This section provides a look at the main issues raised for the topics in this report, with special attention to new issues and basing the analysis on what is requested in the resolved clauses of resolutions. Additional proposals will be filed as the year progresses but the shape of the 2023 spring annual meeting season is now clear. Data in this report are as of February 17, with a few updates for meeting dates released in the last half of the month.

Environment

Climate change was at the top of the proxy season agenda last year and continues to be the biggest single topic. It is even more dominant when 22 related proposals about political influence and board oversight are counted. Many proposals about environmental management also have climate angles, as so do newer “climate justice” requests. In all, there are 160 on the environment so far, compared with nearly 180 in all of 2022. Since more are coming, the year-end totals may be about the same as in 2022.

Climate change: The volume of proposals specifically on climate change is up from last year at this point—122 compared with 109 in mid-February 2022. (Fifteen more with new angles climate-related lobbying are discussed below, p. 42.) The heavy focus on greenhouse gas emissions targets and reporting from last year remains, with a notably consistent approach. The biggest set is 72 proposals on emissions, but 42 ask about strategy and risk assessment and eight are on deforestation.

Emissions reporting—Most of the proposals want companies to set either net-zero GHG goals or those that are “Paris-compliant,” framed as part of a “transition plan” to a lower carbon economy that may stave off catastrophic shifts in the climate. Only three of the emissions disclosure proposals are resubmissions. A few refer to recent sector-specific guidance from initiatives such as the Science-Based Targets Initiative (SBTI), including indirect Scope 3 emissions outside companies’ direct control. Ten are specific to methane and two companies prompted withdrawals after they joined an industry initiative to improve monitoring.

As You Sow has a new and more specific request at Chevron and ExxonMobil about how each calculates an emission baseline that determines progress towards emissions reduction goals. Critics argue that divesting high-carbon operations makes company progress on emissions reduction appear more substantial, while not addressing the continued impact of divested assets (see below for more in the strategy section).

Emissions targets—The mantra for most of 17 consistent proposals is to set “science-based targets” rigorously defined by SBTI for all operations and the supply chain; another seven resolution want Scope 3 targets at energy and utility firms and four others ask for net-zero goals.

Climate finance—Last year’s focus on how banks and insurers finance and underwrite fossil fuel projects continues with 22 proposals, although requests to cut off funds earned much lower support in 2022 and the resolutions now ask for “time-bound phaseouts” that provide more wiggle room. One resolution from the New York City Comptroller asks just for absolute 2030 GHG targets for two high-emitting sectors, in a new and more specific proposal at Bank of America, Goldman Sachs and JPMorgan Chase.

Impact reports—The United Steelworkers and the Teamsters unions have filed more proposals at energy companies on how they will respond to climate-related economic changes, referencing the International Labor Organization’s “just transition” guidelines about layoffs, workers and communities.

A grab bag of additional concerns includes the various impacts climate change may have on water availability, rates of illness from coal pollution, how communities of color and low-income people see greater impacts from environmental problems, plus one on aircraft (at Southwest Airlines). ExxonMobil has three other new proposals, about its offshore oil operations near Guyana, concerning litigation risks and about development in the Arctic National Wildlife Refuge.

Transition planning and accounting—A new proposal from several shareholders asks five oil and gas companies to provide audited reports about how asset retirement obligations affect net-zero goals calculations.

Deforestation—Five of six proposals last year about deforestation were withdrawn but five this year are now pending, asking food companies for reports on their supply chain impacts, with a focus on commodities.

