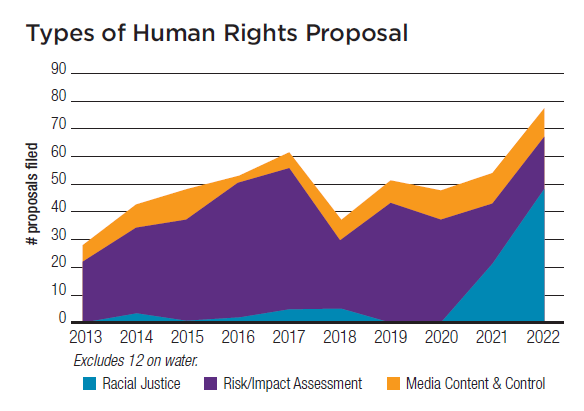

After the Black Lives Matter movement blossomed following the May 2020 murder of George Floyd in Minnesota, shareholder proponents shifted the bulk of their focus in proxy season to racial justice. Proposals last year started asking companies to examine how they may perpetuate or combat systemic racism, long the scourge of American society, and these proposals have multiplied for 2022. At the same time, proponents continue to raise longstanding concerns about setting standards and reporting on how they address human rights, often in far flung global supply chains. Proposals continue, too, about how companies control electronic media and its content, a vexing challenge that heightens our already fraught body politic. Also at issue is the struggle to combat authoritarianism around the globe. (Top graph.)

Human rights proposals have jumped more than 40 percent over last year and 75 are now set for votes, with just one omission to date and three withdrawals. Twenty face outstanding SEC challenges. Racial justice proposals have more than doubled to 51, up from 22 last year.

With human rights, companies and proponents seem to have a harder time reaching common ground compared to many other topis, and the number that go to votes tracks closely with the number withdrawn. (Graph, right.)

Proponents in the past have mainly come from the membership of the Interfaith Center on Corporate Responsibility, but the SOC Investment Group (formerly Change to Win or CtW), working with trade unions, has been a key driver of racial justice resolutions.

Racism & Indigenous Rights

GROWING SUPPORT FOR RACIAL JUSTICE AUDITS

NADIRA NARINE

Senior Program Director, Interfaith Center on Corporate Responsibility

Interfaith Center on Corporate Responsibility (ICCR) members have a long history of supporting calls for diversity and justice, including respect for the rights of Indigenous Peoples and addressing the negative impacts of policies and practices on communities of color. ICCR-member proposal filings on racial justice issues continue to grow and are the second-most frequently filed category of resolutions for 2022, largely because of 32 resolutions that ask for racial equity audits (REAs) and civil rights audits (CRAs). We see these as connected to other proposals about the negative racial justice impacts of employment practices, including those that seek improved representation in the workplace and better pay.

Racial Justice/Civil Rights Audits

Last year most resolutions seeking racial justice audits went to financial firms the proponents considered systemically important, each with a legacy of discriminatory practices. The campaign has branched out to encompass not only financial players, but also retailers, food purveyors, healthcare companies, industrial and materials firms, the tech sector and utilities.

All but six of the 2022 proposals are at new recipients. Votes last year were at Amazon.com (44.2 percent), Goldman Sachs (31.4 percent), Home Depot (13.3 percent), Johnson & Johnson (33.9 percent), Oracle (31.8 percent) and Wells Fargo (13.1 percent).

The proponents take note of various types of systemic racism and company connections to it, noting public company commitments but also deep underrepresentation for people of color in upper-level jobs. They argue addressing racism will make companies better run and more profitable, as well as more equitable and just. Some cite findings from As You Sow’s Racial Justice Scorecard that compares company policies. Proposals also name specific stakeholder groups to consult.

All seek external expertise and advice for steps companies should take.

Promote justice: As You Sow has the pithiest version, asking Entergy and Martin Marietta each simply to report on their plans “to promote racial justice.”

Civil rights, equity, diversity and inclusion business impact: With slight variations proponents ask Dollar General, Amazon.com (a repeat) Chipotle Mexican Grill, Dollar Tree, Match Group and Salesforce.com to commission and report on

a racial equity audit analyzing [the company’s] impacts on civil rights, equity, diversity and inclusion, and the impacts of those issues on [the company’s] business. The audit may, in the board’s discretion, be conducted by an independent third party with input from civil rights organizations, employees, communities in which [the company] operates and other stakeholders.

