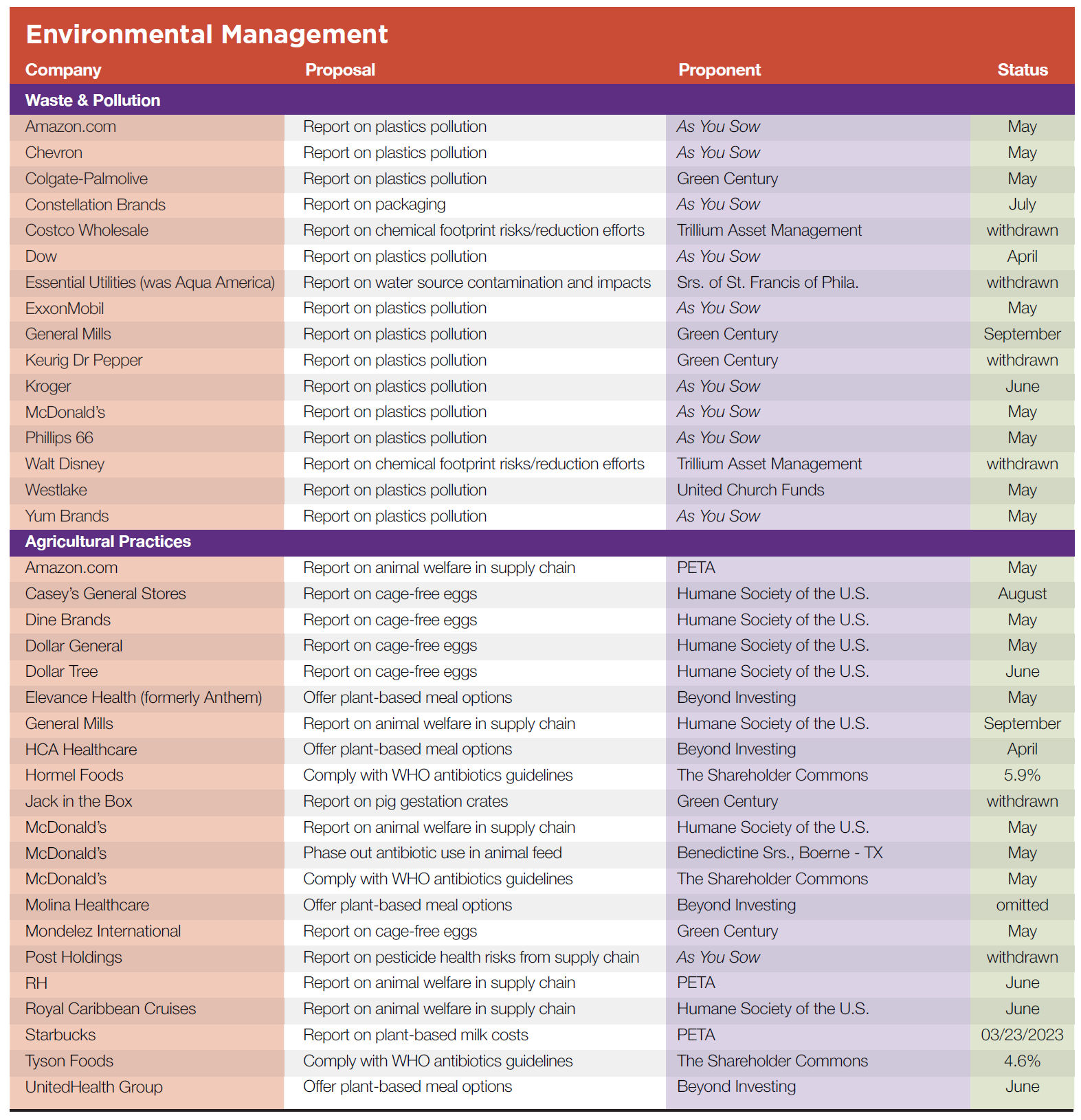

Proposals about environmental management that go beyond direct climate impacts long have asked about mitigating various types of pollution and waste, with a growing focus on plastics. They also address agricultural practices such as the treatment of food animals, antibiotics in feed, pesticides and water. This year, the total now sits at 35 resolutions, with several new issues such as product repair, chemical footprinting and mining and indigenous rights.