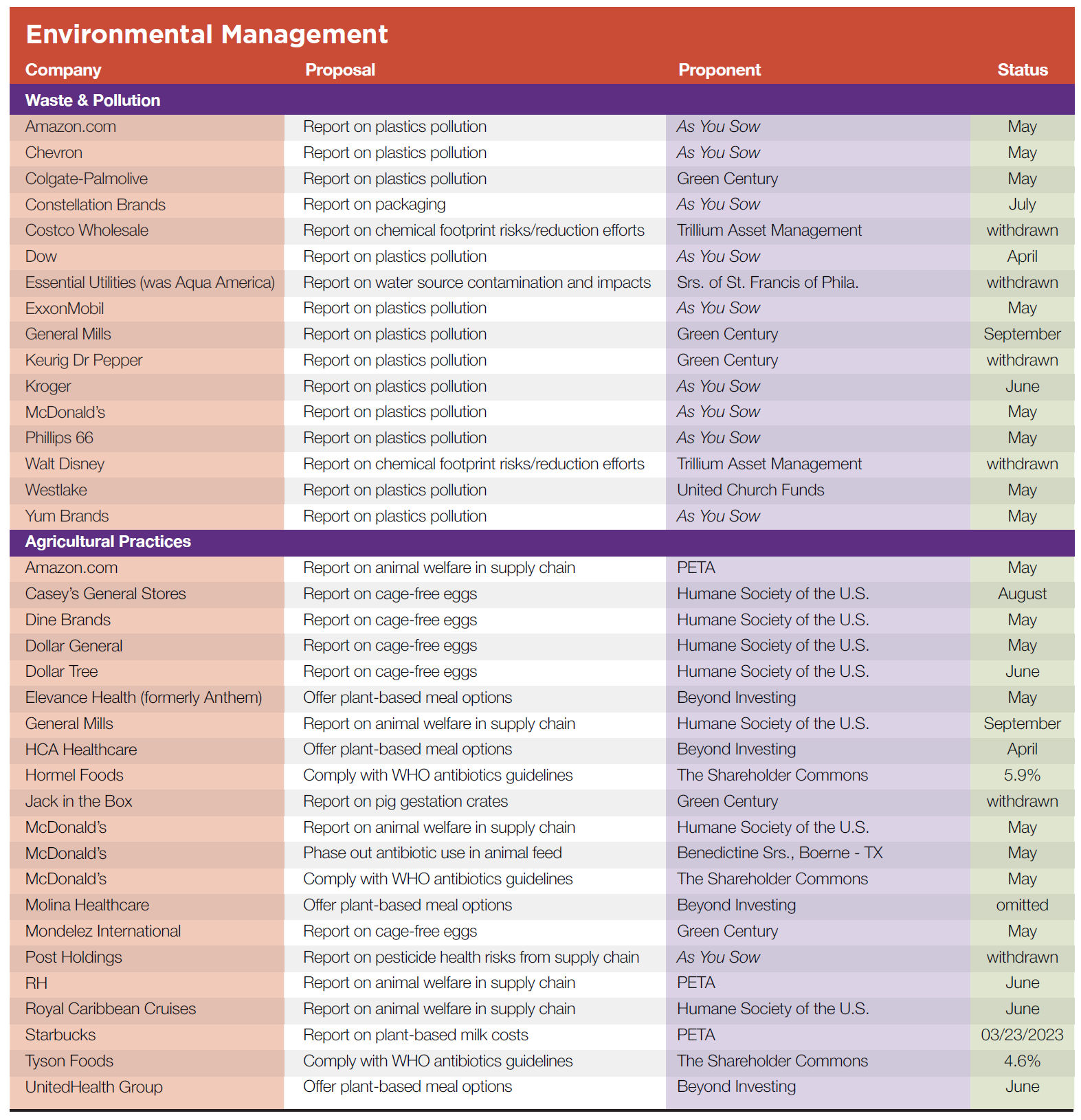

Environmental management: The number of environmental management proposals bumped up last year to 52 but has dropped back to 38.

Plastic—By far the biggest group of waste and pollution resolutions (13) are those seeking more disclosure from producers and users of plastics and their goals to reduce, with six resubmissions. A new proposal at Constellation Brands from As You Sow, filed on behalf of Warren Wilson College, is about supporting a “circular economy,” filed because the company compares unfavorably to peers.

Chemicals and water—Two companies—Costco and Walt Disney—have agreed to report more fully on their chemical reduction efforts and a proposal will not go to a vote. Another vote about water contamination at Essential Utilities will not occur because the company will make public the test results for its wells and water systems, in a win for the Sisters of St. Francis of Philadelphia.

