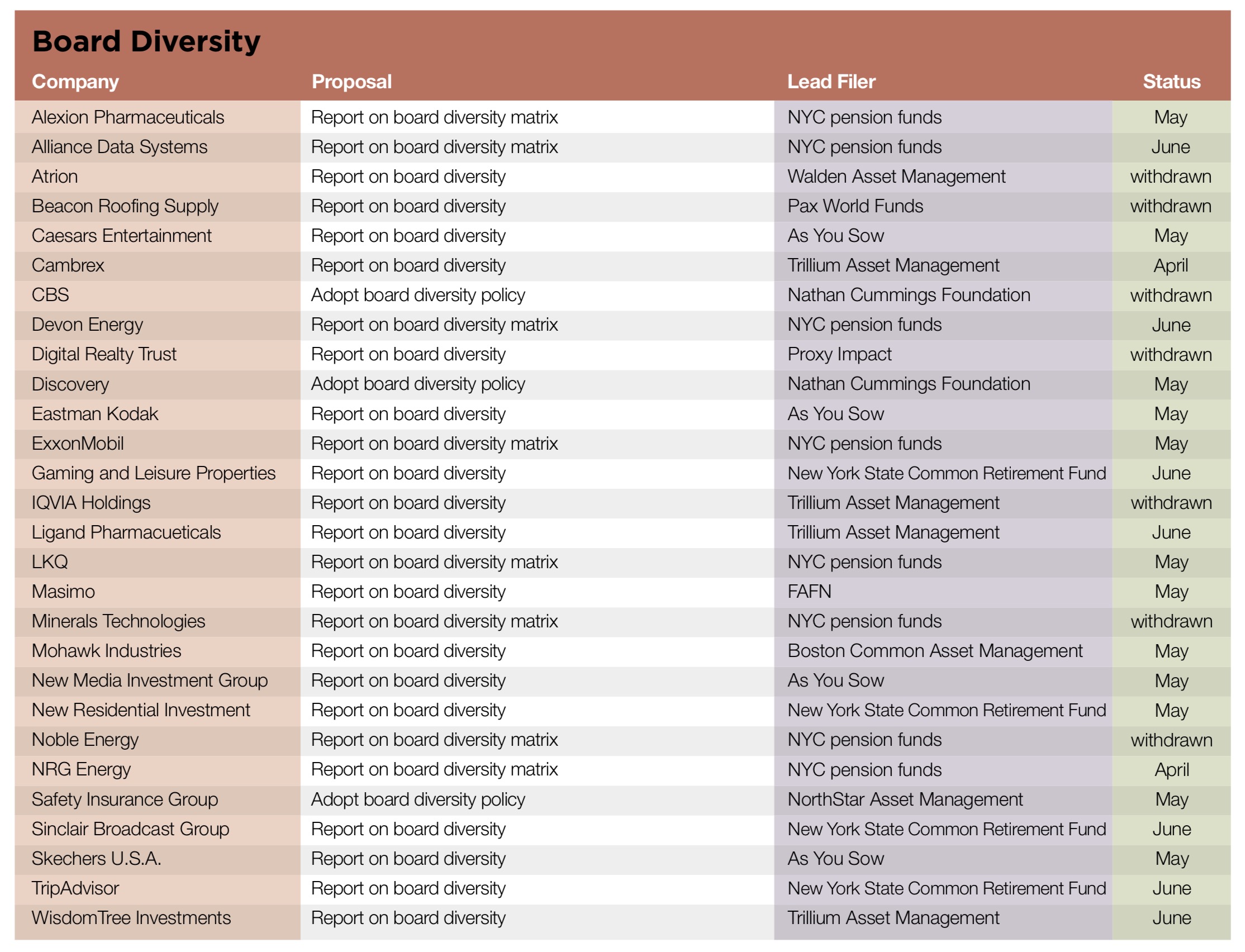

As men at the pinnacle of business and government continue to leave their jobs under the cloud of allegations about sexual misconduct, and as the most diverse class of Congressional representatives takes the reins in Washington, investors are continuing to chip away at boards dominated by white men. Proponents withdrew fully 29 out of 34 resolutions filed on the subject in 2018 after most targeted companies agreed to diversity their selection processes and report to investors. More of the same will occur in 2019. To date, 28 proposals have emerged; more are very likely to crop up as the year progresses.