CHANGING CORPORATE ATTITUDES ON RACIAL JUSTICE

OLIVIA KNIGHT

Racial Justice Initiative Manager, As You Sow

After George Floyd’s murder in May 2020, stakeholders in public companies asked management and boards what they could do about racial injustice. Without any metrics to define best practices and separate leaders from laggards, there was no way to measure and therefore manage this critical social issue. To fill this gap, As You Sow developed two interlocking scorecards on Racial Justice and Diversity, Equity, and Inclusion (DEI) that cover the Russell 1000. We developed 57 Key Performance Indicators (KPIs) to guide companies on the path to achieve racial equity inside their organizations and establish a standard, supporting dozens of related shareholder engagements and resolutions.

Community impacts: The resubmissions at Oracle and Wells Fargo ask each board to “oversee a racial equity audit analyzing [the company’s] impacts on non-white stakeholders and communities of color,” with input from “civil rights organizations and employees” about “the specific matters to be analyzed.” This proposal also is pending at Alphabet, where it suggests additional stakeholders include “temporary vendors and contractors,” while at Verizon Communications it is the same but mentions “contractors.”

At nine more companies—(repeats at Goldman Sachs and Home Depot and newly at Invesco, Maximus, Mondelēz International, Southern, Stericycle, Valero and Pfizer)—it asks for the same thing but adds “customers” to the list of stakeholders. At Comcast, the proposal notes the company settled race and pay discrimination cases with the U.S. Department of Labor in 2020. At Maximus and Home Depot, it includes a carveout to exclude matters in litigation.

Civil right policy and impact: A grab bag of companies—Apple, McDonald’s, Uber Technologies, Waste Management and XPO Logistics—is asked about the “adverse impact of [the company’s] policies and practices on the civil rights of company stakeholders,” with “recommendations for improving the company’s civil rights impact” after input “from civil rights organizations, employees, and customers.”

SEC action—McDonald’s says the resolution is ordinary business because it is being sued about alleged civil rights violations. (The proposal does not include a litigation carveout like some others.)

Products and services: At another four companies—Anthem, LHC Group, SVB Financial and Travelers—the request also is for a report on improvements, but regarding “policies, practices, products and services.” This is the first human rights proposal at Anthem and the first-ever at LHC, which provides health services to government assistance program recipients in the American South. The resolution is also new to SVB Financial, although Trillium Asset Management withdrew a resolution there after it agreed to assess and report on executive diversity in 2020.

Johnson & Johnson is asked simply about “improving the racial impacts of its policies, practices and products.” The proposal says, “Healthcare companies have a history with and ongoing struggle to address disparate racial impacts,” and takes note of controversies and litigation about the company’s talcum powder, which it stopped selling domestically in 2020 but continues to sell elsewhere. The proposal comments, “Claims that it aggressively marketed to Black and Brown women after its talc supplier included the WHO’s “possibly carcinogenic” label on shipments are troubling.” It also notes criticism that company has faced about its Covid-19 vaccine distribution decisions. (A similar iteration of the proposal last year earned 34 percent support.) (See p. 61 for a proposal at Johnson & Johnson seeking an end its talcum powder sales.)

The Sisters of St. Francis of Philadelphia are more expansive at Altria. Like others, the proposal requests a “third-party civil rights equity audit” but it also asks that the review

assess the impact of the Company’s policies, practices, products and services on BIPOC (Black, Indigenous and people of color) and Latinx/a/o/e communities, including youth. Input from civil rights organizations, employees, customers, and communities in which Altria operates and other stakeholders should be considered.

SEC action—The SEC disagreed that the Johnson & Johnson proposal duplicates another it received first from the conservative National Center for Public Policy Research, which asks about the risks of a racial justice audit while using language in favor of racial justice audits, which it does not support. (See Conservatives, p. 85.)

Travelers says the proposal is ordinary business, would be illegal, cannot be implemented, and is both too vague and false and misleading. The company did agree to release detailed diversity data on its employees in 2020, following a 2020 resolution that earlier earned 50.9 percent in 2019.

Environmental Justice

Differential impacts: Five proposals discuss “environmental justice.” At American Water Works the proposal raises a specific concern about low-income residents who would be affected by a desalinization plant and asks for a third-party audit “which assesses and produces recommendations for improving the racial impacts of its policies, practices, products, and services” with contributions “from stakeholders, including civil rights organizations, employees, and customers” to determine the issues examined.

