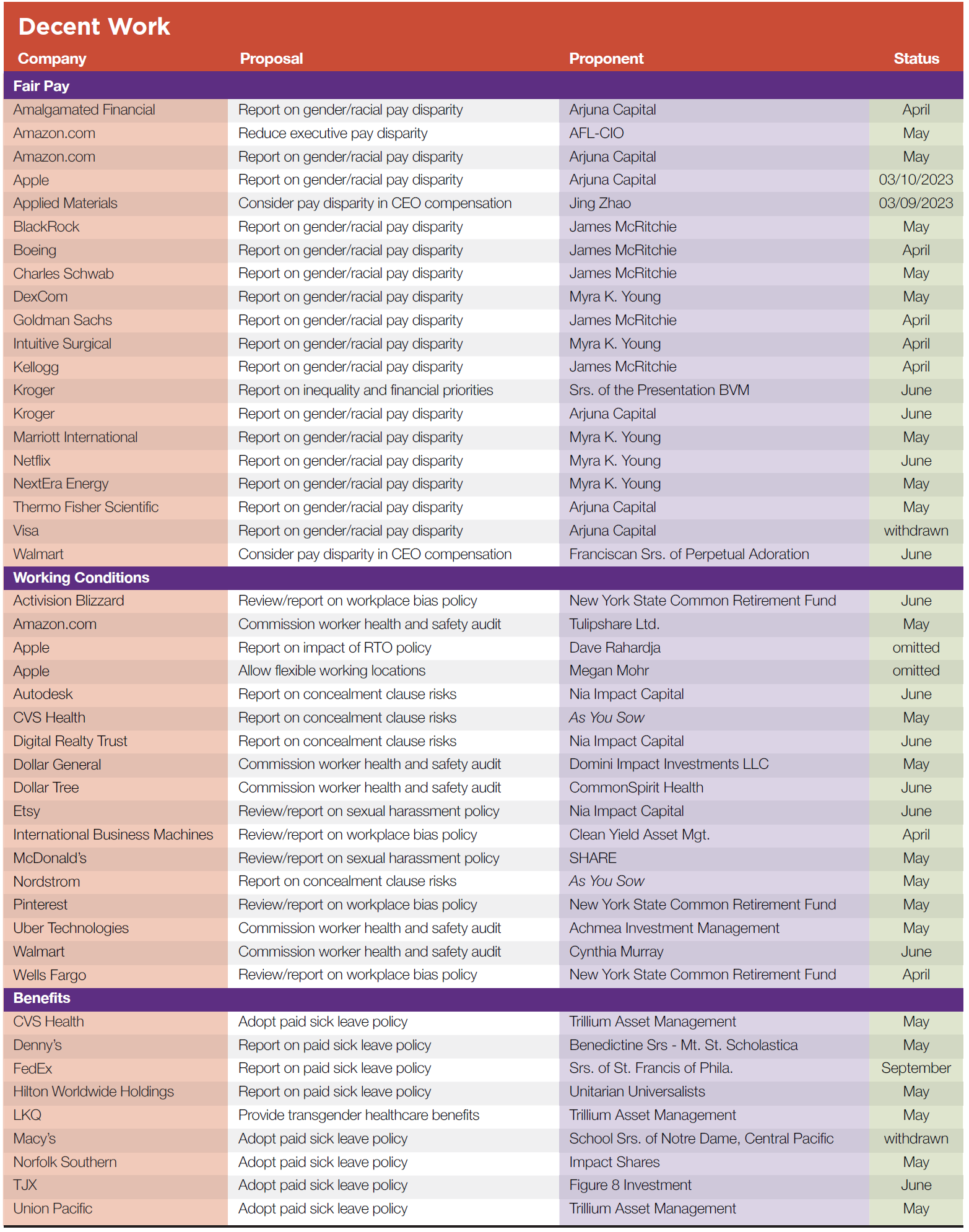

Although support for proposals about fair pay and working conditions has risen annually for ten years, filings in 2023 have fallen after a bump-up last year. Twenty resolutions ask about fair pay (mostly gender and minority pay disparities), another 17 concern working conditions and nine address benefits (mostly paid sick leave). Only two had been withdrawn as of mid-February. Just six of the proposals are resubmissions, although many of the companies have considered diversity issues before.

(Diversity at Work below, p. 50, includes 39 more proposals about fair representation, while a new push with about a dozen proposals invoking international standards and the right to organize is discussed on p. 59 under Human Rights.)

