The convergence between more traditional concerns about how companies are governed and social and environmental topics continues. This interest is expressed in proxy season in resolutions about how companies make their social and environmental policy decisions—and who is on the board to do so—as well as in proposals about how companies make themselves accountable to their investors on strategic sustainability issues. This section examines these issues, looking at board diversity, board oversight and sustainability disclosure, links to compensation and proxy voting policies at mutual funds.

Read moreBoard Governance

Click below to go to the next (or previous) section.

Diversity in the Boardroom

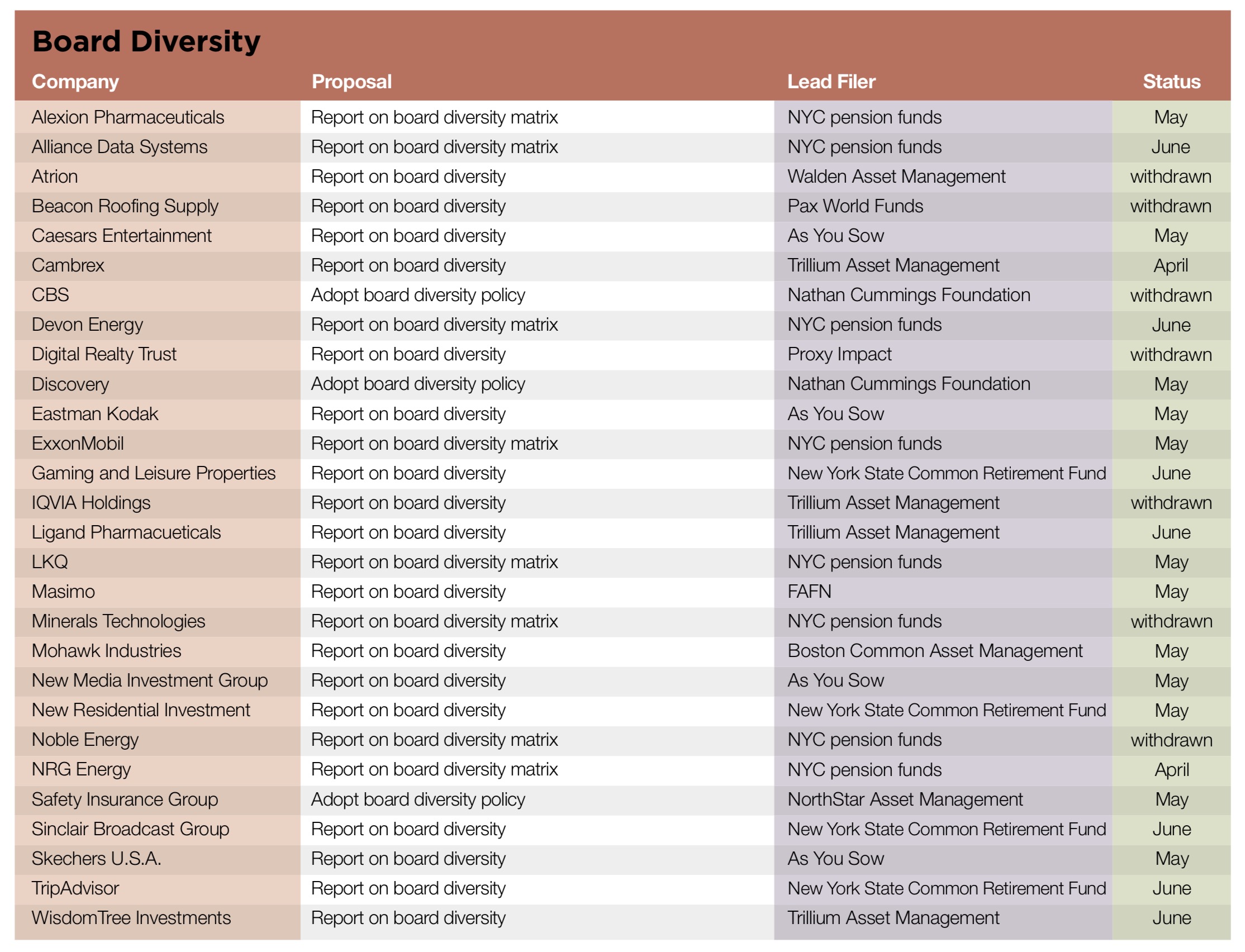

As men at the pinnacle of business and government continue to leave their jobs under the cloud of allegations about sexual misconduct, and as the most diverse class of Congressional representatives takes the reins in Washington, investors are continuing to chip away at boards dominated by white men. Proponents withdrew fully 29 out of 34 resolutions filed on the subject in 2018 after most targeted companies agreed to diversity their selection processes and report to investors. More of the same will occur in 2019. To date, 28 proposals have emerged; more are very likely to crop up as the year progresses.

New this year is the addition in some of the proposals of further differentiating attributes—age, gender identity, gender expression and sexual orientation. All mention gender, race and ethnicity.

The 30 Percent Coalition continues to coordinate resolutions and work in other ways to diversify boards. The coalition’s members include senior business executives, civil society groups, institutional investors, corporate governance experts and board members themselves. The proposals ask companies to add more diversity to the board room and report on how they manage this process. Since most of the very largest companies have made some commitment to more diversity, companies further down the revenue ranks are coming under scrutiny. Since 2010, proponents have filed at least 230 proposals, withdrawing nearly three-quarters after companies have made their policies more inclusive, at least on paper. Proponents are most likely to file proposals at companies with no women or people of color on the board, but increasingly they are not satisfied with a token few and seek expanded representation even where one or two board members already are outside the “pale, male and stale” club.

COUNTING WOMEN COUNTS: MIXING GENDERS ON BOARDS IS GOOD BUSINESS

Aeisha Mastagni

Portfolio Manager, Corporate Governance, California State Teachers’ Retirement System (Calstrs)

Board diversity is not a new topic for investors and governance professionals; it is a topic resonating with a new audience: state legislators.

The California State Teachers’ Retirement System (CalSTRS), with a member base that’s 74 percent women, has long focused on the lack of women on corporate boards. While we know—and empirical evidence confirms—that companies with women in the boardroom are more successful, our vision of a diverse board includes race, ethnicity, background, skill-sets, age, and gender. Still, the large gap between female representation in society (51 percent) and in the boardroom (17.7 percent) remains and is not to be ignored.