A 2021 request for an environmental justice report at Chevron was omitted on ordinary business grounds after the company noted it was being sued on the subject. This year, proponents have resubmitted to Chevron a similar version seeking

an independent racial equity audit, analyzing if, and how, Chevron’s policies and practices discriminate against or disparately impact communities of color. The report should clearly identify, and recommend steps to eliminate, business activities that further systemic racism, environmental injustice, threaten civil rights, or present barriers to diversity, equity, and inclusion (DEI). Input from impacted workers, community members, customers, or other relevant stakeholders should inform the audit and report.

The resolution notes that the report “should exclude confidential and proprietary information, as well as information relevant to any pending legal proceeding or threatened proceeding of which Chevron has notice.” Proponents also have filed this proposal at Dow for the first time.

At 3M and Chemours, NYSCRF has a similar but more detailed version, asking for a report:

on environmental justice, updated annually, describing its efforts, above and beyond legal and regulatory compliance, to identify and reduce heightened environmental and health impacts from its operations on communities of color and low-income communities. The report should be prepared at a reasonable cost and omit confidential or legally privileged information, including litigation strategy, and should be publicly disclosed on [the company’s] website. Such a report should consider, at board and management discretion:

Past, present, and future disparities in environmental and health impacts from its operations;

Any [company] policy statements or commitments on environmental justice;

How responsibilities are allocated within the company for governance and management of environmental justice issues;

Quantitative metrics on impacts and a qualitative discussion as to how this information informs business decisions;

How [the company] communicates any commitment to environmental justice to the communities in which it operates;

Any initiatives, engagements or investments in environmental justice communities;

Whether [the company] intends to adjust it policies and practices in the future.

At Republic Services, a trash and recycling firm that has yet to consider such a resolution, the focus is on environmental impacts, seeking “a third-party environmental justice audit (within reasonable time and cost) which assesses the heightened racial impacts of Republic Services’ operations and produces recommendations for improving them,” with input from civil rights groups and “affected community members.”

Risk consultation: The Franciscan Sisters of Allegheny, N.Y., and As You Sow are concerned about how companies’ environmental impacts disproportionately affect the communities in which they operate, noting this generally means disadvantaged communities of color. There are two similar proposals. At Honeywell International, the resolution asks for a report on its

due diligence process to identify and address environmental and social risks related to emissions, spills, or discharges from Honeywell’s operations and value chain. The report should:

Explain the types and extent of stakeholder consultation; and

Address Honeywell’s plans to track effectiveness of measures to assess, prevent, mitigate, and remedy adverse impacts on the environment and human health.

At Kinder Morgan, the proposal asks for “a public report quantifying emissions released from its facilities that impact local communities and describe how the company intends to address and reduce such community impacts from its operations.”

SEC challenge—Kinder Morgan says its current reporting makes the resolution moot and As You Sow, which had filed on behalf of Warren Wilson College, withdrew before any SEC response.

Indigenous Rights

A proposal at Citigroup and Wells Fargo raises concerns about policies about indigenous peoples, seeking a report “outlining how effective” current “policies, practices, and performance indicators are in respecting internationally recognized human rights standards for Indigenous Peoples’ rights in its existing and proposed general corporate and project financing.” The issue last went to a vote at Citigroup in 2018, when a proposal asking for a policy earned 5.8 percent. At Wells Fargo, it expresses concern about the company’s financing of pipelines on indigenous lands. Both companies do have policies about respecting indigenous rights.

PIPELINE FINANCE AND RESPECT FOR INDIGENOUS RIGHTS

KATE R. FINN

First Peoples Worldwide

JILLIANNE LYON

Investor Advocates for Social Justice

Oil is already flowing through the Enbridge Line 3 tar sands pipeline, a project that has been subject to several years of protest, litigation, and opposition led by Indigenous Peoples and Indigenous-led organizations. Line 3, recently renamed “Line 93,” doubles the pipeline’s previous capacity, transporting 760,000 barrels of oil a day from Alberta, Canada, to Wisconsin – traveling through Anishinaabe territory in the process. Pipelines like Line 3 violate numerous rights of Indigenous Peoples as protected by international law, including the rights to free, prior, and informed consent (FPIC); health; culture; religion; security; and assembly. In particular, these pipelines threaten the quality of water needed for growing manoomin, or wild rice, a critical cultural resource for the Anishinaabe.

Software

Parnassus Investments has withdrawn a new resolution at Cerner, a healthcare technology and services firm, which asked for a report “assessing the racial equity impacts of the algorithmic systems used in its products and services.” The proposal raised concerns about how artificial intelligence (AI) can slant health care delivery and Parnassus withdrew when the company agreed to report about its AI principles on fairness and transparency.