Context: A new SEC disclosure rule about human capital went into effect in November 2020, recommending that companies report on how they manage and set goals, if the measures are materially important—making the rule applicable to some but not all industries. A push continues for a more prescriptive approach, though, which would yield information shareholder proposals have been requesting for years. Academics, former SEC officials and others outlined in June 2022 what this might look like. A key player in the debate is the Human Capital Management Coalition, which includes 37 institutional investors who together manage more than $8 trillion in assets. Experts from Deloitte discussed the shifting corporate board perspective about workforce management risks and pressures for disclosure and shifting corporate practices this January.

Fair Pay

While last year saw several variations on fair pay proposals, in 2023 they are mostly the same and about gender and race-based pay differentials; notably, most are at companies that have never received this request in the past.

Gender/Race Median Pay Gap

Arjuna Capital and Proxy Impact have filed dozens of resolutions trying to persuade companies to report on differential pay rates for women and people of color, compared to white men. At first, they asked only about policies and goals “to reduce” the gap and companies started agreeing to do so. Later proposals sought data on the median pay gap that shows the extent to which higher-level employees are disproportionately white and male (and have higher pay). Support initially dropped but then rebounded and produced an average of more than 40 percent in 2022.

Global and country reporting—James McRitchie and Myra K. Young seek annual reports at 11 companies:

on unadjusted median and adjusted pay gaps across race and gender globally and/or by country, where appropriate, including associated policy, reputational, competitive, and operational risks, and risks related to recruiting and retaining diverse talent. The report should be prepared at reasonable cost, omitting proprietary information, litigation strategy, and legal compliance information.

Racial/gender pay gaps are the difference between non-minority and minority/male and female median earnings expressed as a percentage of non-minority/male earnings.

At Kellogg, the resolution adds, “Pay includes base, bonus, and equity compensation either aggregated or, preferably, disaggregated.”

Arjuna Capital—The proposal omits reference to “unadjusted and adjusted” pay gaps and is a resubmission at Apple, where last year it received 34.5 percent support; it is the first vote on this issue in 2023. This is the fifth year in a row at Amazon.com, where votes reached their highest level yet last year at almost 29 percent.

At four other companies—Amalgamated Financial, Kroger, Thermo Fisher Scientific and Visa—the proposal is similar but asks for “both quantitative median and adjusted pay gaps across race and gender.” It is pending at the first three companies.

Withdrawals—Arjuna withdrew at Visa when the company agreed to report annually on the median and statistically adjusted pay gaps, “assessed on base, bonus, and equity compensation” for its entire workforce. Most of the other companies have engaged with investors previously on various diversity and inclusion, producing several agreements that have yielded more reporting, so additional withdrawals seem likely.

Executive Compensation

CEOs and senior executives: Two proposals are about CEO pay but they are not very specific:

Jing Zhao has resubmitted a proposal to Applied Materials that earned 8.3 percent last year. He wants the company to “improve the executive compensation program and policy, such as to include the CEO pay ratio factor and voices from employees.”

The Franciscan Sisters of Perpetual Adoration have filed the first proposal to ask Walmart specifically about disparity between pay for the CEO and workers, although many resolutions before have concerned fair pay and treatment. Most recently, a request to report on pay and racial justice earned 13.4 percent in 2022 and 12.7 percent in 2021. The AFL-CIO also has filed the proposal at Amazon.com, although there the proposal refers to “senior executive officer compensation” instead of the CEO. It asks the board

to take into consideration the pay grades and/or salary ranges of all classifications of Walmart employees when setting target amounts for [CEO/senior executive officer] compensation. Compliance with this policy is excused if it violates any existing contractual obligation or the terms of any existing compensation plan.

INDEPENDENT AUDITS CAN FURTHER WORKER HEALTH AND SAFETY

MARY BETH GALLAGHER

Director of Engagement, Domini Impact Investments

Safety at work is a bare minimum for workers’ dignity. Yet, far too often, it is at risk. In June 2022, the International Labor Organization (ILO) recognized a safe and healthy work environment as a universal labor right, adding it to the core ILO fundamental principles of rights at work.

In practice, a safe and healthy work environment involves physical and mental safety, keeping a workplace free of hazards, providing training and equipment and offering reasonable expectations for workers’ hours and capacity. That way, people can go to work each day and come home safely.

Inequality and financial priorities: Continuing concerns about the societal costs of company action voiced by The Shareholder Commons, the Sisters of the Presentation of the Blessed Virgin Mary asks Kroger to report on

(1) whether the Company participates in compensation and workforce practices that prioritize Company financial performance over the economic and social costs and risks created by inequality and racial and gender disparities and (2) the manner in which any such costs and risks threaten returns of diversified shareholders who rely on a stable and productive economy.

Elsewhere, last year this proposal earned 9.7 percent at Marriott International and 14.7 percent at Tractor Supply, while a Kroger proposal seeking a report on competitive employee compensation given the tight postpandemic labor market received 29.5 percent.