Adopt policy: Just three proposals so far ask for adoption of a policy, with two pending. The Nathan Cummings Foundation resubmitted a proposal to Discovery that has gone to a vote annually since 2015. It earned 33.2 percent last year and again asks the company to apply the “Rooney Rule” concept that helped to diversify National Football League coaching. It says Discovery should

adopt formalized nominating committee procedures for identifying new board candidates. We request that this include a policy to address board diversity which requires that the initial list of candidates from which new management supported director nominees are chosen include (but need not be limited to) qualified women and minority candidates and that any third-party consultant assisting in the identification of potential nominees be asked to include such candidates.

The foundation had to withdraw a similar proposition at CBS after a technical problem with its filing pointed out by the company in an SEC challenge. The proposal had highlighted the company’s decision to donate departing CEO Lester Moonves’ $120 million forfeited severance package to the Time’s Up initiative that supports women bringing legal action against alleged workplace abusers. Nathan Cummings said the company’s board nomination process is opaque and that the board does not reflect the company’s “vast audiences.”

Another proposal that suggests using the same idea to diversify nominee pools comes from NorthStar Asset Management. It asks Safety Insurance Group, a first-time recipient, to

adopt a diversity policy in which the Board publicly commits to:

Ensuring that women and minority candidates are routinely sought as part of each Board search;

Expanding director searches to include nominees beyond the executive suite, from non-traditional environments such government, academia, and non-profit organizations; and

Reviewing Board composition to ensure that the Board reflects the knowledge, experience, skills, and diversity required for the Board to fulfill its duties.

SCANDAL PLAGUED FACEBOOK NEEDS INDEPENDENT BOARD CHAIR

Jonas Kron

Director of Shareholder Advocacy, Trillium Asset Management

Mark Zuckerberg is both the CEO and Chairman of the Board at Facebook and because of his 60 percent voting power, he is, for all intents and purposes, accountable only to himself. Corporate governance experts and the Council of Institutional Investors have argued for years that an independent chair is vastly superior because that person is free of conflicts created by a chair who can excessively influence the rest of the board and its agenda. An independent chair is better able to monitor the management of the company on behalf of its shareholders and we see the structure virtually everywhere. For example, the percentage of S&P 500 companies with a unified CEO/chairman is at a decadal low of 45.6 percent. Leading technology companies like Apple, Alphabet, Autodesk, Microsoft and Intel all have independent chairmen.

Reporting: Reprising language suggested for several years at other companies about commitment, candidate pools and reporting, proponents note that Atrion and Beacon Roofing Supply have no women board members and that there is just one woman director at Cambrex, Digital Realty Trust, IQVIA Holdings, Ligand Pharmaceuticals and Mohawk Industries. Proposals ask each to report before the end of the year on efforts

to enhance board diversity beyond current levels, such as:

Strengthening Nominating and Corporate Governance policies by embedding a commitment to diversity inclusive of gender, race, ethnicity;

Commit publicly to include women and people of color in each candidate pool from which director nominees are chosen;

Report on its process to identify qualified women and people of color for the board.

We believe this request for a status report will help build Board accountability on this issue.

None of the companies has received the proposal before. At Beacon Roofing, the proposal asked also for an “annual assessment of progress and challenges experienced fostering greater diversity.

Gender identity and expression—Nine more reporting proposals add new angles for board membership. As You Sow and Amalgamated Bank want Caesars Entertainment, Eastman Kodak, New Media Investment Group and Skechers U.S.A. to report on how each is working

to enhance board diversity beyond current levels, such as:

Adopt a formal commitment to diversify the Board with respect to such characteristics as gender, race, ethnicity and sexual orientation;

Commit publicly to include candidates who are diverse with respect to these characteristics in the pool from which director nominees are chosen;

Report on its process for identifying candidates for the board who are diverse with respect to these characteristics.

Another proposal that asks the same thing about “sex, race, ethnicity, age, gender identity, gender expression, and sexual

orientation” at WisdomTree Investments and four more companies.

Withdrawals—Walden Asset Management withdrew at Atrion after the company agreed to fill its next open board seat with a woman. Beacon Roofing agreed to amend its corporate governance guidelines and actively reach out to women and minority board nominees, and to include diversity in annual board self-assessments, prompting Pax to withdraw. Proxy Impact and Trillium also withdrew after Digital Realty and IQVIA agreed to add a commitment to diversity, including gender, race and ethnicity, in its corporate governance guidelines; the resolution noted the company had just one female director. Further, the NYC funds have withdrawn the matrix proposal (see below) at Minerals Technologies and Noble Energy following agreements.

Board matrix reporting: The New York City pension funds are continuing an effort begun last year to persuade companies to present diversity attributes and other information about board members and nominees in a matrix format that would make it easily comparable. The resolutions this year, as last, ask eight companies—Alexion Pharmaceuticals, Alliance Data Systems, Devon Energy, ExxonMobil, LKQ, Minerals Technologies, Noble Energy and NRG Energy—to

disclose to shareholders each director’s/nominee’s gender and race/ethnicity, as well as skills, experience and attributes that are most relevant in light of Alexion’s overall business, long-term strategy and risks, presented in a matrix form . The requested matrix shall not include any attributes the Board identifies as minimum qualifications for all Board candidates in compliance with SEC Regulation S-K.

The requested matrix shall be presented to shareholders in Alexion’s annual proxy statement and on its website within six months of the date of the annual meeting, and updated annually.

The proposal is a resubmission at ExxonMobil, where it earned 16.5 percent support in 2018, when the company unsuccessfully challenged the resolution at the SEC, which disagreed that it was too vague and related to ordinary business. It is also a repeat at LKQ and NRG Energy.