Policing

Arjuna last year saw a proposal about underwriting police departments with racist practices at Chubb omitted because the SEC agreed it was not significantly related to the company’s business. Arjuna is trying again at Travelers, although the company is arguing at the SEC the subject is ordinary business (since it concerns product offerings and could affect litigation strategy), is not significantly related to Travelers and is false and misleading. The company notes several ongoing civil rights cases involving Travelers to bolster its point on litigation strategy. The resolution seeks a report

on current company policies and practices, and options for changes to such policies, to help ensure its insurance offerings reduce and do not increase the potential for racist police brutality, nor associate our brand with police violations of civil rights and liberties. The report should assess related reputational, competitive, operational, and financial risks, and be prepared at reasonable cost, omitting proprietary, privileged or prejudicial information.

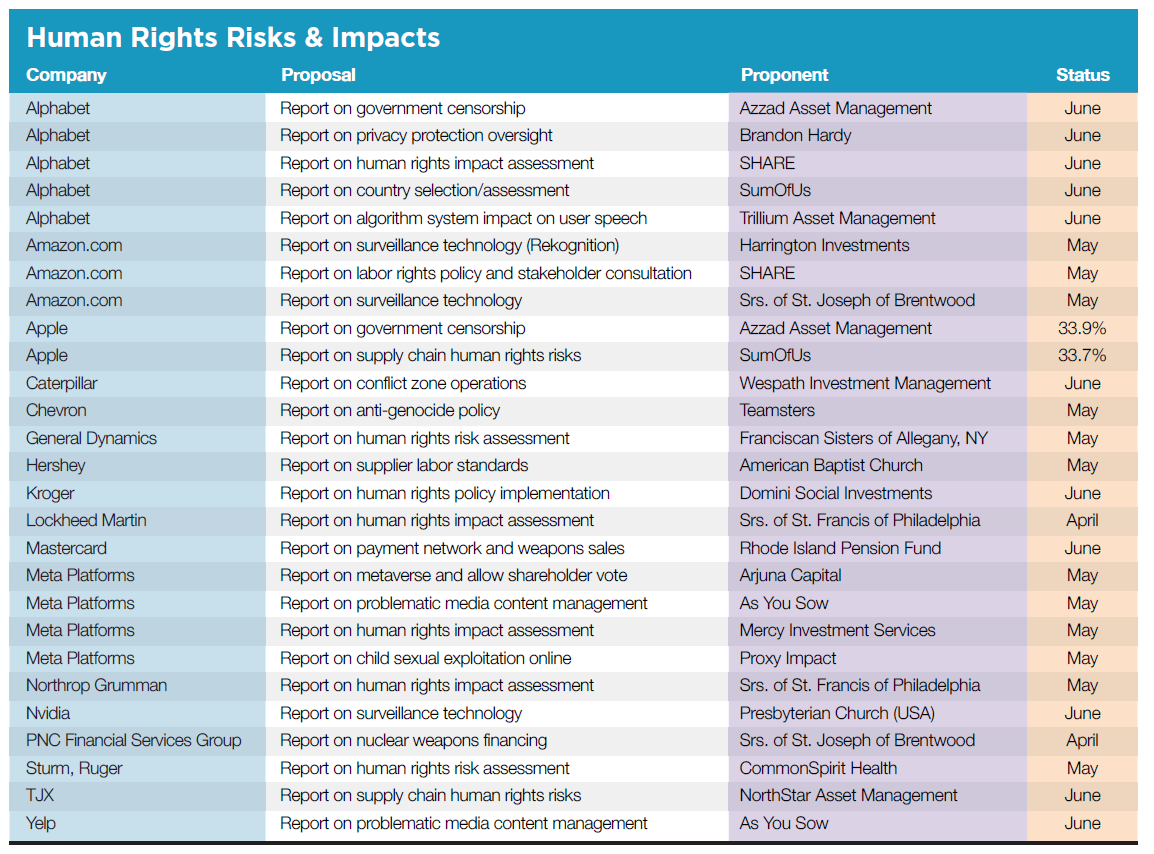

Risks and Impacts

Eleven more proposals reprise oft-expressed concerns about human rights policies and impact, another 10 focus on electronic media content and control, three specifically address doing business in conflict zones and two are about weapons. Most recipients have seen similar resolutions before.

(A resolution from the National Legal and Policy Center seeking a report from Walt Disney about its human rights policy in China is covered in the section on Conservatives, p. 85. It addresses controversy over filming the Mulan movie in Xinjiang province in China. Another proposal from NLPC asks General Motors about labor concerns in the supply chain for electric vehicle components.)

