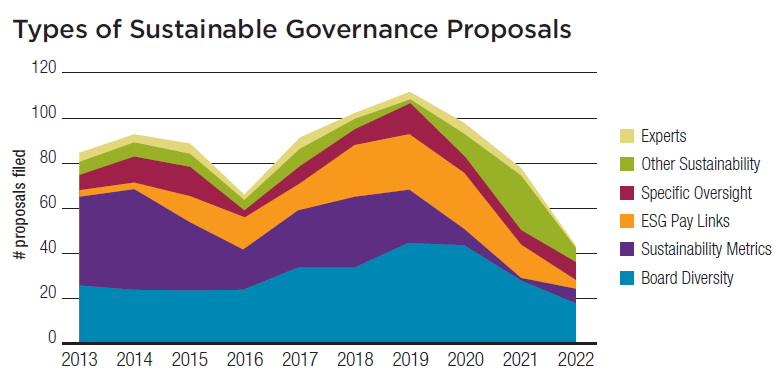

Companies have taken to heart research that more diverse boards produce better results, and most now realize they must routinely monitor and report on to properly respond to the many social and environmental challenges they face. As a result, the volume of generalized sustainability proposals has shifted and fallen (graph below). About one-third of all resolutions on sustainable governance in the last decade has been about board diversity, but the 18 filed this year are less than half the apex of 45 in 2019. More significant is the evaporation of proposals seeking general sustainability metrics (seven this year, down from 45 in 2014). From 2018 to 2020, proponents sought ESG links to executive pay but these, too, have nearly vanished (three in 2022, compared with two dozen earlier). These outcomes encapsulate the extent to which sustainability has become a mainstream approach to doing business. It is now ordinary. As other sections of this report show, however, investors remain keen to learn how companies are approaching specific problems—most often when it comes to climate change, diversity and corporate political influence; these topics continue to drive the overall increase in proposal filings.

Not every shareholder request on sustainable governance has gotten substantial support from investors. Last year’s resolutions coordinated by The Shareholder Commons (TSC) that asked companies to become public benefit corporations earned scant support (just one received enough to be resubmitted). The group has recast most of it add flags to TSC proposals to ask for reports on various types of externalized costs (covered in this report under each topic—see pp. 29, 47, 49 and 79). The thread raised by TSC—holding companies’ feet to the fire about stated support for the stakeholder capitalism concept articulated in the 2019 Business Roundtable’s (BRT) Statement on the Purpose of the Corporation—continues to hover in the proxy season background, inspiring proponents from both the left and right to question whether shareholder primacy is at an end, as the BRT suggested.

This section examines board composition (19 proposals), proposed changes to board committees to add specific types (eight) and 14 more raising broad sustainability concerns about corporate governance arrangements and reporting to investors, linking ESG to executive pay and general ESG policy. The total number of proposals filed on these topics has dropped to 41, down from 78 last year and a high of 112 in 2019.