Waste & Pollution

Plastics and Packaging

As You Sow and Green Century remain the main players seeking to cut the use of plastics at both producers and users, with 13 proposals, six resubmitted. The proposals foresee financial risks to industry of up to $100 billion should governments require them to cover waste management costs they impose. They reference a July 2020 Pew Charitable Trusts report, Breaking the Plastic Wave, which estimates current initiatives will cut ocean plastics by only 7 percent, tripling flows into the oceans by 2040. The resolutions call for sharp reductions in production and use, plus more recycling.

PETROCHEMICAL COMPANIES’ UNSUSTAINABLE PRODUCTION POLICIES DRIVE PLASTIC POLLUTION CRISIS

CONRAD MACKERRON

Sr. Vice President, As You Sow

Following strong votes last year, As You Sow is expanding engagement on plastics and petrochemicals for 2023. The plastic pollution crisis continues unabated, with 139 million tons of single-use plastic waste created in 2021, six million more tons than in 2019, according to a recent report by Minderoo Foundation. Optimism is rising for a global treaty on plastics within the next two years that could include potential curbs on plastic production after initial treaty negotiations in December 2022 in Uruguay.

Producers: At plastics producers, As You Sow and United Church Funds ask about reducing production. At Chevron, Phillips 66 (where it received 50.4 percent in 2022), Dow and ExxonMobil (36.5 percent last year), the proposal asks for an audited report on “whether and how a significant reduction in virgin plastic demand, as set forth in Breaking the Plastic Wave System Change Scenario to reduce ocean plastic pollution, would affect the Company’s financial position and assumptions underlying its financial statements.” The Pew Charitable Trusts, which produced the referenced report, launched a new tool in September 2022 to guide reduction strategies and solutions. Scientists have modeled various responses to cut plastics and the System Change Scenario the proposal mentions is an “all of the above” option, the most aggressive.

At Westlake, the resolution asks how it “could shift its plastics resin business model from virgin to recycled polymer production as a means of reducing plastic pollution of the oceans.” The company, which dropped “Chemical” from its name in 2021, makes and markets chemicals but also now makes consumer products from postindustrial recycled polyethylene and PVC. As You Sow withdrew a proposal at the company in 2020 on plastics after it provided more information.

SEC action—Chevron is arguing the proponent failed to prove stock ownership, which generally is successful, while ExxonMobil argues As You Sow impermissibly submitted three resolution and argues it therefore can exclude this one. (The other proposals are on GHG emissions calculations and asset retirement obligations— see p. 21 and 27.)

Retailers: Four retail companies that have faced the same issue before are being asked how they can reduce “plastics use in alignment with the one-third reduction findings of the Pew Report, or other authoritative sources, to reduce its contribution to ocean plastics pollution.” The proposal is pending at Amazon.com (where it received 48.9 percent in 2022 and 35.5 percent in 2021), Kroger (38.3 percent in 2022 and 45.6 percent in 2021), McDonald’s (41.9 percent in 2022) and Yum Brands (where a sustainable packaging proposal in 2019 earned 33.6 percent).

CLOSING THE LOOP ON PLASTIC POLLUTION

KELLY MCBEE

Circular Economy Sr. Coordinator, As You Sow

Many corporations are attempting to mitigate the plastic pollution crisis by reducing their use of plastics, yet few have committed to tackling the crisis in its entirety by taking accountability for what actually happens to their packaging at its end of life.

To solve the plastic pollution crisis, corporations need to adopt a circular economy mindset for packaging. With this framework, natural resource use is limited; products and packaging are designed to be reusable, compostable or recyclable and are collected for reuse or recycling when their useful life is complete.