MANDATORY HUMAN RIGHTS AND ENVIRONMENTAL DUE DILIGENCE IS GOOD FOR INVESTORS AND BUSINESS

PATRICIA JUREWICZ

Founder and Chief Executive Officer, Responsible Sourcing Network

REBECCA DEWINTER-SCHMITT

Associate Program Director, Investor Alliance for Human Rights

When done responsibly, business can be a driving force for prosperity and inclusive economic development. Yet, far too often, companies in many different sectors harm people and planet in their operations or value chains.

Referencing the widely-accepted UN Guiding Principles on Business and Human Rights (UNGP), a growing number of investors are telling portfolio companies that they have a responsibility to respect human rights. They say the process of continuously conducting human rights due diligence is a core requirement for companies to fulfill that responsibility. The UNGP define human rights due diligence as an ongoing and iterative process to identify, prevent, mitigate, and account for how companies – and investors – address the most severe risks to people in connection with business activities.

Policy and Implementation

High risk products and services: Two different orders of Franciscan Sisters have proposals at three defense companies—General Dynamics, Lockheed Martin and Northrop Grumman—asking for a report on their “human rights due diligence process to identify, assess, prevent, mitigate, and remedy actual and potential human rights impacts associated with high-risk products and services, including those in conflict-affected areas.” Last year the proposal earned 32.1 percent Lockheed; a similar resolution at General Dynamics received 37.9 percent in 2013.

SEC action—Northrop Grumman has lodged what seems likely to be a successful challenge; the company notes the proposal earned 22.4 percent last year in its third year and needed 25 percent to qualify for resubmission.

Human rights impact assessments of ads and guns: Two proposals seek reports for different reasons:

Mercy Investments wants Meta Platforms (the former Facebook) to commission an

independent third-party Human Rights Impact Assessment (HRIA), examining the actual and potential human rights impacts of Facebook’s targeted advertising policies and practices throughout its business operations. omit information relevant to litigation or enforcement actions; and be published on the company’s website by June 1, 2023.

SEC action—The company has lodged what looks likely to be a successful challenge at the SEC, arguing a previous similar proposal missed the resubmission threshold. In 2015 a similar proposal received only 1.6 percent support, although it did attract an unusually large number of abstaining votes. Meta also says it is ordinary business because it concerns products.

CommonSpirit Health wants the impact assessment at Sturm, Ruger to make “recommendations for improving the human rights impacts of its policies, practices and products,” with input from “human rights organizations, employees, and customers.” Earlier, a proposal seeking a policy on gun safety and harm mitigation received notably high support of 68.9 percent in 2018.

Supply chains: Three proposals ask about human and labor rights in supply chains, at home and abroad:

China—Investors at Apple gave 33.7 percent support to a proposal from SumOfUs that survived an SEC challenge arguing it was moot. It raises new concerns about forced labor in China and the Uyghur people. The resolution asked for a public report

on the extent to which Apple’s policies and procedures effectively protect workers in its supply chain from forced labor, including the extent to which Apple has identified suppliers and sub-suppliers that are at significant risk for forced labor violations, the number of suppliers against which Apple has taken corrective action due to such violations, and the availability and use of grievance mechanisms to compensate affected workers.

SumOfUs is concerned about forced labor in Apple’s supply chain, particularly in China where the government has used Uyghur and Turkish Muslim people in forced labor camps and practices what some have called “crimes against humanity” and “genocide.” The proponent points out that nine of Apple’s suppliers have recently been accused of participating in the Chinese government’s forced labor program, and that the company had to terminate its relationship with one of these firms for similar reasons. Apple says it already provides enough information on the issue and that numerous reviews in recent years have found no evidence of forced labor. The company has a global human rights policy and a supplier code of conduct. It also publishes an annual progress report on its supply chain management efforts, including assessments and big-picture performance measures. Despite the wealth of information, some key gaps remain, including what percentage of its supplier universe Apple assesses each year. (A second proposal expressing similar concerns from the conservative NLPC was omitted on the grounds it duplicated SumOfUs. SumOfUs also has a resolution at Alphabet on China—see p. 72).

Africa—The American Baptist Church addresses the supply of chocolate at Hershey asking for a report within a year on “if, and how, Hershey’s living wage position statement and planned implementation steps will put the company on course to eradicate child labor in all forms from the company’s West African cocoa supply chain by 2025.”

SEC action: The company has lodged a challenge at the SEC, arguing the proposal is moot. The same proponent withdrew a 2018 proposal about supply chain standards after Hershey agreed to review its policies and conduct an ethical trade audit.