Board Oversight

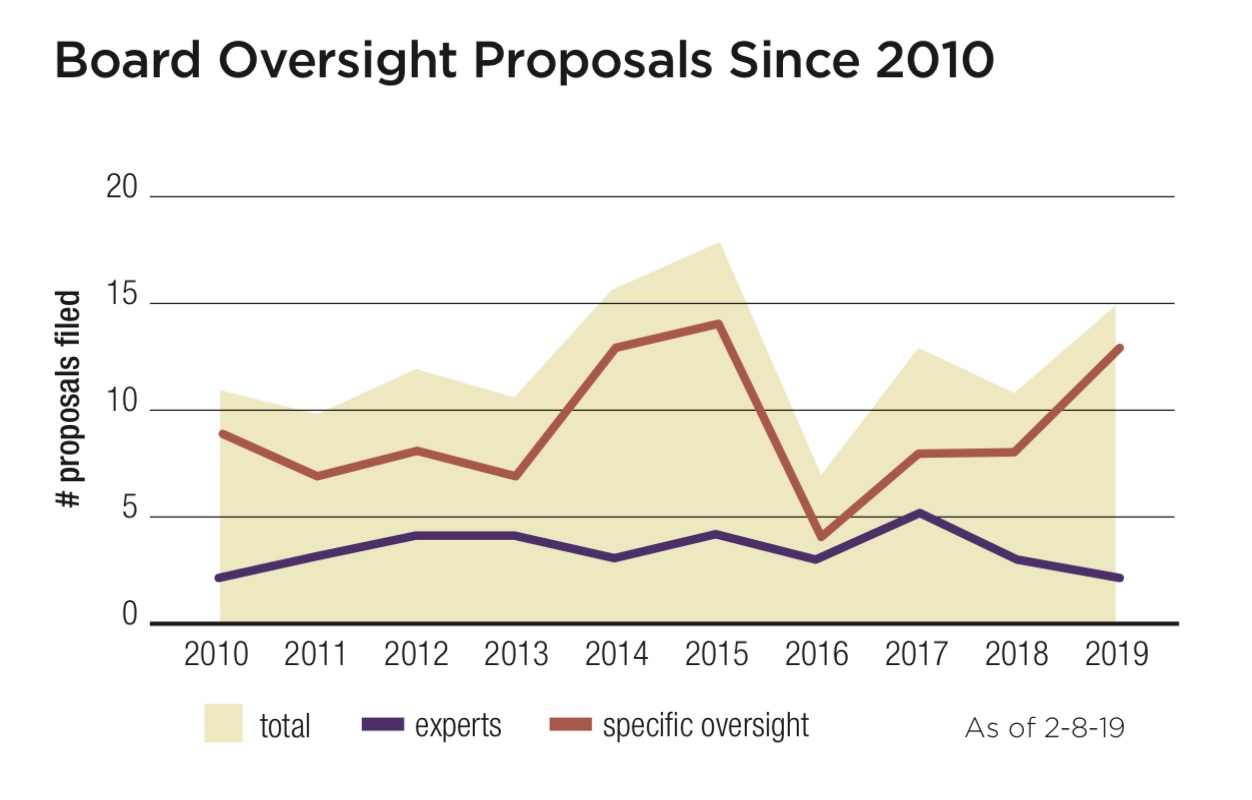

Resolutions about board oversight fall into two functional categories—suggesting specific types of committees are needed to properly oversee complicated sustainability issues (13, up from seven last year at this time) or asking for the nomination of specific types of experts to sit on the board (three this year).

Specific Issues

Human rights: Proponents raise concerns about a range of human rights issues in five resolutions. At Citigroup, Harrington Investments has withdrawn a proposal that asked it to amend a board committee charter “to explicitly require fiduciary oversight by the committee on matters affecting human rights.” Harrington reports there will be further dialogue with the company. Citigroup had lodged a challenge at the SEC, arguing it was moot given current oversight and would cause it to violate the law in its call for a connection between fiduciary duty and human rights.

Harrington Investments also proposed that Goldman Sachs amend its bylaws to add a new section connecting the board’s fiduciary responsibility to “policies or activities of our company affecting issues of human and indigenous peoples’ rights.” Last year, a slightly different proposal along the same lines was omitted on the grounds that it was moot. Goldman Sachs challenged the 2019 proposal at the SEC, as well, and Harrington withdrew. The 2019 proposal was a binding bylaw amendment.

Harrington wants Bank of America to do the same thing and amend its bylaws “to expressly extend the fiduciary duties of directors to oversight of the Human and Indigenous Peoples’ Rights policy.” The company has challenged the proposal at the SEC, arguing it is moot, illegal, cannot be implemented by the company and is false and misleading, and Harrington withdrew. The proposal was a binding bylaw amendment and Harrington last year withdrew a proposal seeking a more specific policy on indigenous peoples and human rights after the company challenged it on the grounds it was moot.

SomeOfUs says Mastercard processes transaction for white supremacist groups and suggests this poses reputational risks. It therefore asks for “a standing committee to oversee the Company’s responses to domestic and international developments in human rights that affect Mastercard’s business.

The United Church Funds also raises a key current controversy at SunTrust Banks, noting that the bank provides funding to U.S. government contractors that help to carry out “zero tolerance” immigration policies, and also underwrites debt for private prison companies that have been involved in detaining immigrants. The proposal asks SunTrust to set up a board level human rights commit “to create company policies and review existing policies...on the human rights of individuals in the US and worldwide, including adopting and assessing criteria for evaluating potential clients’ corporate social responsibility record and human rights performance.” The parties reached an agreement, which provides for proponent input on the company's materiality assessment for sustainability reporting; SunTrust also will change the charter of its Enterprise Business Practices Committee.

Drug pricing: Proponents want AbbVie and Pfizer to “take the steps necessary to strengthen Board oversight of prescription drug pricing risk by formalizing oversight responsibility, which could take the form of creating a new Board committee or assigning responsibility to an existing committee, and by adding drug pricing risk expertise to the director qualifications skills matrix.” The resolution is new in 2019 and the Sisters of St. Francis of Philadelphia withdrew after discussions at AbbVie, which agreed to additional proxy statement disclosures. AbbVie also had challenged the proposal at the SEC, arguing it consisted of multiple proposals, concerned ordinary business and was moot because of current board oversight and disclosure practices. A challenge has yet to surface at Pfizer.

The proposal contends that given growing problems with drug affordability and legislative and regulatory scrutiny, more oversight at the board level about the pricing of company products is warranted. Further, it says that these companies are particularly vulnerable to risks connected with rising prices given their product mix. (See p. 72 for related proposals suggesting links to executive pay incentives and p. 49 for a proposal about pharmaceutical pricing.)

Climate change: Arjuna Capital is asking Chevron and ExxonMobil each to set up a new board committee on climate change “to evaluate Chevron’s strategic vision and responses to climate change. The charter should require the committee to engage in formal review and oversight of corporate strategy, above and beyond matters of legal compliance, to assess the company’s responses to climate related risks and opportunities, including the potential impacts of climate change on business, strategy, financial planning, and the environment.” ExxonMobil has challenged the proposal at the SEC, arguing it is moot because its Public Issues and Contributions Committee is already charged with climate change oversight.

