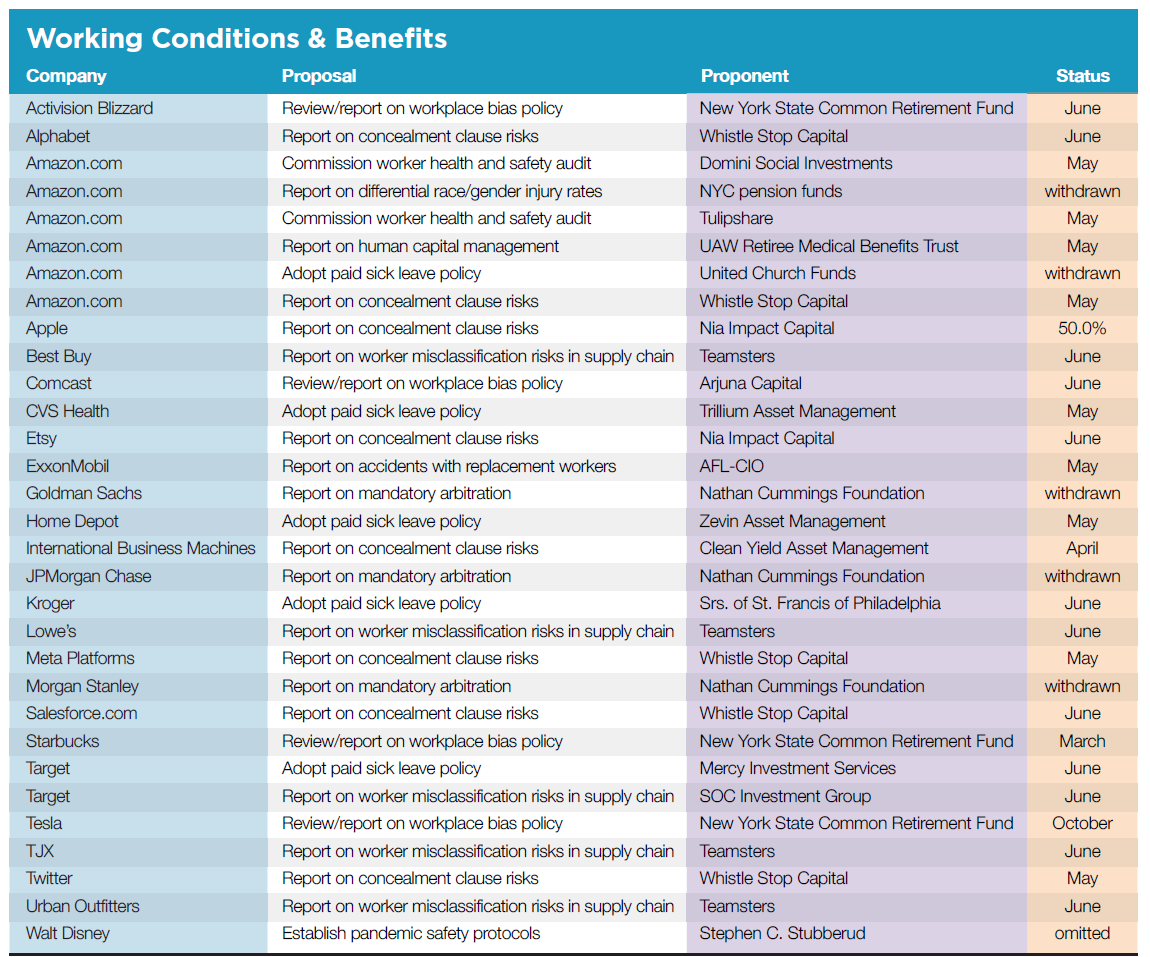

New issues: Notable this year are new resolutions about working conditions—many of them with uncertain outcomes at the SEC. Proposals raise fresh ideas about reporting on employee stock ownership and competetive approaches to employee pay, plus inequality and corporate financial priorities. Repeated are resolutions, at new recipients, about paying higher starting wages. New working conditions proposals asks about the use of concealment clauses, worker misclassifications in the supply chain, differential injury rates for people of color and women, accidents with replacement workers and pandemic safety protocols. Finally, sick leave proposals also have been filed, but all those filed last year were omitted on ordinary business grounds and they again face challenges at the SEC. (Tables, p. 50, 51, lists all 65 resolutions.)