Agriculture—While proposals about the welfare of farm animals had abated for a few years, they are back this year in force. As before, the concerns are cage-free eggs and the treatment of animals ultimately headed for the slaughterhouse (11 proposals). Plant-based foods resolutions (five) are new but one has been omitted and the other four face SEC challenges. People for the Ethical Treatment of Animals (PETA) will see its proposal at Starbucks about the higher cost of plant-based milk go to a vote on March 23.

The Shareholder Commons is reiterating its previously expressed concerns about the dangers of antibiotic resistance emanating from usage in food animals and has a new proposal seeking compliance with World Health Organization guidelines, but investors remain unenthused, so far giving just 5.9 percent at Hormel Foods and 4.6 percent at Tyson Foods. McDonald’s will consider this and a pesticides proposal if they are not withdrawn.

Social Issues

Animal testing: PETA has returned to proxy season with new angles in its long-running opposition to the use of animals in laboratories. It is seeking reports about the welfare of non-human primates imported to and transported in the United States at Charles River Labs and Laboratory Corporation of America, its long-time foes. PETA argues the primates may be a public health risk but also is concerned about the impact on populations in the wild. It also is taking aim at Ford Motor given its earlier sponsorship of car crash tests that used dead pigs.

Corporate political influence: The shift in political influence proposal continues, with 30 proposals this year on lobbying, 28 on elections and 35 on other issues that largely are about mismatches between corporate policies and recipients’ viewpoints. Only a handful have been withdrawn so far. The established approach to political money controversy—adopting a policy and providing oversight and disclosure—is clearly not sufficient to the moment for most; hyper-partisanship in the political arena means companies face ever-greater scrutiny about the actions of political players they fund.

New references for investors with respect to climate-related influence spending are a new set of international guidelines released last March, as well as a report from ICCR this past fall.

Oversight and disclosure—There are 30 proposals about lobbying and just over half are at new targets; the resubmissions earned for the most part high previous support. On elections, there are 17 proposals (just one a resubmission) that continue to request oversight and disclosure on campaign expenditures, although eight more promote adherence to CPA’s Model Code about disclosing third-party recipients of company money and what they spend. Four SEC challenges to the Model Code proposal have yet to be decided, however.

Congruency—Proposals about how companies may affect public policy on climate change are more specifically concerned with support for net-zero or Paris-compliant aims this year. Another new angle seeks a “framework for identifying and addressing misalignments” at big tech firms. Most climate lobbying proposals were withdrawn after agreements last year and three of four votes were more than 30 percent.

Rhia Investors continues to pressure companies about inconsistencies between policies on women (and other issues) and their support for anti-abortion politicians. (Si2 has uncovered highly partisan spending in the South and other parts of the country where abortion bans are proliferating.) Votes on six Rhia proposals last year averaged about 40 percent, evincing strong support. The first in 2023 goes to a vote at Walt Disney on April 3.