Food: Last year, Harrington asked McDonald’s about its charitable contributions and their impact on public debate over healthy food. It is following up with the same theme in a new proposal this year at the company, expressing a wide variety of concerns about the types of food offered by the company and food safety. It wants to see

a special Board Committee on Food Integrity to restore public confidence in our Company’s reputation for food quality and integrity. The committee should assess the recent company breaches of safety and security of McDonald’s restaurants’ food service as well as long term concerns and criticism regarding food quality, recommending any necessary improvements in governance, sanitation and safety systems necessary to instill in our Company’s culture the highest standards of food quality and security.

The company has challenged the resolution at the SEC, arguing it relates to ordinary business since it concerns food preparation methods, which it says are quintessentially routine matters for a restauranteur.

Public policy and social risk: The Sustainability Group wants Amazon.com to set up a “Social Risk Oversight Committee” that could

provide an ongoing review of corporate policies and procedures, above and beyond legal and regulatory matters, to assess the potential societal consequences of the Company’s products and services, and should offer guidance on strategic decisions. As with the other Committees of the Board, a formal charter for the Committee and a summary of its functions should be made publicly available.

The company has challenged the proposal at the SEC, arguing it can be excluded because it relates to ordinary business, since it concerns the company’s product offerings and policies, relates to business practices and operations, and relates to Amazon’s choice of technologies.

Jing Zhao wants Applied Materials to set up a committee “to oversee the Company’s policies including human rights, governmental regulations and international relations affecting the Company’s business.” But the company successfully challenged the proposal at the SEC, which agreed the resolution was moot – since the board as a whole current oversees public policy issues. In its challenge, the company said its audit committee attends to risk management and Applied Materials already has robust policies about human rights and governmental relations.

Marco Segal suggests that Verizon Communications needs a dedicated committee at the board level given the wide range of environmental and social challenges it faces that have the potential to damage its reputation. It notes problems in the last year connect to allegations of mistreatment of pregnant women, allegations of sexual harassment and discrimination, the “throttling” of firefighters’ access to its communications network during the California fires, and privacy protections being tightened in Europe and potentially the United States. It points out that competitor AT&T has a dedicated public policy committee but these issues are only one of 14 responsibilities for Verizon’s Corporate Governance and Policy Committee. It asserts, “The fact that Verizon finds itself enmeshed in needless controversies suggests that public policy issues are getting short shrift at the board level and that a standalone committee is warranted to avoid reputational damage and other risks on a wide range of issues.”

Experts

Only three resolutions in 2019 ask companies about requiring specific types of board experts, but one raises the issue of human capital management, which is new to proxy season. The AFL-CIO is proposing that Amazon.com amend its Guidelines on Significant Corporate Governance Issues and “add human capital management to the types of business and professional experience included in the qualifications and skills of a director candidate considered important by its nominating committee. The proposal argues that companies should pay close attention to managing human capital, as it is critical to “value creation and a source of potential risk”—to which boards should attend. It points to BlackRock’s focus on the subject as one of its 2018 engagement priorities and the new Human Capital Management Coalition that submitted a petition to the SEC in July 2017, as investors backed by $2.8 trillion in assets under management, seeking more disclosure about corporate policies and practices. In Amazon’s case, the proposal says, the company has come under fire for alleged poor treatment of employees in its fulfillment centers, and an “exhausting environment of ‘purposeful Darwinism.’”

The other two proposals reprise past concerns. At Motorola Solutions, the Episcopal Church asks that the nominating committee choose “at least one [independent] candidate who: has a high level of human rights expertise and experience in human rights matters relevant to Company production and supply chain, related risks, and is widely recognized in business and human rights communities as such.” It is a resubmission that earned 10.4 percent in 2018. It also earned 4.9 percent in 2018 at Caterpillar.

Individual investor Robert Andrew Davis proposes that PNM Resources proffer an independent board candidate who “has a high level of expertise and experience in environmental and climate change related matters relevant to electric generation and transmission and is widely recognized in the business and environmental communities as an authority in such fields.” Davis points to recent UN assessments that point out community risks posed by climate change and “growing losses to American infrastructure and property and impede the rate of economic growth over this century,” to which electric utilities are particularly exposed. He notes that Chevron and ExxonMobil have added climate experts to their boards and assert that PNM would benefit from such a board member.

Sustainability Disclosure and Management

After a dip in 2016, the number of sustainability reporting resolutions surged back in 2017 and reached 58 proposals in 2018, a high for the decade. Thirty-four are now pending, six have been withdrawn and just two have been omitted. Many more withdrawals are likely, if last year’s tendencies hold: there were 31 withdrawals in 2018, surpassing the 22 votes. (Graph below.)

Sustainability reporting in corporate America has become increasingly common, making companies that do not report stand out; proponents are going to the relatively smaller non-reporting firms and asking for disclosure, with 23 resolutions this year seeking reports. At the same time, resolutions increasingly are asking companies to tie sustainability metrics to executive pay incentives. Last year, pay resolutions on an array of topics grew to 22 and this year there are 20. (Graph p. 68.) This year, though, the focus so far is even more on tying incentives to drug pricing risks.

A handful of proposals over the years have asked large investment managers to review and report on their proxy voting about social and environmental resolutions, with an eye to persuading the firms of these issues’ materiality. The big funds started voting in favor of a few climate-relate proposals in 2017, and in 2018 they branched out to support additional proposals about gun rights, the opioid crisis and other topics. This sea change in voting policy has pushed support levels to all-time highs and produced an unprecedented number of majority votes. Just one resolution this year raised the issue, at Artisan Partner Asset Management, but Walden Asset Management withdrew when the firm agreed to change its voting policy.

Timothy Smith

Director Of Esg Shareowner Engagement, Walden Asset Management

Carly Greenberg, CFA

Manager Of Esg Investing, Walden Asset Management

CHANGE IN PROXY VOTING AS MANY ASSET OWNERS ACCEPT ESG AS PART OF FIDUCIARY DUTY

Each year, investors file approximately 800 shareholder resolutions. In 2018, more than 450 proposals focused on environmental and social issues. For a significant portion of these resolutions, companies and proponents reached agreements and the proponents withdrew. But nearly 180 proposals went to a vote.