Fair Pay

Most fair pay resolutions address compensation differentials between executives and employees (25 proposals), with some new angles this year, but another 10 continue to ask for more detailed reporting on differentials based on race and gender. Women, and women of color, continue to earn much less than their White male counterparts, but shareholder votes on pay disparity proposals have fallen from earlier levels.

Compensation

CEOs and employee stock ownership: The biggest group of resolutions presents a new angle for investors, asking companies to consider employee stock ownership plans alongside other elements of compensation when setting CEO pay, to build an “ownership culture.” Proposals are still pending at Chipotle Mexican Grill, Johnson & Johnson, Kellogg and Kimberly-Clark and ask each to:

take into consideration the pay grades, salary ranges, and stock ownership incentives (such as, but not limited to, stock grants, performance share units, employee stock purchase plans, restricted stock units, and options) of all classifications of Company employees in the United States when setting target amounts for CEO compensation. The committee should describe in the Company’s proxy statements for annual shareholder meetings how it complies with this requested policy. Compliance with this policy is excused where it will result in the violation of any existing contractual obligation or the terms of any existing compensation plan.

Withdrawals and SEC action—The proponent withdrew at Bank of America, Bristol Myers-Squibb and Goldman Sachs after each agreed to partially implement the proposal. Two other proposals were withdrawn after procedural challenges, at Edwards Lifesciences and IBM. At 3M, the resolution was omitted when the SEC agreed that earlier proposals failed to receive enough support; a pay disparity resolution from the United Steelworkers went to a vote three times and earned only 11 percent in 2021, below the 25 percent needed under new SEC rules.

General CEO disparity: Two other proposals about CEO pay are less specific. Jing Zhao resubmitted a proposal that earned 8.3 percent last year and wants AT&T and Applied Materials to “improve the executive compensation program and policy, such as to include the CEO pay ratio factor and voices from employees.” An early vote will occur on March 10 at Applied Materials. The proposal at AT&T survived an SEC challenge that argued it was too vague, as a similar proposal did in 2020 when it went on to win 8.7 percent support.

In addition, the AFL-CIO would like PPG Industries to “take into consideration the compensation of the Company’s employees and any other workforce that the Compensation Committee determines to be relevant to the Company’s business operations. It is new to the company.

Reporting on employee stock ownership: In addition to his proposals about CEO pay and stock ownership, James McRitchie also is pursing the idea of an “ownership culture” in another new proposal at five more companies. Still pending at Amazon.com, Meta Platforms, PetMed Express and Repligen, the proposal asks for a report

annually assessing the distribution of stock-based incentives throughout the workforce (such as but not limited to performance share units, employee stock purchase plans, restricted stock units, and options). The report should include a matrix, sorted by EEO-1 employee classification or another appropriate classification scheme with four or more categories chosen by the Committee, showing aggregate amounts of stock ownership granted and utilized by all U.S Company employees and including associated voting power, if any. The Committee should issue the report before or concurrent with the next annual proxy statement.

Withdrawal—James McRitchie withdrew at Nvidia after discussions.

SEC action— Amazon.com and Repligen both are arguing at the SEC that the proposal concerns ordinary business since it is primary about employee compensation despite references to broader societal concerns. Meta adds that this is a workforce management concern.

“Competitive” employee compensation: Two ICCR members are asking Dollar Tree and Kroger to address the tight labor market caused by the pandemic. At Dollar Tree, it seeks a report:

on risks to its business strategy in the face of increasing labor market pressure. The report should, at minimum, (1) explain how the Company’s forward-looking strategy and incentives will enable competitive employment standards, including wages, benefits and employee safety and (2) include particular attention to its lowest paid employees across geographies.

At Kroger, it is similar but asks about “the risks of increasing labor market pressures to its business plan. The report should address to what extent the Company’s workforce strategy includes competitive wage, benefit, and safety conditions for all its associates across all racial and gender demographics.”

SEC action—Dollar Tree is arguing this is an ordinary business issue since it is about employee compensation and workforce management.

Tipped wages: At two restaurant companies—Denny’s and Dine Brands—the focus also is on low wages. The resolution asks for a report on “the feasibility of increasing tipped workers’ starting wage to a full minimum wage, per state and federal levels, with tips on top to address worker retention issues and economic inequities.” This is a new resolution and so far neither company has lodged a challenge at the SEC.