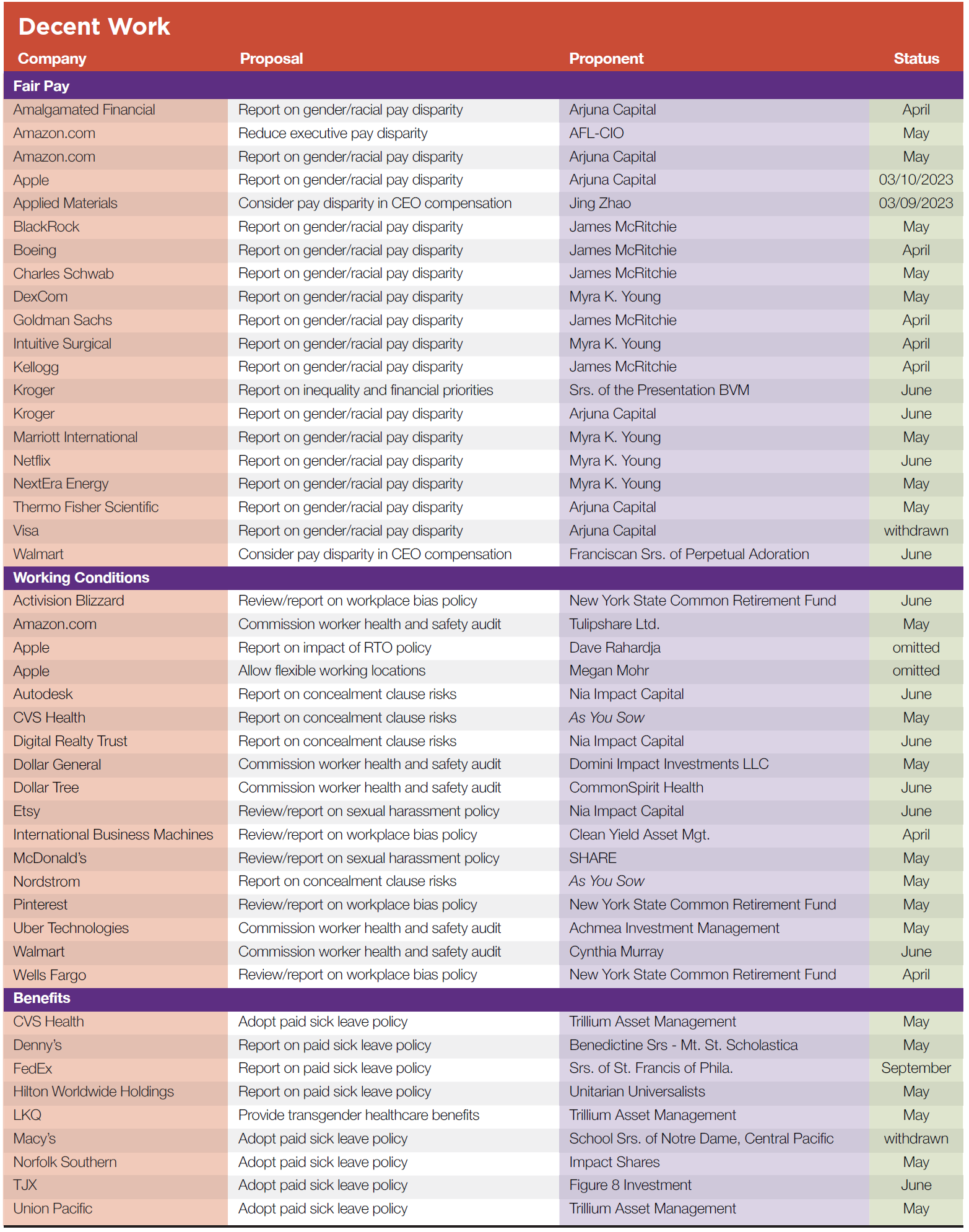

Decent work: About 50 proposals (down from last year’s 70+) ask about fair pay, working conditions and benefits. The resolutions come as the SEC says it plans to soon release a mandatory human capital management disclosure rule, long sought by investors and advocates. Academics, former SEC officials and experts outlined possibilities in June 2022 and Deloitte recently discussed shifting corporate board perspectives.

Fair pay—Almost all the 2023 proposals about gender and racial pay disparities are the same. Support for greater disclosure jumped dramatically last year after falling when proponents became more precise about what they wanted disclosed in 2020. Proposals this year seek unadjusted median and adjusted pay gaps at 11 companies and global and country-specific reporting, with some variations. An early win this year was an agreement by Visa last fall to report. Just three proposals this year ask about pay disparities between the CEO or senior executives, down from earlier years, plus one more about inequality and financial priorities at Kroger.

Working conditions—New worker health and safety proposals ask for audited annual reports on company performance at warehouses (Amazon.com), two dollar stores and Uber Technologies. Another new proposal asks Walmart how it plans to keep workers safe from gun violence.

The New York State Common Retirement Fund (NYSCRF) has a new, detailed proposal at Activision Blizzard, Pinterest and Wells Fargo seeking specific metrics on harassment and discrimination. The proposal joins others familiar from earlier years about concealment clauses that can mask malfeasance, particularly with sexual harassment, in addition to two more specifically on such harassment.