New this year is the addition in some of the proposals of further differentiating attributes—age, gender identity, gender expression and sexual orientation. All mention gender, race and ethnicity.

The 30 Percent Coalition continues to coordinate resolutions and work in other ways to diversify boards. The coalition’s members include senior business executives, civil society groups, institutional investors, corporate governance experts and board members themselves. The proposals ask companies to add more diversity to the board room and report on how they manage this process. Since most of the very largest companies have made some commitment to more diversity, companies further down the revenue ranks are coming under scrutiny. Since 2010, proponents have filed at least 230 proposals, withdrawing nearly three-quarters after companies have made their policies more inclusive, at least on paper. Proponents are most likely to file proposals at companies with no women or people of color on the board, but increasingly they are not satisfied with a token few and seek expanded representation even where one or two board members already are outside the “pale, male and stale” club.

COUNTING WOMEN COUNTS: MIXING GENDERS ON BOARDS IS GOOD BUSINESS

Aeisha Mastagni

Portfolio Manager, Corporate Governance, California State Teachers’ Retirement System (Calstrs)

Board diversity is not a new topic for investors and governance professionals; it is a topic resonating with a new audience: state legislators.

The California State Teachers’ Retirement System (CalSTRS), with a member base that’s 74 percent women, has long focused on the lack of women on corporate boards. While we know—and empirical evidence confirms—that companies with women in the boardroom are more successful, our vision of a diverse board includes race, ethnicity, background, skill-sets, age, and gender. Still, the large gap between female representation in society (51 percent) and in the boardroom (17.7 percent) remains and is not to be ignored.

Adopt policy: Just three proposals so far ask for adoption of a policy, with two pending. The Nathan Cummings Foundation resubmitted a proposal to Discovery that has gone to a vote annually since 2015. It earned 33.2 percent last year and again asks the company to apply the “Rooney Rule” concept that helped to diversify National Football League coaching. It says Discovery should

adopt formalized nominating committee procedures for identifying new board candidates. We request that this include a policy to address board diversity which requires that the initial list of candidates from which new management supported director nominees are chosen include (but need not be limited to) qualified women and minority candidates and that any third-party consultant assisting in the identification of potential nominees be asked to include such candidates.

The foundation had to withdraw a similar proposition at CBS after a technical problem with its filing pointed out by the company in an SEC challenge. The proposal had highlighted the company’s decision to donate departing CEO Lester Moonves’ $120 million forfeited severance package to the Time’s Up initiative that supports women bringing legal action against alleged workplace abusers. Nathan Cummings said the company’s board nomination process is opaque and that the board does not reflect the company’s “vast audiences.”

Another proposal that suggests using the same idea to diversify nominee pools comes from NorthStar Asset Management. It asks Safety Insurance Group, a first-time recipient, to

adopt a diversity policy in which the Board publicly commits to:

Ensuring that women and minority candidates are routinely sought as part of each Board search;

Expanding director searches to include nominees beyond the executive suite, from non-traditional environments such government, academia, and non-profit organizations; and

Reviewing Board composition to ensure that the Board reflects the knowledge, experience, skills, and diversity required for the Board to fulfill its duties.