Shareholders have filed environmental and social proposals since the early 1970s, and resolutions on governance extend back to the 1950s. Early on, both companies and other investors treated environmental, social and governance (ESG) proposals with incredulity. These days, however, many recognize such proposals have strong business cases buttressing their requests and many vote thoughtfully.

Reporting

NEW REPORT BENCHMARKS INTEGRATED & SUSTAINABILITY REPORTING FOR THE S&P 500

Heidi Welsh

Executive Director, Sustainable Investments Institute (Si2)

Requests for sustainability reports are evergreen in proxy season; investors have filed more than 300 proposals since 2010. These requests for companies to provide quantified, comparable metrics about their performance on key environmental and social impacts earn substantial, sustained support from investors, with eight majority votes this decade. Most companies are responding in some fashion, providing the metrics mainstream Wall Street analysts want to assess performance.

Although sustainability reporting resolutions in 2018 varied quite a bit, in 2019 proponents have stuck to very similar scripts, with two main variants—one that asks about material or “the most important” sustainability metrics, and another that in addition seeks information on climate change data. To date, companies do not appear to have lodged any SEC challenges on these resolutions.

But companies are challenging new proposals that make requests specifically invoking the standards put forth by the Sustainability Accounting Standards Board, as noted below. Other non-standard reporting proposals also seem unlikely to pass muster at the SEC.

Standard reporting requests: The Illinois State Treasurer starting filing shareholder resolutions on behalf of his state’s $30 billion investment portfolio last year, and has expanded these efforts in 2019, including five proposals that ask companies to “issue an annual sustainability report describing the company’s policies, strategies, performance, and improvement targets on material environmental, social, and governance (ESG) issues,” to be issued “within a reasonable timeframe.” The proposal is pending at Activision Blizzard, Intuitive Surgical and O’Reilly Automotive for the first time. The Treasurer withdrew following commitments from Crown Castle International, where it was filed for the first time, and Host Hotels & Resorts, where a more detailed resolution last year earned 31.1 percent support.

SHAREHOLDERS, WORKING IN CONCERT, CHANGE KINDER MORGAN’S TUNE ON SUSTAINABILITY

Luan Jenifer

Chief Operating Officer, Miller/Howard Investments

Think back to 2014: At the 20th annual United Nations Climate Change Conference of the Parties (COP 20) in Lima, Peru, political action seemed more achievable than, perhaps, it does today. And think back to last October: Despite the COP 21 global agreement reached in Paris in 2015, the United States had declared its intention to withdraw and political action on the climate front seemed stalled. However, also in those years and around those times, other parties were at the table, advocating for responsible stewardship and disclosure:

NYSCRF resubmitted a resolution to American Financial Group that earned 48.4 percent in 2018. It asks the company to issue by December “an annual sustainability report describing the company’s analysis of, and short- and long-term responses to the ESG-related issues that are most important to the company.” The fund has filed this proposal at Papa John’s International, as well, noting that the company does not issue a sustainability report and has little ESG information on its website, in contrast to competitors.

Trillium Asset Management has taken up the baton at Tesla Motors, where NYSCRF last year withdrew a somewhat more detailed proposal seeking sustainability information after the company agreed to report. This year, Trillium is asking the company to “issue an annual corporate sustainability report describing the Company’s Environmental, Social, and Governance (ESG) policies, management strategies, quantitative performance metrics, and improvement targets.” The proposal suggests Tesla should consider reporting using frameworks and standards articulated by the Global Reporting Initiative, CDP, the Sustainability Accounting Standards Board and the Taskforce on Climate-related Financial Disclosure, on a wide range of issues. It notes the company has faced criticism for its health and safety performance while providing little disclosure.

Climate change: A mix of investors have filed the same resolution at six companies, asking them to annually “issue a report describing the company’s environmental, social, and governance (ESG) policies, quantitative performance metrics, and improvement targets, including a discussion of greenhouse gas (GHG) emissions management strategies and metrics.” The proposal is new and still pending at Charter Communications, Mid- America Apartment Communities and SBA Communications, but withdrawn at Quanta Services after the company agreed to publish a report covering its policies, practices, metrics and targets on key ESG issues. The proposal was a resubmission at Acuity Brands, where a reporting request received 49.8 percent support in 2018— which appears to have brought the company to the table this year and prompted a withdrawal. Another resubmission is at Middleby, where the vote last year was 57.2 percent, up from 44.6 percent in 2017.

Other ESG reporting: Additional proposals raise several different issues but few votes seem likely:

Domini Social Investments is asking Amazon . com for annual reports on the company’s “analysis of the community impacts of Amazon’s operations, considering near- and long-term local economic and social outcomes, including risks, and the mitigation of those risks, and opportunities arising from its presence in communities.”

The company says the proposal is ordinary business since it relates to the location of company facilities and the SEC has yet to respond to the challenge. (The resolution discusses the company’s search for new headquarters locations and social inequities that may result from the new facilities.) Last year, Amazon.com persuaded the SEC that a wide- ranging proposal from the AFL-CIO that asked about “risks arising from the public debate over Amazon’s growth and societal impact and how Amazon is managing or mitigating those risks” dealt with ordinary business and SEC staff agreed, saying it related to public relations and the ways in which the company sells its products.

At Berkshire Hathaway, a proposal was tailored to the company’s structure as a holding company and asked only for more publicity about subsidiary company sustainability efforts. The proponent withdrew when the company agreed to present the requested information, with links, on its website.

A resolution at DTE Energy that asked for a report on “the impact of its environmental performance challenges on the company’s reputation and financial performance” has been omitted because it was filed too late. A similar proposal to the company last year was omitted on ordinary business grounds.

Another proposal was from the Sisters of St. Francis of Philadelphia, asking Walgreens Boots Alliance to report on its work to support the UN Sustainable Development Goals (SDGs), expressing concern about tobacco sales in the company’s drugstores. Walgreens prevailed at the SEC in its contention that the proposal was moot. It was a resubmission that last year was omitted on ordinary business grounds.

SASB ADDRESSES GROWING DEMAND FOR SUSTAINABILITY DISCLOSURE

Paul Rissman

Co-founder, Rights CoLab

U.S. public companies spend less time communicating with investors about ESG issues than their global peers. They also disclose less. U.S. investors, in turn, fall below the global average when incorporating ESG factors into their strategies, and have less influence over responsible business behavior. This aversion to transparency isn’t surprising, due to the treatment of “materiality” within U.S. securities law.