Benefits—Eight resolutions ask for adopting or reporting on paid sick leave, an issue that continues to resonate given the long reach of the Covid-19 pandemic and also recent labor strife with American railroads that nearly caused a crippling strike last fall. Trillium Asset Management has a new proposal at auto part company LKQ that seeks a policy that would provide “transgender-inclusive healthcare coverage.”

Diversity in the workplace: Proponents pushed their capacities and filed more than 70 resolutions two years ago seeking more disclosure on diversity program metrics so investors could assess their effectiveness. Last year there were 50 workplace diversity resolutions but there are only 38 this year. But many companies now are offering more transparency, so the reduction marks success rather than waning interest from proponents. All but three of the 21 filings on diversity programs this year are at new targets but five already have been withdrawn.

NorthStar Asset Management continues to focus on racism in employment practices and has a new proposal at four companies—Adobe, Badger Meter, IDEX and Xylem—asking how hiring practices regarding those with a criminal record align with their DEI approaches.

Ethical finance: A big idea for proxy season begun last year is that compliance with the Global Reporting Initiative’s (GRI) Tax Standard is needed, given concerns that companies do not pay their fair share to the public treasury when they offshore profits. A request from Oxfam and two other investors is a resubmission at Amazon.com and Microsoft, which earned votes around 20 percent last year; it also is pending at three big oil companies—Chevron, ConocoPhillips and ExxonMobil.

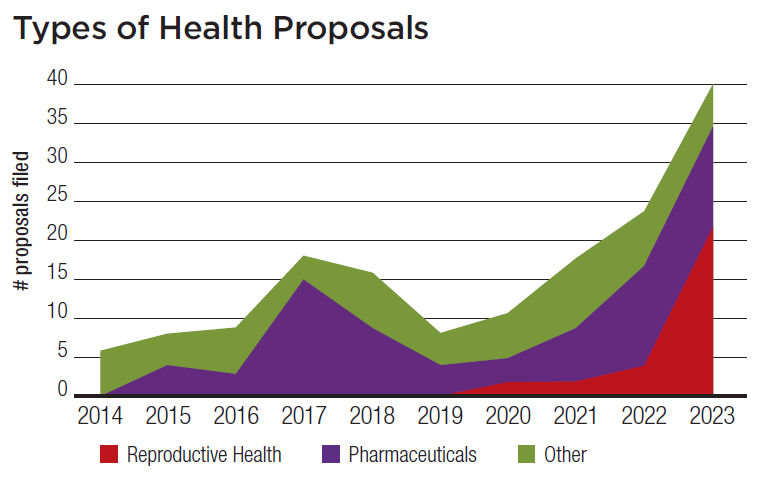

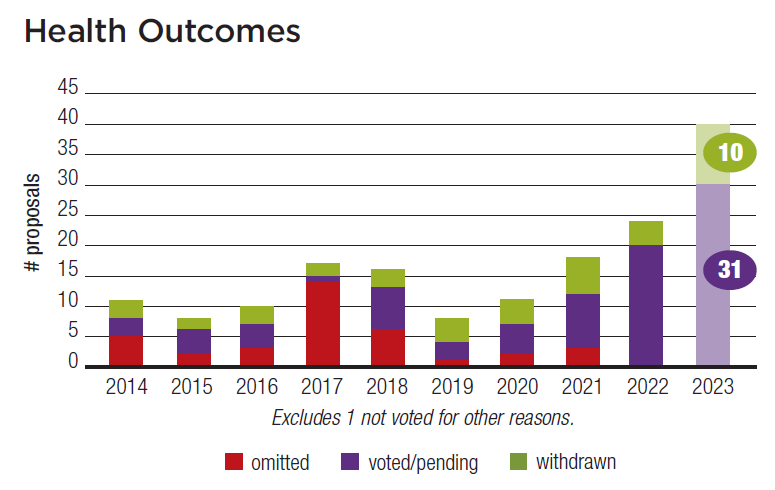

Health: Investors face a much larger array of proposals about health, driven by barriers to care that are politically motived but those based on cost. Proponents have filed 41 proposals and withdrawn 10 as of mid-February.