SCANDAL PLAGUED FACEBOOK NEEDS INDEPENDENT BOARD CHAIR

Jonas Kron

Director of Shareholder Advocacy, Trillium Asset Management

Mark Zuckerberg is both the CEO and Chairman of the Board at Facebook and because of his 60 percent voting power, he is, for all intents and purposes, accountable only to himself. Corporate governance experts and the Council of Institutional Investors have argued for years that an independent chair is vastly superior because that person is free of conflicts created by a chair who can excessively influence the rest of the board and its agenda. An independent chair is better able to monitor the management of the company on behalf of its shareholders and we see the structure virtually everywhere. For example, the percentage of S&P 500 companies with a unified CEO/chairman is at a decadal low of 45.6 percent. Leading technology companies like Apple, Alphabet, Autodesk, Microsoft and Intel all have independent chairmen.

Reporting: Reprising language suggested for several years at other companies about commitment, candidate pools and reporting, proponents note that Atrion and Beacon Roofing Supply have no women board members and that there is just one woman director at Cambrex, Digital Realty Trust, IQVIA Holdings, Ligand Pharmaceuticals and Mohawk Industries. Proposals ask each to report before the end of the year on efforts

to enhance board diversity beyond current levels, such as:

Strengthening Nominating and Corporate Governance policies by embedding a commitment to diversity inclusive of gender, race, ethnicity;

Commit publicly to include women and people of color in each candidate pool from which director nominees are chosen;

Report on its process to identify qualified women and people of color for the board.

We believe this request for a status report will help build Board accountability on this issue.

None of the companies has received the proposal before. At Beacon Roofing, the proposal asked also for an “annual assessment of progress and challenges experienced fostering greater diversity.

Gender identity and expression—Nine more reporting proposals add new angles for board membership. As You Sow and Amalgamated Bank want Caesars Entertainment, Eastman Kodak, New Media Investment Group and Skechers U.S.A. to report on how each is working

to enhance board diversity beyond current levels, such as:

Adopt a formal commitment to diversify the Board with respect to such characteristics as gender, race, ethnicity and sexual orientation;

Commit publicly to include candidates who are diverse with respect to these characteristics in the pool from which director nominees are chosen;

Report on its process for identifying candidates for the board who are diverse with respect to these characteristics.

Another proposal that asks the same thing about “sex, race, ethnicity, age, gender identity, gender expression, and sexual

orientation” at WisdomTree Investments and four more companies.

Withdrawals—Walden Asset Management withdrew at Atrion after the company agreed to fill its next open board seat with a woman. Beacon Roofing agreed to amend its corporate governance guidelines and actively reach out to women and minority board nominees, and to include diversity in annual board self-assessments, prompting Pax to withdraw. Proxy Impact and Trillium also withdrew after Digital Realty and IQVIA agreed to add a commitment to diversity, including gender, race and ethnicity, in its corporate governance guidelines; the resolution noted the company had just one female director. Further, the NYC funds have withdrawn the matrix proposal (see below) at Minerals Technologies and Noble Energy following agreements.

Board matrix reporting: The New York City pension funds are continuing an effort begun last year to persuade companies to present diversity attributes and other information about board members and nominees in a matrix format that would make it easily comparable. The resolutions this year, as last, ask eight companies—Alexion Pharmaceuticals, Alliance Data Systems, Devon Energy, ExxonMobil, LKQ, Minerals Technologies, Noble Energy and NRG Energy—to

disclose to shareholders each director’s/nominee’s gender and race/ethnicity, as well as skills, experience and attributes that are most relevant in light of Alexion’s overall business, long-term strategy and risks, presented in a matrix form . The requested matrix shall not include any attributes the Board identifies as minimum qualifications for all Board candidates in compliance with SEC Regulation S-K.

The requested matrix shall be presented to shareholders in Alexion’s annual proxy statement and on its website within six months of the date of the annual meeting, and updated annually.

The proposal is a resubmission at ExxonMobil, where it earned 16.5 percent support in 2018, when the company unsuccessfully challenged the resolution at the SEC, which disagreed that it was too vague and related to ordinary business. It is also a repeat at LKQ and NRG Energy.