Inequality and financial priorities: Continuing its concern about the societal costs of company action, The Shareholder Commons wants Marriott International and Tractor Supply to report on

(1) whether the Company participates in compensation and workforce practices that prioritize Company financial performance over the economic and social costs and risks created by inequality and racial and gender disparities and (2) the manner in which any such costs and risks threaten returns of diversified shareholders who rely on a stable and productive economy.

SEC action—Last year, Marriott persuaded the SEC a similar proposal was ordinary business, but the request was slightly different, seeking a report “on the external social costs created by the compensation policy of our company.” While Marriott has yet to lodge a challenge this year, Tractor Supply is arguing at the SEC that this year’s proposal also is ordinary business.

Detailed pay report: Individual Jan Ott faces an SEC challenge from JPMorgan Chase, which argues her proposal concerns workforce management and therefore is an ordinary business issue. The resolution asks for annual reports “of pay and total estimated compensation for each role, broken down by location, for the prior year giving the mean, median, and pay band (high/low) for the role, both weighted and unweighted for Cost of Living Adjustments (COLA).” (A gender/minority pay reporting resolution at the bank received 9.9 percent in 2020 and 31 percent in 2019. )

Race and Gender Pay Gaps

Median pay gap: Arjuna Capital and Proxy Impact have filed dozens of resolutions trying to persuade companies to report on differential pay rates for women and people of color, compared to White men. At first, they asked only about policies and goals “to reduce” the gap and companies started agreeing to do so. Later proposals sought data on the median pay gap that shows the extent to which higher-level employees are disproportionately White (and have higher pay). Common ground wasscarcer for this specific reporting and half of the 2020 votes were too low, missing resubmission thresholds. In 2021, votesrebounded, with a high of 40 percent at Microsoft and three others above 23 percent. This year has had strong early votes with 34.5 percent at Apple and 59.4 percent at Disney. The proposal is pending at six companies and asks for a report

on both median and adjusted pay gaps across race and gender, including associated policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining diverse talent…. Racial/gender pay gaps are defined as the difference between non-minority and minority/male and female median earnings expressed as a percentage of non-minority/male earnings (Wikipedia/OECD, respectively).

The proposal has earned 34.5 percent at Apple and is pending at Amazon.com (where it earned 25.9 percent last year; this is the proposal’s fourth year), Best Buy, Chipotle Mexican Grill, CIGNA (32.6 percent last year; resubmitted for a fourth year) and Lowe’s.

Withdrawals—Arjuna Capital withdrew at Home Depot because it agreed to provide the requested information. In 2021, after two decades of proposals, Home Depot agreed to release its EEO-1 data on workforce composition by job category in response to a proposal from the New York City Comptroller. Proxy Impact also has withdrawn at Target because it will provide adjusted and unadjusted (median) pay gap data by gender for all employees globally and by race in the United States.

SEC action—SEC staff turned back a request to have the resolution omitted at Walt Disney. The company argued it could be omitted on ordinary business grounds because it is being sued in California. Separately, in 2021 Disney did agree to release its EEO-1 data and have a “deeper discussion” about other data such as recruitment, retention and promotion rates, prompting proponents to withdraw a resolution about diversity programs.

Race and pay: The Franciscan Sisters of Perpetual Adoration have returned to Walmart with a proposal that earned 12.7 percent last year. It asks that the company report “on whether and how Walmart’s racial justice goals and commitments align with the starting pay for all classifications of Walmart associates.”

Working Conditions

Just over two dozen resolutions are about working conditions, with several new angles. Companies have challenged many of them at the SEC, mostly arguing that conditions in the workplace are a matter of long-established ordinary business about which shareholders should not weigh in. Many of the new proposals about working conditions come from trade unions, which beg to differ about who should have input on working conditions, for obvious reasons.

Concealment clauses: The biggest single group of proposals was inspired by the common use of concealment clauses in employment contracts, which are widely known to suppress information about sexual harassment and other employment problems such as wage theft or discrimination. A growing number of large companies has stopped using mandatory arbitration for cases involving sexual harassment, because of these problems, but it is still common practice.

Three social investment firms are asking 10 companies to report, “assessing the potential risks to the company associated with its use of concealment clauses in the context of harassment, discrimination and other unlawful acts.” It is pending at Alphabet, Amazon.com, Etsy, IBM, Meta Platforms, Salesforce.com and Twitter. The vote at Apple was 50.0 percent.