Vulnerable U.S. workers and Uyghurs—At TJX, where NorthStar Asset Management raises concerns about the domestic and foreign supply chain, this year’s request is for a “third-party assessment and report to shareholders… assessing the effectiveness of current company due diligence in preventing forced, child, and prison labor in TJX’s supply chain.” The proposal notes the company’s vendor code does not require routine factory audits of its 21,000 vendors in more than 100 countries, it scored poorly on the World Benchmarking Alliance’s assessment of compliance with UN principles, and has yet to take steps to avoid Uyghur forced labor, or to address undocumented worker abuses in the U.S. garment industry or incarcerated workers.

NorthStar saw a prison labor proposal omitted in 2021 on ordinary business grounds but a similar resolution in 2019 earned 38.8 percent. The Priests of the Sacred Heart withdrew a human rights risk assessment proposal in 2020 after it received 39 percent the year before.

Protections during the pandemic: Domini Social Investments is focused on North American farmworkers in Kroger’s supply chain, the focus of shareholder resolutions for years. It asks how well its human rights policy has protected them,

from human rights violations, including forced labor, sexual assault, heat exhaustion, and COVID-19. This report should detail any mechanisms similar to the Fair Food Program, including:

Whether Kroger has required its North American produce suppliers (“Suppliers”) to implement COVID-19 worker safety and heat stress prevention protocols (“Safety Protocols”), and, if so, the content of those Safety Protocols;

The number of times Kroger suspended a Supplier for violating the Statement or Safety Protocols, and the specific grounds for each such suspension;

A list of the total number of Supplier locations purchased from, how often Kroger social compliance audits were conducted on-site at each such location, and the number of farmworkers personally interviewed there by the auditor;

Whether Kroger ensured its Suppliers’ farmworkers had access to a third-party grievance mechanism, with the authority to order a remedy, for reporting Statement or Safety Protocol violations, and, if so, the required procedures, number of such grievances filed, and outcomes of all such grievances.

A more general but similar proposal earned 44.7 percent support in 2020. Earlier, the company agreed to strengthen supply chain auditing after votes of 24.9 percent in 2016, 30.8 percent in 2015 and 38.8 percent in 2014.

Stakeholders and labor rights: SHARE has a new resolution at Amazon.com, asking for a

report analyzing how Amazon’s current human rights policies and practices protect the rightful application of the fundamental rights of freedom of association and collective bargaining as guaranteed by the ILO Declaration on Fundamental Principles and Rights at Work and the UN Universal Declaration of Human Rights. The report should include information on whether, and if so how, input from affected stakeholders was taken into account.

Media Content and Control

Investors have been concerned about the ills of electronic media since the dawn of the Internet, noting risks associated with how repressive governments control media platforms, misuse technology and threaten privacy, and how social media can spread hate speech and foment and publicize violence. Proposals this year again highlight these persistent problems but also raise new questions about algorithms and the “metaverse” concept.

Surveillance: Two resolutions again take up different aspects of surveillance problems at Amazon.com. The first, a resubmission that earned 35.3 percent last year, comes from the Sisters of St. Joseph of Brentwood and asks for an independent report “assessing Amazon’s process for customer due diligence, to determine whether customers’ use of its surveillance and computer vision products or cloud-based services contributes to human rights violations.”

The other, from Harrington Investments, is focused for the fourth year in a row on Rekognition, Amazon’s facial recognition system. Last year it earned 34.3 percent, its highest vote yet. It seeks an independent report by September on:

The extent to which such technology may endanger, threaten or violate privacy and/ or civil rights, and unfairly or disproportionately target or surveil people of color, immigrants and activists in the United States;

The extent to which such technologies may be marketed and sold to authoritarian or repressive governments, including those identified by the United States Department of State Country Reports on Human Rights Practices;

The potential loss of good will and other financial risks associated with these human rights issues;

Nvidia faces its first human rights proposal, from the Presbyterian Church (USA), which notes the company provides products and services to customers in conflict zones, including in the Uyghur region in China, occupied Palestinian territory, Saudi Arabia, and autonomous vehicles used by the U.S. military. The church wants an independent report on the company’s

customer due diligence process to determine whether customers’ use of its products or services with surveillance technology and artificial intelligence (AI) capability or of its components that support autonomous military and police vehicles, contributes to human rights harms.

Censorship: Azzad Asset Management is taking the lead on government censorship proposals. It has sponsored a proposal now in its third year that asks Alphabet to report “assessing the feasibility of publicly disclosing on an annual basis, by jurisdiction, the list of delisted, censored, downgraded, proactively penalized, or blacklisted terms, queries or sites that the company implements in response to government requests.” The proposal earned 13.3 percent last year and 11.4 percent in 2020.