SASB: Five new proposals specifically invoke the new reporting framework issued last fall by SASB after multi-stakeholder consultation:

The resolution asks Advance Auto Parts, CarMax and Dollar Tree for a report within 180 days of the annual meeting “prepared in consideration of the SASB Multiline and Specialty Retailers & Distributors standard, describing the company’s policies, performance, and improvement targets related to material sustainability risks and opportunities.”

At Essex Property Trust, it seeks the same sort of report “in consideration of the SASB Real Estate standard... summarizing the company’s strategies and practices to mitigate risks, stemming from climate change, to the availability of adequate water resources.”

Finally, at PACCAR, it asked that the report be “prepared in consideration of the SASB Industrial Machinery and Goods standard.

SEC action and withdrawal—Advance Auto has lodged a challenge at the SEC, although the specifics of the challenge are not yet available. As You Sow withdrew at PACCAR, since the company had begun to use SASB standards in a new report and will consider expanding its future disclosures consistent with those standards. PACCAR also had lodged an SEC challenge, arguing the proposal was moot given this new report.

ESG Pay Links

The field of resolutions seeking links between sustainability issues and executive compensation continues to be broad, but is dominated by drug pricing. This year, nine proposals address the risk of drug price increases and another the opioid crisis; three address senior executive diversity and two are about cybersecurity; further issues, with one proposal each, are risky banking practices, greenhouse gas emissions goals and human rights. Last year, six different proposals sought links to several specific environmental or social issues, as well.

THE LINK BETWEEN HIGHER DRUG PRICES AND EXECUTIVE PAY

Cathy Rowan

Director Of Socially Responsible Investing, Trinity Health

Prescription drug expenditures make up nearly 20 percent of all health care costs, and spending for prescription drugs is growing faster than any other part of the health care dollar. A Kaiser Health Tracking Poll in early 2018 found that one out of four patients have a difficult time affording their medicines. December 2018 POLITICO poll showed the public’s top priority for the 116th Congress is taking action to lower prescription drug prices.

Drug pricing: Proponents are doubling down on an approach they tried last year to address concerns about expensive pharmaceutical drug prices and the long-term risks high prices may pose to companies. Last year, investors gave these resolutions fairly strong support, with most votes in the 20-percent range. The resolution has the same resolved clause at each company, with supporting statements articulating concerns about specific drugs; it asks for an annual report

on the extent to which risks related to public concern over drug pricing strategies are integrated into [the company’s] incentive compensation policies, plans and programs...for senior executives. The report should include, but need not be limited to, discussion of whether incentive compensation arrangements reward, or not penalize, senior executives for (i) adopting pricing strategies, or making and honoring commitments about pricing, that incorporate public concern regarding the level or rate of increase in prescription drug prices; and (ii) considering risks related to drug pricing when setting financial targets for incentive compensation.

Last year the resolution was close to this wording, but the final point was “considering risks related to drug pricing when allocating capital.” It is a resubmission at four companies—AbbVie (21.8 percent in 2018), Biogen (28.2 percent), Bristol-Myers Squibb (22.7 percent) and Eli Lilly (17.8 percent), and new to five more—Celgene, Johnson & Johnson, Merck, Pfizer and Vertex Pharmaceuticals.

SEC action—Two companies have lodged SEC challenges. Bristol-Myers Squibb contends it relates to ordinary business by dint of micromanagement, invoking the 2018 SEC legal bulletin. Last year, SEC staff disagreed that a similar proposal was ordinary business and also did not think it was moot, as the company argued. Pfizer is making another try at the ordinary business rule, as well, saying it raises executive compensation issues that are applicable to the general workforce, which would make the proposal ordinary business; it also says the resolution seeks to micromanage compensation arrangements.

Executive diversity: Last year, Zevin Asset Management asked several tech companies to report about how they might integrate senior executive diversity metrics into CEO incentive pay. There were three withdrawals after agreements and two omissions; the highest vote was 13.3 percent at United Parcel Service.

This year, Zevin is back with a similar request at Alphabet, where it earned 8.8 percent last year, Amazon.com (last year it withdrew after the company noted its CEO receives no incentives) and Anthem, a new target. The tech company proposal asks for a report

assessing the feasibility of integrating sustainability metrics, including metrics regarding diversity among senior executives, into performance measures or vesting conditions that may apply to senior executives under the Company’s compensation plans or arrangements. For the purposes of this proposal, “sustainability” is defined as how environmental and social considerations, and related financial impacts, are integrated into long-term corporate strategy, and “diversity” refers to gender, racial, and ethnic diversity.

At Anthem, the request is shorter and asks only for a report by October “assessing the feasibility of integrating sustainability metrics into the performance quotas of senior executives of Anthem Inc. compensation plans.”

SEC action—Anthem has told the SEC the resolution should be omitted because Zevin has not provided proof of its stock ownership.

Cybersecurity: At Verizon Communications, Trillium Asset Management asks for a report “assessing the feasibility of integrating cyber security and data privacy performance measures into the Verizon executive compensation program.” This resolution earned 11.6 percent support in 2018, after an unsuccessful company challenge—in which the SEC rejected the company’s contention that this concerned ordinary business. In 2019, the company again makes this argument, reasoning that the compensation program referenced, in the proxy statement, extends to non-executive employees and therefore is a matter of ordinary business.

This resolution, filed by James McRitchie, goes to a vote on March 8 at Walt Disney.

Climate goals: As You Sow has withdrawn a proposal that asked Pinnacle West Capital for a report on the “feasibility of linking executive compensation metrics to the accomplishment of Paris-aligned greenhouse gas emission reduction objectives.” As You Sow withdrew after the company agreed to report. The proposal said the company’s carbon intensity GHG target is inconsistent with its financing of natural gas infrastructure and “artificial caps on renewables” in bidding. It also raised concerns about the company’s spending “to block renewable energy policy in Arizona.” The proposal was new in 2019.

Sustainability metrics: SustainInvest wants Dunkin’ Brands to report by October, “assessing the feasibility of integrating sustainability metrics into the performance quotas of senior executives of Dunkin Brands Group Inc. compensation plans.” The proposal suggests metrics such as workplace and executive level diversity, greenhouse gas reduction goals or “using recycled and/or compostable supply chain inputs.”