Packaged food: The resolution pending at Colgate-Palmolive and General Mills seeks more sustainable packaging, asking for a report on “if and how the Company can increase its sustainable packaging efforts by reducing its absolute plastic packaging use.” It earned 56.5 percent at General Mills last year but Colgate-Palmolive last saw a similar proposal 10 years ago. As You Sow withdrew a plastics proposal at Keurig Dr Pepper in 2021 after the company agreed to cut virgin plastic use by 20 percent but this year Green Century called for “absolute reduction goals, annual reporting and new ways to use less plastic,” then withdrew after an agreement.

Circular economy: New is a proposal at Constellation Brands, filed by As You Sow on behalf of Warren Wilson College. It seeks a report on “opportunities for the Company to support a circular economy for packaging.” The proposal asserts that the company may face crippling costs for waste management if it does not take more aggressive action on reusable or recyclable packaging for its drinks; it claims the company “has taken virtually no action to ensure the circularity of its product packaging.” This contrasts unfavorably with peers such as Molson Coors, Heineken, Diageo and others, the proposal claims.

Chemicals

Chemical footprint: Trillium Asset Management has withdrawn a proposal that asked Costco Wholesale and Walt Disney to report “on the outcomes of… chemical reduction efforts by publishing quantitative and qualitative data on progress to eliminate the use of chemicals of concern.” Disney agreed to enhance its reporting and cut key chemicals, disclosing its baseline for measuring improvements, which it will track; it also will explain safer alternatives. Costco disclosed its Restricted Substance Lists which suppliers must avoid and information on packing materials, began to report on supplier compliance and updated its guide to help suppliers choose safter alternatives.

Water pollution: The Sisters of St. Francis of Philadelphia withdrew at Essential Utilities a request that it report “on PFA levels at all Essential water sources along with the potential public health and/or environmental impacts of toxic materials in the water it provides to the public.” The company will make public test results for its wells and water systems and report the results to its one million customers.

Agricultural Practices

The Humane Society of the United States (HSUS) has been the most prolific recent proponent of shareholder resolutions seeking changes to how animal raised for human consumption are treated. It raises familiar concerns in 2023 about cage-free eggs and the treatment of meat-producing chickens. A new proposal asks about vegan meal options at health care companies. People for the Ethical Treatment of Animals (PETA) raises questions about plant-based milk and farm animal welfare. Most proposals are still pending; just one is a resubmission.

Eggs: HSUS is joined by Green Century in a proposal at five companies about cage-free eggs. The proposals note past commitments to only use eggs from chickens not confined to cages, and seeks information on how these pledges are being implemented:

• Casey’s General Store: “disclose what percentage of its eggs come from cage-free hens and what further steps it will take toward accomplishing 100% cage-free egg compliance, including any annual benchmarks the company may have.”

• Dine Brands: “disclose any updated cage-free egg targets it may have with the goal of accelerating its progress. If the company has no such updated targets, then shareholders ask it to develop and disclose them.”

• Dollar General and Dollar Tree: “disclose what percentage of its eggs come from cage-free hens, the specific steps the company has taken toward implementing its cage-free egg commitment, and what next steps the company will take to reach its goal of sourcing only cage-free eggs by 2025.” . “

• Mondelēz International: “disclose any annual glidepath benchmarks the company may have for achieving its global cage-free egg goal. If the company does not have any such glidepath, shareholders ask it to develop and disclose one.”

Animal product sourcing: HSUS takes up different aspects of supply chain animal welfare at three more companies but again references past company commitments, while PETA wants a report:

• At General Mills, which has not faced an animal welfare proposal before, HSUS wants to know: “A) what percentage of the broiler chicken meat in its supply chain meets the standards for its 2024 goals, B) what specific steps the company has taken toward meeting these goals since 2017, and C) what specific next steps it will take.”