A similar proposal has earned 33.9 percent at Apple having asked it to

revise the Company’s Transparency Reports to provide clear explanations of the number and categories of app removals from the app store, in response to or in anticipation of government requests, that may reasonably be expected to limit freedom of expression or access to information. Such revision may exclude proprietary or legally privileged information.

Azzad focused on the company’s role in suppressing citizens’ freedom of expression in China, noting its cooperation with the government in its work against democracy activists. Apple publishes mostly quantitative data on government requests for customer data and app removals, twice a year, but not historical data on app removals or meaningful qualitative details. Only a handful of governments request app removals, according to Apple’s disclosure, and China tops the list in the number of requests. Apple argues that engagement over absence in challenging markets makes sense.

SEC action—The SEC turned back a no-action request from Apple, disagreeing its current reports make the resolution moot. Earlier, a resolution about free speech and human rights at Apple earned 40.6 percent in 2020.

Problematic content: Meta Platforms faces a proposal slightly different than election-related content management proposals voted on by investors in 2021 and 2020. Now the proposal seeks a report

analyzing why the enforcement of “Community Standards” as described in the “Transparency Center” has proven ineffective at controlling the dissemination of user content that contains or promotes hate speech, disinformation, or content that incites violence and/or harm to public health or personal safety.

Yelp has a resolution for the first time, asking it to report by the end of 2022 on “a stakeholder harm assessment study related to misinformation and false postings on its platform.” It says the report should determine “strategically appropriate next steps identified as a result of this study.” The proposal expresses concern about how the company manages negative reviews on its platform.

SEC action— Meta Platforms (Facebook) says its proposal can be omitted because last year’s proposal about elections failed to earn the 25 percent needed as a third-year resolution. (The 2021 resolution asked about content moderation the U.S. elections and received 19.5 percent, a 2019 proposal about content governance and human rights received 5.7 percent, and a 2018 proposal on enforcement of its content standards received 10.2 percent.)

Yelp says its practices and reporting make the resolution moot, that it concerns ordinary business since it is about customer relations and seeks to micromanage, and that it is materially false and misleading.

New advertising technology risks: Two proposals raise similar concerns about Alphabet’s plans to revamp how its search engine works:

Trillium Asset Management has a new resolution about free speech that asks for a report

above and beyond its existing disclosures and provide more quantitative and qualitative information on its algorithmic systems. Exact disclosures are within management’ s discretion, but suggestions include, how Alphabet uses algorithmic systems to target and deliver ads, error rates, and the impact these systems had on user speech and experiences. Management also has the discretion to consider using the recommendations and technical standards for algorithm and ad transparency put forward by the Mozilla Foundation and researchers at New York University.

SHARE, has another new resolution at Alphabet asking it to provide a report from an “independent human rights impact assessment…evaluating the potential human rights impacts of Google’s upcoming Federated Learning of Cohorts technology.” The proposal explains that the company’s Google subsidiary plans to transform its advertising approach, eliminating cookies and relying instead on algorithms to define user cohorts with similar attributes. SHARE says individual users might be identified and users’ privacy violated. It wants to know more about how the company “will enforce its advertising policies to detect bad actors and prevent them from using the opacity of algorithmic grouping to their advantage,” noting well-known harms from currently targeted advertising that exacerbates hate speech, posing what SHARE says are material risks. The proposal asserts the company’s current approach is lacking and that it has inadequately evaluated the risks of the new approach.

SEC action—The company has lodged challenges to both proposals. It says both concern ordinary business because they are about its advertising practices and could compel the disclosure of proprietary information. Alphabet also says the SHARE proposal is moot.

Metaverse: Arjuna is skeptical about the direction Meta Platforms is headed and wants both a report and an advisory shareholder vote on the company’s “metaverse” project. It says:

The report should summarize results of a third-party assessment of potential psychological and civil and human rights harms to users that may be caused by the use and abuse of the platform, whether harms can be mitigated or avoided, or are unavoidable risks inherent in the technology. After the report’s publication, the Company should seek a shareholder vote, expressing non-binding advisory approval or disapproval of the metaverse project, advising the board and management whether investors consider continued implementation of the metaverse platform to be prudent or appropriate.

SEC action—Meta says the proposal is ordinary business because it is about product offerings.