Working Conditions

Seventeen proposals raise questions about fair treatment and working condition this year, down from more than two dozen last year at this time, but an expanded slate seeks audited reports on worker health and safety; most of the others relate to sexual harassment and discrimination in the workplace.

Health and safety audits: During the height of the COVID-19 pandemic, workers in frontline jobs faced unprecedented hazards when they showed up to work and the fallout from these challenges and a tight labor market continues to affect the economy and proxy season. The five pending proposals are similar, each asking for independent or third-party audits:

Warehouses—Tulipshare has resubmitted a proposal at Amazon.com that earned 44 percent last year. It seeks “an independent audit and report of the working conditions and treatment that Amazon warehouse workers face, including the impact of its policies, management, performance metrics, and targets.” The request for an audited report was new in 2022, but a 2021 report proposal on worker health and safety was omitted on ordinary business grounds, as was a 2020 proposal about accident prevention.

Dollar stores—The proposal at Dollar General and Dollar Tree asks for “an independent third-party audit on the impact of the company’s policies and practices on the safety and well-being of workers.”

SEC action: Both companies are arguing at the SEC that the proposal concerns ordinary business. Dollar General notes it faces ongoing litigation, while Dollar Tree says it is about workforce management.

Rideshare drivers—Achmea Investment Management, a Dutch asset manager for pension funds, wants a thirdparty audit at Uber Technologies “on driver health and safety, evaluating the effects of Uber’s performance metrics and ratings and its policies and procedures on driver health and safety.” The audit “should be conducted with input from drivers, workplace safety experts, and other relevant stakeholders and consider legislative and regulatory developments and adverse media coverage.”

Guns and violence—A new angle comes from Cynthia Murray at Walmart. Last year she asked for a workers’ council to address pandemic safety and earned 12.7 percent support. Now, she wants an audited report from the company after an

independent review of the impact of Company policies and practices on workplace safety and violence, including gun violence….At company discretion, the proponents recommend the audit and report include: (1) Evaluation of management and business practices that contribute to an unsafe or violent work environment, including staffing capacity and the introduction of new technologies; and (2) Recommendations that will help Walmart create safer work environments and prevent workplace violence.

Concealment clauses: Concealment clauses in employment contracts are widely known to suppress information about sexual harassment and other employment problems such as wage theft or discrimination. Nia Impact Capital and As You Sow, with the help of Whistle Stop Capital, are continuing a recent campaign that asks for reports from six companies—Autodesk (where proponents withdrew a mandatory arbitration proposal in 2021 after an agreement), CVS Health, Digital Realty Trust (where it earned 45.6 percent last year) and Nordstrom (which agreed to review mandatory arbitration in 2020). The resolution asks for a report “assessing the potential risks to the company associated with its use of concealment clauses in the context of harassment, discrimination and other unlawful acts.”

Sexual harassment: Nia Impact and SHARE want two companies to report on their policies:

The proposal at Etsy is pithier, asking only for “an independent review of the effectiveness and outcomes of the company’s efforts to prevent harassment and discrimination against its protected classes of employees.” Nia withdrew a proposal about concealment clauses last year after an SEC challenge that argued it was moot; Esty reported on the subject in January 2022.

At McDonald’s, the resolved clause from SHARE is much longer. Proponents have withdrawn six proposals in the last five years on fair treatment and diversity issues at the company, but a 2022 request to conduct a racial justice audit earned 55.7 percent. This is the first resolution specifically on sexual harassment and it calls for an independent assessment by the end of the year about the company’s “efforts to eradicate sexual harassment and gender discrimination in its corporate owned and franchised restaurants.” It says the review should cover:

- McDonald’s commitment, policies, and measures to prevent and address sexual harassment and gender discrimination including those outlined in the Company’s Global Brand Standards, its Global Statement of Principles on Workplace Violence Prevention and its Global Statement of Principles Against Discrimination, Harassment and Retaliation;

- The measures taken to support franchised owners to adopt best practices and the McDonald’s policies mentioned above;

- The grievance mechanisms implemented, including the process for handling complaints and access to effective remediation.

The company was in the news recently when one of its franchise operators with 18 locations in Nevada, Arizona and California agree to pay nearly $2 million to settle a lawsuit from the Equal Employment Opportunity Commission that alleged the franchisee knew of harassment by supervisors, manager and coworkers directed at young employees since 2017. The franchisee will hire an outside monitor to conduct audits of its practices and track problems.

Workplace bias: Clean Yield and NYSCRF want four companies to review and report on their workplace bias policies. The Clean Yield resolution asks International Business Machines to report about findings from “an independent review of the effectiveness and outcomes of the Company’s efforts to prevent harassment and discrimination against its protected classes of employees.” A proposal on concealment clauses earned 62.7 percent last year and a request for more data on IBM’s diversity programs earned 94.3 percent in 2021 after the company supported it.