SEC action—Earlier, the New York City Comptroller’s Office and trade unions in 2019 asked nine companies to end what they defined as “inequitable employment practices,” such as mandatory arbitration and non-disclosure agreements for employment related claims, including but not limited to sexual harassment. The SEC at the time agreed this was an ordinary business issue, saying it related “generally to the Company’s policies concerning its employees, and does not focus on an issue that transcends ordinary business matters.”

CONCEALING HARASSMENT AND DISCRIMIMNATION CLAIMS HINDERS DIVERSITY EFFORTS

MEREDITH BENTON

Principle, Whistle Stop Capital

KRISTIN HULL

Founder and CEO, Nia Impact Capital

In 2020, after George Floyd’s murder, we monitored many of the CEO statements and company pledges to support the Black Lives Matter movement and to increase their diversity, equity, and inclusion efforts. Now, in 2022, employees and investors want to see real progress on these pledges.

Particularly in this time of the Great Resignation (the current wave of people quitting jobs), investors want to see signs that companies are building and nurturing a positive and inclusive workplace culture. They especially want action from companies with policies and practices that hinder development of an inclusive and equitable work environment.

This year, in what seems to be a shift at the commission, Apple was unsuccessful in its effort to exclude the proposal on the grounds that it is ordinary business and moot. Challenges from Amazon.com and Etsy that argue company policies make the resolution moot have yet to be decided. (A proposal at Amazon in 2019 from the conservative National Legal and Policy Center at the company on sexual harassment earned 33.3 percent.)

Harassment and discrimination data: NYSCRF has a detailed request for data at Starbucks (where an early vote will occur on March 16). The proposal also is pending at Activision Blizzard and Tesla. It asks for an annual report,

describing and quantifying the effectiveness and outcomes of company efforts to prevent harassment and discrimination against protected classes of employees, including, but not limited to, sexual harassment and racial discrimination. In its discretion, the board may wish to consider including disclosures such as:

the total number and aggregate dollar amount of disputes settled by the company related to sexual abuse or harassment or discrimination based on race, religion, sex, national origin, age, disability, genetic information, service member status, gender identity, or sexual orientation;

the average length of time it takes to resolve harassment complaints, the total number of pending harassment or discrimination complaints the company is seeking to resolve through internal processes or through litigation; and

whether the company uses nondisclosure or mandatory arbitration clauses in employment agreements, the company’s assessment as to any negative effects on workers’ ability to seek redress, and whether any exceptions are provided for harassment and discrimination matters.

This Report should not include the names of accusers or details of their settlements without their consent and should be prepared at a reasonable cost and omit any information that is proprietary, privileged, or violative of contractual obligations.

Safe and inclusive workplace: Arjuna Capital has filed a resolution at Comcast like one that earned 22 percent last year and 13.1 percent in 2020. It asks for a report “assessing the effectiveness of the company’s workplace sexual harassment policies, including the results of a comprehensive, independent audit/investigation, analysis of policies and practices, and commitments to create a safe, inclusive work environment.”

Mandatory arbitration: The Nathan Cummings Foundation has reached agreements and withdrawn a proposal asking three financial companies—Goldman Sachs, JPMorgan Chase and Morgan Stanley—to report on their use of mandatory arbitration. The resolution asked for a report by the third quarter of this year, omitting personal data,

on the impact of the use of mandatory arbitration on [the company’s] employees and workplace culture. The report should evaluate the impact of [the company’s] current use of arbitration on the prevalence of harassment and discrimination in its workplace and on employees’ ability to seek redress.

While the resolution is new to Morgan Stanley, it earned 53.2 percent of shares cast in 2021 at Goldman Sachs. JPMorgan agreed to conduct the requested investigation this year and so did Goldman, which had argued the resolution was moot because of its report.

Worker misclassification: The SOC Investment Group and the Teamsters have a new proposal at five companies—Best Buy, Lowe’s, Target, TJX and Urban Outfitters—about the risks of worker misclassification in their product supply chains, taking note of a new California law that aims to curb the practice in its ports, which are key link for goods entering the country from Asian manufacturers. It wants a report

on the financial, reputational, and human rights risks resulting from the use in the Company’s supply chain and distribution networks of companies that misclassify employees as independent contractors. The report should be…available at least 90 days prior to the 2023 annual shareholders meeting.