SEC action—The company has lodged an SEC challenge, arguing the proposal is moot since Dunkin’ already links the replacement of foam cups to compensation for some executives and increasing diversity for others, and concerns ordinary business since it addresses matters applicable to the workforce as a whole, not just executive compensation.

Risky banking: NYSCRF has resubmitted a resolution to Wells Fargo that earned 21.9 percent last year. The text for this year’s resolution is not yet available but last year it sought a report on:

whether the Company has identified employees or positions, individually or as part of a group, who are eligible to receive incentive- based compensation that is tied to metrics that could have the ability to expose Wells Fargo to possible material losses, as determined in accordance with generally accepted accounting principles;

if the Company has not made such an identification, an explanation of why it has not done so; and

if the Company has made such an identification, the:

methodology and criteria used to make such identification;

number of those employees/positions, broken down by division;

aggregate percentage of compensation, broken down by division, paid to those employees/positions that constitutes incentive-based compensation; and

aggregate percentage of such incentive-based compensation that is dependent on (i) short-term, and (ii) long-term performance metrics, in each case as may be defined by Wells Fargo and with an explanation of such metrics.

The requested report would provide shareholders with important information concerning incentive-based compensation that could lead employees to take inappropriate risks that could result in material financial loss to our company.

Opioid legal costs: The Philadelphia Public Employees’ Retirement System has a proposal that earned 11.1 percent at AmerisourceBergen on March 1. It also has been filed at AbbVie and asks that each

adopt a policy that no financial performance metric shall be adjusted to exclude Legal or Compliance Costs when evaluating performance for purposes of determining the amount or vesting of any senior executive Incentive Compensation award. “Legal or Compliance Costs” are expenses or charges associated with any investigation, litigation or enforcement action related to drug manufacturing, sales, marketing or distribution, including legal fees; amounts paid in fines, penalties or damages; and amounts paid in connection with monitoring required by any settlement or judgment of claims of the kind described above....

The proponents want the company not to exclude litigation and compliance costs from future performance metrics for executive incentive compensation because of the company’s exposure to a myriad of lawsuits from multiple jurisdictions. The company contends it needs flexibility and discretion to design and administer its compensation programs. It also believes that the exclusion of non-recurring or one-time events provide a more accurate picture of company performance.

Human rights: The SEIU Master Trust is taking up human rights and wants CoreCivic “to incorporate respect for inmate and detainee human rights into incentive compensation arrangements for senior executives.” The proposal expresses concern about lawsuits filed against the company regarding human rights violation allegations, involving both inmates and immigrant detainees—and argues this risk should be addressed in executive compensation arrangements.

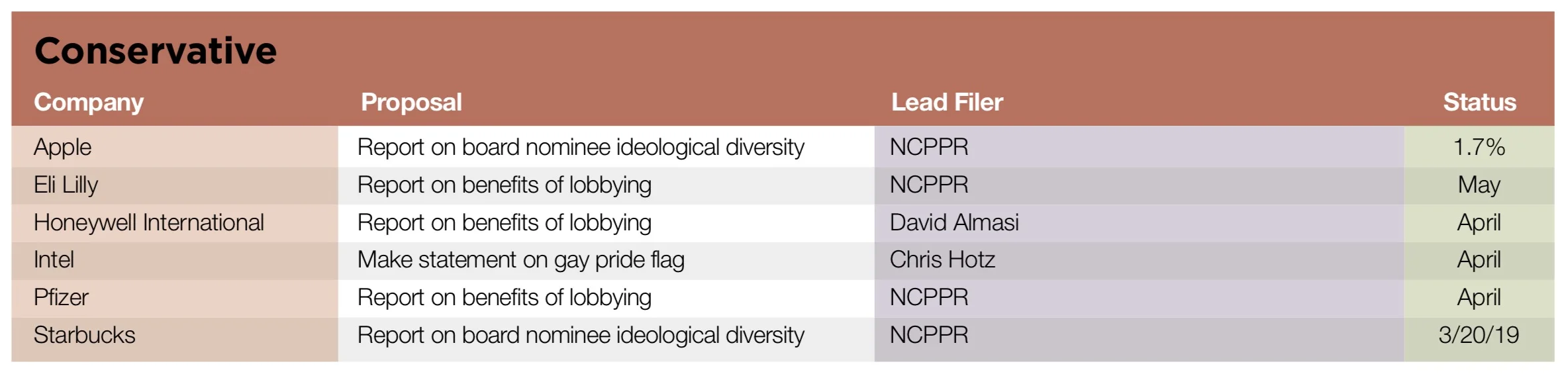

Conservatives

Less information is available at this point in the proxy season than in years past about shareholder resolutions proffered by politically conservative groups, given the government shutdown in December and January that temporarily halted the SEC’s evaluation of corporate challenges. SEC listings are a key source of information about these proposals because the proponents do not make them public. It seems likely that more than the six proposals identified so far have been filed, given the long-term trend, but no further information is yet available.

The proposals have expressed support for free market solutions to the world’s ills and push-back against policies that favor protections for LGBTQ people or abortion rights; they largely have been about social issues (left graph). Most of the resolutions get omitted on substantive or technical grounds (right graph), yielding just a few that go to votes each year.

The National Center for Public Policy Research (NCPPR), a Washington, D.C.-based think tank, is the main player, with resolutions also filed by David Ridenour, one of its principals, and like-minded supporters. NCPPR calls itself “the nation’s preeminent free-market activist group focusing on shareholder activism and the confluence of big government and big business.”

Lobbying: NCPPR supports unfettered corporate spending in the political arena but lifts some language from the resolutions of proponents who are instead looking for spending disclosure. It also is critical of companies that support environmental regulation and incorporates these values in its resolutions. This year, NCPPR is lauding lobbying by Honeywell, Eli Lilly and Pfizer and asks for a report, using the same resolved clause of disclosure advocates concerned about what they see as undue influence in the political system. (Covered in this report under Political Activity, p. 34.) NCPPR resolution praises both companies for supporting the American Legislative Exchange Council and the Business Roundtable and says they should continue to “advance economic liberty” and “free speech rights.”

SEC action—Honeywell and Pfizer both also received the standard lobbying proposal from the campaign coordinated by Walden and AFSCME, as well as the conservatives’ filing. Because they have the identical resolved clause, the proposal received second can be omitted on the grounds it duplicates the first. At Honeywell, the conservative proposal came in second—while at Pfizer it came first; a vote is therefore likely on the NCPPR proposal only at Pfizer.