• McDonald’s has long been under fire about animal welfare in its supply chain and this year the focus is meat-producing chickens, asking it to “disclose what exactly the “15 key welfare indicators” (KWI)" being used for the company’s animal welfare program are. The disclosure should include specific details about the KWIs and how the company is using each one to measure and improve the welfare of animals in its poultry supply.” Last year, HSUS withdrew a proposal about pig welfare once the company acknowledged some pregnant sows were confined—and animal welfare concerns inspired billionaire Carl Icahn to run two dissident candidates for the board (though none was elected).

• The lens at Royal Caribbean Cruises is broader, seeking a report on progress on “2022 animal welfare benchmarks for egg, pork, and poultry procurement.” It says, “if the company has failed to fully meet any of these benchmarks, shareholders further ask RCG to disclose an action plan showing what its next steps for moving forward on the commitment will be.”

• People for the Ethical Treatment of Animals (PETA) also is concerned about farm animals, but in the Whole Foods supply chain. It found “horrifying” conditions at one supplier in an investigation in 2021 and says Whole Foods is not living up to its stated animal welfare policy, so it wants parent company Amazon.com to report before the end of the year “evaluating the efficacy and shortcomings of Whole Foods’ animal welfare standards and auditing procedures.”

Gestation crates: Green Century has withdrawn at Jack in the Box, where it asked for a report on “the percentage of its pork produced without gestation crates, its timeline for reaching 100%, and what steps it will take to get there.

Vegan meals: A new shareholder proponent, the vegan investment firm Beyond Investing, wants four health care companies to “require their hospitals to provide plant-based food options to patients at every meal, within vending machines and in the cafeterias used by outpatients, staff and visitors.” The resolution has been omitted on procedural grounds at Molina Healthcare but is still pending at Elevance Health, HCA Healthcare and UnitedHealth. Each has lodged a challenge at the SEC. The companies variously argue that they cannot implement it or that it is ordinary business.

Non-dairy milk: Starbucks investors will vote on a resolution from PETA, which the group mentioned in a September press release. The proposal asks for a report by the end of September:

In light of heightened public concern about the dairy industry’s environmental impact, the growing prevalence of allergies to cow’s milk, and the increasing demand for alternatives to dairy milk, the board is strongly urged to commission a report examining any costs to Starbucks’ reputation and any impact on its projected sales incurred as a result of its ongoing upcharge on plant-based milk. The report should address the risks and opportunities presented by the shift in public opinion regarding dairy vs. nondairy options, including, but not limited to, the aforementioned issues.

Antibotics & Pesticides

Antibiotics: Only three resolutions address the dangers of antibiotic resistant bacteria this year. The Shareholder Commons (TSC) is reprising past concerns that food companies are not sufficiently attending to risks that the World Health Organization and others see as significant threats to human health. In a new proposal, TSC has asked Hormel Foods, McDonald’s and Tyson Foods to comply with WHO’s Guidelines on Use of Medically Important Antimicrobials in Food-Producing Animals throughout their supply chains. It earned 5.9 percent support at Hormel, where a proposal last year asking for a report on the externalized costs of antibiotic resistance earned 6.9 percent. The vote was 4.6 percent at Tyson Foods, not enough for resubmission.

The TSC resolution is still pending at McDonald’s, which has received many antibiotics proposals in the past, including one last year from TSC on systemic risks that received 13.4 percent. A second proposal from the Benedictine Sisters of Bourne, Texas, asks the company to “adopt an enterprise-wide policy to phase out the use of medically important antibiotics for disease prevention purposes in its beef and pork supply chains. The policy should include, in the discretion of board and management, global sourcing targets with timelines, metrics for measuring implementation, and third-party verification.”

Pesticides: As You Sow had one resolution this year on pesticides but withdrew at Post Holdings when the company agreed to engage its suppliers about pesticide use and provide more information on its use of pesticides. As You Sow withdrew four similar proposals at food companies in 2022 and one went to a vote at Archer-Daniels-Midland, earning 33.7 percent.