FINDING THE BALANCE BETWEEN CHILD SAFETY AND INTERNET PRIVACY

MICHAEL PASSOFF

CEO, Proxy Impact

Online child sexual exploitation is a global crisis that is growing at an exponential rate. Yet efforts to promote online child safety and privacy have met strong opposition from privacy and human rights proponents. Child safety and internet privacy do not have to conflict, even though advocates on each side seem to be at odds.

Child sexual exploitation: Proxy Impact has returned for the third year in a row to Meta Platforms. In 2020, Facebook was responsible for 94 percent of the 21 million cases of reported online child sexual abuse materials (CSAM). The company’s plans to apply end-to-end encryption across its platforms could hide 70 percent of reported CSAM cases which would greatly hinder efforts to help victims and to catch predators, the proposal asserts. The proposal earned 17.3 percent last year, about 56 percent of the vote not controlled by CEO Mark Zuckerberg. Proxy Impact wants a report by February 2023

assessing the risk of increased sexual exploitation of children as the Company develops and offers additional privacy tools such as end-to-end encryption. The report should address potential adverse impacts to children (18 years and younger) and to the company’s reputation or social license, assess the impact of limits to detection technologies and strategies, and be prepared at reasonable expense and excluding proprietary/confidential information.

Conflict Zones

While several more general proposals have raised concerns about human rights with broadly worded resolved clauses, three proposals mention specific conflict zones or countries with a poor record on human rights:

At Alphabet, SumOfUs has a new resolution asking for a report within six months “assessing the siting of Google Cloud Data Centers in countries of significant human rights concern, and the Company’s strategies for mitigating the related impacts.” Outside the resolved clause, the resolution expresses concerns about data centers located in “human rights hotspots” such as Indonesia, Qatar, India and Saudi Arabia. (Also see p. 69 for a similar supply chain resolution.)

SEC action—The company has challenged the proposal at the SEC, arguing it relates to ordinary business because it is about deciding where to locate and would micromanage, and is moot given its current reporting on human rights.

Caterpillar has long faced questions about how its heavy construction equipment is armored by military forces in global hotspots. Wespath Investment Management has a proposal like one that earned 7.8 percent in 2019. It asks the company to “assess and report to shareholders” on its “approach to mitigating the risks associated with business activities in conflict-affected and high-risk areas (CAHRA) as called for by the UN Guiding Principles on Business and Human Rights (UNGPs). The resolution notes company equipment has been used by governments in Myanmar, Occupied Palestinian Territory and Western Sahara; supply chain connections to Belarus; and sourcing from garment factories in China’s Xinjiang region where Uyghurs are persecuted.

The Teamsters want a report within six months from Chevron, “evaluating the feasibility of adopting a policy of not doing business with governments that are complicit in genocide and/or crimes against humanity as defined in international law.” The proposal raises specific concerns about operations in Burma (Myanmar), the Democratic Republic of Congo and Nigeria.

In 2021 proponents withdrew a proposal about operations in conflict zones after dialogue, while investors in 2020 gave 16.7 percent support to a proposal asking for a human rights assessment. On January 21, Chevron announced it would pull out of Burma given the ongoing human rights crisis, so it seems possible this resolution may be withdrawn.

Weapons

Nuclear weapons: The Sisters of St. Joseph of Brentwood have resubmitted a proposal about financing nuclear weapons to PNC Financial. It earned 7.9 percent last year and asks the board to report “assessing the effectiveness of PNC’s Environmental and Social Risk Management (ESRM) systems at managing risks associated with lending, investing, and financing activities within the nuclear weapons industry.” The supporting statement says the report could include:

Review of PNC’s existing financing to the nuclear weapons industry and associated actual and potential human rights impacts;

An assessment of the legal, financial, regulatory, and reputational risks that PNC may face due to involvement with the nuclear weapons industry; and

Evaluation of if and how PNC plans to reduce or eliminate its potential exposure to risks of nuclear weapons financing.

Handguns: The Rhode Island Pension Fund is concerned about small weapons; its focus is on how Mastercard’s payment network may be used for selling untraceable firearms. It calls for the board to

conduct an evaluation and issue a report within the next year…describing if and how MasterCard…intends to reduce the risk associated with the processing of payments involving its cards and/or its electronic payment system services for the sale and purchase of untraceable firearms, including “Buy, Build, Shoot” firearm kits, components, and/or accessories used to assemble privately made firearms known as “Ghost Guns.”

SEC action—Mastercard is arguing at the SEC that the proposal is an ordinary business matter because it is about the sale of specific products. (Proponents withdrew a similar proposal at Visa in 2020 for procedural reasons.)