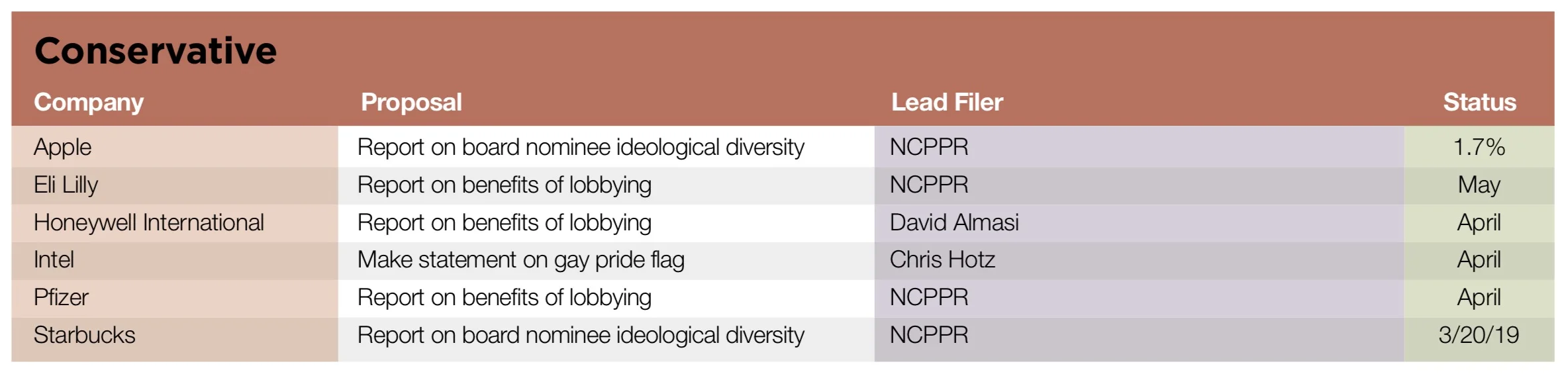

Less information is available at this point in the proxy season than in years past about shareholder resolutions proffered by politically conservative groups, given the government shutdown in December and January that temporarily halted the SEC’s evaluation of corporate challenges. SEC listings are a key source of information about these proposals because the proponents do not make them public. It seems likely that more than the six proposals identified so far have been filed, given the long-term trend, but no further information is yet available.

The proposals have expressed support for free market solutions to the world’s ills and push-back against policies that favor protections for LGBTQ people or abortion rights; they largely have been about social issues (left graph). Most of the resolutions get omitted on substantive or technical grounds (right graph), yielding just a few that go to votes each year.

The National Center for Public Policy Research (NCPPR), a Washington, D.C.-based think tank, is the main player, with resolutions also filed by David Ridenour, one of its principals, and like-minded supporters. NCPPR calls itself “the nation’s preeminent free-market activist group focusing on shareholder activism and the confluence of big government and big business.”

Lobbying: NCPPR supports unfettered corporate spending in the political arena but lifts some language from the resolutions of proponents who are instead looking for spending disclosure. It also is critical of companies that support environmental regulation and incorporates these values in its resolutions. This year, NCPPR is lauding lobbying by Honeywell, Eli Lilly and Pfizer and asks for a report, using the same resolved clause of disclosure advocates concerned about what they see as undue influence in the political system. (Covered in this report under Political Activity, p. 34.) NCPPR resolution praises both companies for supporting the American Legislative Exchange Council and the Business Roundtable and says they should continue to “advance economic liberty” and “free speech rights.”

SEC action—Honeywell and Pfizer both also received the standard lobbying proposal from the campaign coordinated by Walden and AFSCME, as well as the conservatives’ filing. Because they have the identical resolved clause, the proposal received second can be omitted on the grounds it duplicates the first. At Honeywell, the conservative proposal came in second—while at Pfizer it came first; a vote is therefore likely on the NCPPR proposal only at Pfizer.

At Eli Lilly, no competing corporate political resolution has been filed. But the company has lodged an SEC challenge, saying it can be omitted because lobbying is not financially significant to its business. It provides a detailed discussion of its board’s analysis, as suggested in SEC Staff Legal Bulletin 14I in late 2017, and characterizes previous support for lobbying disclosure as “lackluster” but also bolstered by proxy advisory firm ISS’s support. A resolution from the main AFSCME/Walden campaign for lobbying disclosure earned 20.1 percent in 2018 and 24.8 percent in 2017, and last year the SEC rejected company attempts to exclude proposals on “insignificance” grounds if they received such levels of support. It seems likely the SEC will reach the same conclusion this year.

Board diversity: Repeating last year’s approach that copied board diversity resolutions initially filed by the New York City Comptroller’s Office, so far two proposals have shown up, asking Apple and Starbucks to

adopt a policy to disclose to shareholders the following:

1. A description of the specific minimum qualifications that the Board’s nominating committee believes must be met by a nominee to be on the board of directors; and

2. Each nominee’s skills, ideological perspectives, and experience presented in a chart or matrix form.

The disclosure shall be presented to the shareholders through the annual proxy statement and the Company’s website within six (6) months of the date of the annual meeting and updated on an annual basis.

At each company, the proposal makes arguments in favor of diversity that parallel those expressed by those seeking greater gender, racial and ethnic diversity on boards of directors. But the proposals also aver that what is missing is “ideological diversity.” At Apple, it says the company “and other Silicon Valley firms” do not display “diversity of thought” but instead “operate in ideological hegemony that eschews conservative people, thoughts, and values. This ideological echo chamber can result in groupthink that is the antithesis of diversity. This can be a major risk factor for shareholders.” At Starbucks, the resolution also says the company “operates in ideological hegemony that eschews conservative people, thoughts, and values.” A similar proposal went to a vote in 2018 at Alphabet but received less than 2 percent support, not enough for resubmission. It also was omitted on technical grounds at Facebook in 2018.

SEC action—SEC staff rejected Apple’s assertion this year that the proposal’s discussion of “ideological diversity” was too vague, that the proposal has been implemented since it describes board nominee’ requirements and characteristics, and that it concerns ordinary business because it would impose specific requirements on proxy statement content. The vote was just 1.7 percent on March 1 at Apple and will happen on March 20 at Starbucks.

Gay pride flag: An individual investor has filed a new proposal at Intel, asking it to “update its ‘Global Human Rights Principles’ to include the following statement, as well as displaying said statement on all websites and communications which have Diversity and/or Inclusion as their primary subject matter: ‘Intel affirms and believes all that the Pride flag and the Gay Pride movement it is associated with represent or assert to be right and true.’” On its face, the proposal appears to favor Intel’s support for its LGBTQ employees. But in the body of the resolution, it notes Intel said flying the rainbow flag at its facilities was “celebrating sexual diversity and gender variance.” The proposal asserts this “left those employees from religious or moral traditions which did not celebrate sexual diversity or gender variance unsure as to whether their beliefs were actually being contradicted, or were only publicly perceived to be so, either of which could be disparaging.” It concludes that the company should make its suggested statement, but does not precisely explain how this would solve the problem it says exists.

The company has challenged the proposal at the SEC, arguing it is too vague and relates to ordinary business since it concerns workforce management and related communications, and because it seeks to micromanage those communications. An omission seems likely.