NYSCRF filed its detailed proposal at three companies. One is a resubmission at Activision Blizzard that earned a whopping 67 percent last year, but it is new to Pinterest and Wells Fargo. It asks for an annual report

describing and quantifying the effectiveness and outcomes of Company efforts to prevent abuse, harassment and discrimination against protected classes of employees. The report should also disclose the Company’s progress on relevant metrics and targets such as the:

- total number and aggregate dollar amount of disputes settled by the Company related to abuse, harassment or discrimination based on race, religion, sex, national origin, age, disability, genetic information, service member status, gender identity, or sexual orientation for the last three years; and

- Company’s progress toward reducing the average length of time it takes to resolve abuse, harassment or discrimination complaints either through internal processes or litigation, and

- total number of pending abuse, harassment or discrimination complaints the Company is seeking to resolve through internal processes or litigation.

This report should not include the names of accusers or details of their settlements without their consent and should be prepared at a reasonable cost and omit any information that is proprietary, privileged, or violative of contractual obligations.

RAILROAD WORKERS’ LACK OF PAID SICK LEAVE PUTS EMPLOYEES, PUBLIC AND INVESTORS AT RISK

MARVIN J. OWENS

Chief Engagement Officer, Impact Shares

Impact Shares considers paid sick leave (PSL) to represent an important human capital investment critical to investors, as well as a racial and gender equity concern. Filing a shareholder proposal at Norfolk Southern railways requesting that the company adopt a PSL policy as a standard benefit was the first step in leveraging our position as an ETF issuer representing leading social and environmental advocacy organizations. It carries the expectation that, in so doing, we create changes in company policy toward workers. Much like our general investment strategies, the Impact Shares approach to the PSL issue with Norfolk Southern has been informed by our advocacy partners, specifically the YWCA and the NAACP.

Flexible work: Apple employees filed proposals asking it to allow flexible working locations and report on the company’s return to the office policy, but both were omitted on ordinary business grounds.

Benefits

In the teeth of the pandemic three years ago, shareholder proponents started asking companies to extend pandemic paid sick leave benefits, but six were omitted on ordinary business grounds. After the SEC decided to allow more proposals to appear last year, two resolutions went to votes, while proponents withdrew five more after the companies provided more information. In 2023, there are eight proposals, plus another new one on transgender health benefits.

Adopt paid sick leave: A proposal to adopt a policy is the same this year, asking five companies to

to adopt and publicly disclose a policy that all employees, part- and full-time, accrue some amount of PSL that can be used after working at Amazon for a reasonable probationary period. This policy should not expire after a set time or depend upon the existence of a global pandemic.

It is new at two railroad companies—Norfolk Southern and Union Pacific. Investors will recall paid sick leave was a key sticking point in a threated national rail strike in fall 2022, which was averted by negotiations and then outlawed by Congress on December 2. While Congress considered providing paid sick days, it ultimately did not pass the measure, which the railroads have opposed given the expense. The proposal last year earned 26.2 percent CVS Health and 33.7 percent at TJX.

Withdrawal—Macy’s faced its first proposal on the subject but the proponent withdrew after the company agreed to report more in its next Human Capital Report about its paid leave policy and to continue engagement with investors.

SEC action—Norfolk Southern is arguing at the SEC that the proposal can be omitted because it would violate federal law but the commission has yet to respond.

Report on paid sick leave: ICCR members want three companies to report on their sick leave policies. At Denny’s it asks for a report “analyzing the provision of paid sick leave among franchise employees and assessing the feasibility of inducing or incentivizing franchisees to provide some amount of paid sick leave to all employees.” The other proposals ask FedEx and Hilton Worldwide Holdings to report on their “permanent paid sick leave policies, above and beyond legal requirements. For purposes of this proposal, ‘permanent’ means a sick leave policy that is not conditioned on the existence of a pandemic or other external event.”

Transgender benefits: A new proposal from Trillium Asset Management asks vehicle parts firm LKQ to

adopt and publicly disclose a policy, with details and timing at the discretion of the company, offering all employees affirmative transgender-inclusive healthcare coverage.

Transgender-inclusive healthcare benefits may include hormone replacement therapies, mental health services, surgical reconstruction, and other medically-necessary procedures. While the Affordable Care Act has removed categorical exclusions of gender-related care, insurers can still restrict some forms of care for being “cosmetic” or “not medically necessary.”

Trillium withdrew a 2020 proposal asking for gender identity to be added to the company’s non-discrimination policy after LKQ agree to do so.