All but Urban Outfitters have lodged challenges at the SEC. The companies make several arguments about why the proposal is an ordinary business issue, saying it can be excluded because it concerns supplier relationships or standards, legal compliance or litigation, assessment of government regulations, workforce management, employee compensation, or workplace safety and working conditions. Best Buy also says the resolution is too vague.

Safety audit: Proponents filed two new but similar resolutions about worker safety at Amazon.com:

Domini Social Investments asked it to

commission an independent third-party audit on workplace health and safety, evaluating:

productivity quotas,

surveillance practices, and

the effects of these practices on injury rates and turnover.

The audit should be conducted with input from employees, experts in workplace safety and surveillance, and other relevant stakeholders; informed by recent state legislation; and address regulatory inquiry, and media coverage.

Tulipshare, the new U.K.-based shareholder advocacy firm, asks for essentially the same thing, requesting “an independent audit and report of the working conditions and treatment that Amazon warehouse workers face, including the impact of its policies, management.”

SEC action—The company has lodged challenges at the SEC, arguing both proposals are about ordinary business. Amazon further argues that if the SEC disagrees with its ordinary business argument that it should be able to exclude the Domini proposal because it was received first and the two are duplicative. (A similar proposal about worker health and safety in the Covid-19 pandemic was omitted on ordinary business grounds in 2021, as was a 2020 proposal about accident prevention.)

Differential injury rates: Also at Amazon.com is another new proposal from the New York City Comptroller’s office, although the company has lodged an SEC challenge arguing it duplicates another proposal it received first seeking a racial justice audit. The proposal asks for a report

examining whether Amazon’s health and safety practices give rise to any racial and gender disparities in workplace injury rates among its warehouse workers and the impact of any such disparities on the long-term earnings and career advancement potential of female and minority warehouse workers. Among other things, the report shall include lost time injury rates for all warehouse workers, broken down by race, gender and ethnicity.

Human capital management: Still another proposal at Amazon.com, from the United Auto Workers Retirees’ Medical Benefit Trust, voices concerns similar to those at Dollar Tree and Kroger on competitive employee compensation. The Amazon proposal is broader, however. It discusses the various challenges brought on by the Covid-19 pandemic and asks for a report

on the risks to the Company related to ensuring adequate staffing of Amazon’s business and operations, including risks associated with tighter labor markets, and how Amazon is mitigating or plans to mitigate those risks. The report should include a discussion of the extent to which Amazon relies on part-time, temporary and contracted workers in each of its three operating segments, and whether staffing considerations have affected any of Amazon’s decisions about strategy, such as expansion plans or entering new geographies or lines of business.

Amazon is arguing at the SEC that this is a matter of ordinary business but also duplicates a proposal from the AFL-CIO about the pandemic’s impact on diversity. (See p. 57 under Diversity at Work.)

Replacement workers and safety: The AFL-CIO has a new proposal at ExxonMobil about accidents and replacement workers, asking for a report “on flaring events and the risk of industrial accidents that may arise from the use of temporary replacement workers.” The company says this is a matter of workplace management and ordinary business. ExxonMobil also contends the problem is a personal grievance because an AFL-CIO affiliated union, the United Steelworkers, was affected by a worker lockout in May 2021 that the proposal says created safety risks.

Pandemic safety: Safety also was on the mind of an individual proponent, Stephen C. Stubberud, who saw his proposal asking Walt Disney to establish pandemic-related safety protocols omitted on procedural grounds (he failed to prove his stock ownership). The resolution said, “Since management is so important to the continued success of the Walt Disney Company, special COVID-19 safety protocols shall be implemented,” and went on to provide a detailed set of suggested actions that included immediately firing any employee who declined to be vaccinated and banning such employees from ever working for the company again.

Benefits

Paid sick leave: Last year several proposals asked for a report on extending pandemic paid sick leave benefits, but six were omitted on ordinary business grounds. Proponents nonetheless are trying again in 2022. The proposal is pending at CVS Health, Home Depot, Kroger and Target

to adopt and publicly disclose a policy that all employees, part- and full-time, accrue some amount of PSL that can be used after working at Amazon for a reasonable probationary period. This policy should not expire after a set time or depend upon the existence of a global pandemic.

Withdrawal—The United Church Funds withdrew at Amazon.com after it learned the company already discloses its paid time off policies.

SEC action—CVS Health has lodged a challenge at the SEC, arguing it is ordinary business.