At Eli Lilly, no competing corporate political resolution has been filed. But the company has lodged an SEC challenge, saying it can be omitted because lobbying is not financially significant to its business. It provides a detailed discussion of its board’s analysis, as suggested in SEC Staff Legal Bulletin 14I in late 2017, and characterizes previous support for lobbying disclosure as “lackluster” but also bolstered by proxy advisory firm ISS’s support. A resolution from the main AFSCME/Walden campaign for lobbying disclosure earned 20.1 percent in 2018 and 24.8 percent in 2017, and last year the SEC rejected company attempts to exclude proposals on “insignificance” grounds if they received such levels of support. It seems likely the SEC will reach the same conclusion this year.

Board diversity: Repeating last year’s approach that copied board diversity resolutions initially filed by the New York City Comptroller’s Office, so far two proposals have shown up, asking Apple and Starbucks to

adopt a policy to disclose to shareholders the following:

1. A description of the specific minimum qualifications that the Board’s nominating committee believes must be met by a nominee to be on the board of directors; and

2. Each nominee’s skills, ideological perspectives, and experience presented in a chart or matrix form.

The disclosure shall be presented to the shareholders through the annual proxy statement and the Company’s website within six (6) months of the date of the annual meeting and updated on an annual basis.

At each company, the proposal makes arguments in favor of diversity that parallel those expressed by those seeking greater gender, racial and ethnic diversity on boards of directors. But the proposals also aver that what is missing is “ideological diversity.” At Apple, it says the company “and other Silicon Valley firms” do not display “diversity of thought” but instead “operate in ideological hegemony that eschews conservative people, thoughts, and values. This ideological echo chamber can result in groupthink that is the antithesis of diversity. This can be a major risk factor for shareholders.” At Starbucks, the resolution also says the company “operates in ideological hegemony that eschews conservative people, thoughts, and values.” A similar proposal went to a vote in 2018 at Alphabet but received less than 2 percent support, not enough for resubmission. It also was omitted on technical grounds at Facebook in 2018.

SEC action—SEC staff rejected Apple’s assertion this year that the proposal’s discussion of “ideological diversity” was too vague, that the proposal has been implemented since it describes board nominee’ requirements and characteristics, and that it concerns ordinary business because it would impose specific requirements on proxy statement content. The vote was just 1.7 percent on March 1 at Apple and will happen on March 20 at Starbucks.

Gay pride flag: An individual investor has filed a new proposal at Intel, asking it to “update its ‘Global Human Rights Principles’ to include the following statement, as well as displaying said statement on all websites and communications which have Diversity and/or Inclusion as their primary subject matter: ‘Intel affirms and believes all that the Pride flag and the Gay Pride movement it is associated with represent or assert to be right and true.’” On its face, the proposal appears to favor Intel’s support for its LGBTQ employees. But in the body of the resolution, it notes Intel said flying the rainbow flag at its facilities was “celebrating sexual diversity and gender variance.” The proposal asserts this “left those employees from religious or moral traditions which did not celebrate sexual diversity or gender variance unsure as to whether their beliefs were actually being contradicted, or were only publicly perceived to be so, either of which could be disparaging.” It concludes that the company should make its suggested statement, but does not precisely explain how this would solve the problem it says exists.

The company has challenged the proposal at the SEC, arguing it is too vague and relates to ordinary business since it concerns workforce management and related communications, and because it seeks to micromanage those communications. An omission seems likely.

SECTION_TOC_Climate Change

As average global temperatures continue to rise and the disasterous effects threaten major population centers and significant geographical regions, investors are continuing their efforts to enlist companies in the fight to lessen the worst effects. In the United States, political barriers to climate action continue to abound. President Trump not only denies climate science, but also has openly mocked those who take it seriously. Republicans controlled Congress for the first half of Trump’s administration and have largely conformed to Trump’s agenda, but the new Democratic majority in the House of Representatives plans to press for stronger climate action. On the GOP side, a growing conservative coalition is promoting a carbon tax, opening the possibility that a bipartisan deal is possible. Recent “Green New Deal” proposals from Democratics seems likely to feature high in the 2020 presidential election, even though meaningful climate change legislation still seems uncertain and may arrive too late to force the emissions reductions we must achieve to avoid severe impacts on the economy and society at large. This reality underscores investors’ urgency in pressing companies to act, and it explains why large, usually cautious mutual funds continue to press for disclosure and action to mitigate climate risks from companies they own.

Shareholder proposals remain evenly divided between those focused on carbon asset risk and those seeking information about greenhouse gas (GHG) emissions management, as in 2018. Proponents remain keenly interested in how companies are assessing carbon asset risks and still want to see more oversight, management and disclosure of strategy—with 20 resolutions about this (down from 27 at this point last year). Investors have seen significant progress in persuading companies to report—with tailwinds coming from majority votes during the last two proxy seasons at leading energy firms. But proponents also have filed 23 proposals about GHG management, seeking goals or reports on such goals. Nine resolutions ask about renewable energy use and goals, down from 15 last year. After 11 proposals last year on unconventional fossil fuel energy production and its associated methane releases, there are just three this year. Four also address deforestation, with a final new proposal about access to sustainable energy. (Pie chart.)

The Ceres coalition coordinates nearly all these proposals, working with its Investor Network on Climate Risk (INCR) and a broad coalition of institutional investors, including many members of the Interfaith Center on Corporate Responsibility (ICCR) and some individuals. Investors around the globe are focusing their efforts on key carbon emitters that account for two-thirds of global industrial emissions, through the new initiative Climate Action 100+, with backing from 310 institutions that have $32 trillion in assets under management. Undergirding many of the resolutions, and the strategic concern of long-term investors, is the sense that regulatory regimes ultimately will favor lower-carbon fuel sources and leave stranded carbon assets that account for a large part of the market value claimed on the balance sheets of energy companies. Proponents also contend that utilities dependent in large part on fossil-fuel powered electricity will be caught short if they do not aggressively manage a transition to lower carbon-intensive power generation. The January bankruptcy of Pacific Gas & Electric, on the hook for damages from the California wildfires, is being called one of the first climate-related casualties—underscoring these concerns and showing how much investors can lose when claimants line up in court. The company faces $30 billion in liabilities, exceeding its assets.

(Sections below on Environmental Management, p. XX and Sustainable Governance, p. XX, cover environmental and social topics that also raise climate change issues.)