Reproductive rights—The June 2022 U.S. Supreme Court decision that struck down nearly 50 years of abortion rights is rapidly eroding access to both abortion and other reproductive and maternal health care across the country. In response, Rhia Ventures has substantially increased the number proposals about these issues, adding several new angles. Seven ask how companies are handling the risks new restrictions impose—a reprise of earlier proposals. New requests ask seven more companies how they will handle law enforcement queries about private health information and two make specific request to step up digital privacy policies. Three ask about insurance coverage for reproductive health care, two are about maternal health benefits and three others ask hospital companies about their policies on access to abortion.

One of the seven withdrawals so far occurred at HCA Healthcare after it clarified that its own doctors would perform emergency abortions as needed for miscarriage care.

Health equity—Parallel to the Rhia campaign are proposals from NYSCRF about maternal and general health disparities based on race. Comptroller DiNapoli discussed the issue in a February 15 press release, noting a withdrawal at Humana and pending proposals at Centene and Elevance Health.

Pharmaceuticals—ICCR members have a new and very specific proposal about the drug patenting process, with challenges from eight of nine recipients that argue it is too detailed; the SEC has yet to respond. Oxfam has resubmitted proposals that earned 25 percent to 35 percent last year about government subsidies for Covid drug development and the resulting impact, if any, on prices and access; other are about sharing technology to help spread access to treatment in lower-income countries.

Human rights: The surge in proposals seeking racial justice audits helped drive last year’s record volume, with 79 resolutions (down from 91 last year). Sixty were pending as of mid-February and many will go to votes since withdrawals are scarcer on human rights than other topics.

Audits—Half of 24 pending proposals seeking civil rights or racial justice audits are resubmissions that earned in almost every case significant support in 2022. Most ask for a comprehensive assessment of how race and civil rights intersect with employment practices and in product offerings, regarding financial services, disparate rates of tobacco use, the treatment of prisoners and detained immigrants, and differential credit ratings. A few specifically focus on community impacts and environmental justice. One such proposal resubmitted at Chevron this year earned 47.5 percent in 2022 and is now pending at Valero Energy, as well.

Risky business—Almost two dozen resolutions voice longstanding requests for assessments of human rights policies and risks. Resubmitted proposals address military products, targeted social media ads, Indigenous peoples and child and forced labor in supply chains.

A specific new proposal asks Kroger to join the Fair Food Program for purchasing tomatoes. PayPal has a new proposal asking it to make its services available in conflict zones “such as Palestine,” which other electronic payment companies do. In one of the only proposals to directly address the war in Ukraine, Friends Fiduciary asks Texas Instruments to report about its processes for avoiding links to international law violations, noting a report that company components have been found in weapons Russia is using in Ukraine—some made by Iran.

With regard to personal firearms, the New York City pension funds have withdrawn a proposal at American Express that is still pending at Mastercard. It asks about compliance with using a new industry merchant code for firearms sales, supported by gun control advocates. (Other resolutions argue companies are discriminating against gun owners, as noted below).

Organizing rights—Domestic union organizing ferment has sparked new proposals filed mostly by the New York City and State Comptrollers. Eleven proposals are still pending, asking either that companies adopt International Labor Organization and UN trade union standards or report on their compliance if they already invoke these standards in their policies. NYC Comptroller Brad Lander reached an agreement in January in which Apple will assess its compliance with organizing rights following allegations of union busting at its retail stores; this could provide space for additional agreements.

Media and technology—About a dozen proposals continue to ask about the vexing problems of divisive content on digital platforms, including the algorithms responsible for shaping personal experience and the challenges of ensuring online safety. One proposal at Alphabet newly notes impending regulations that could affect YouTube. Another new proposal from SumOfUs at Meta Platforms asks about facilitating political extremism in India. Proponents again ask about protecting digital privacy and collaborating with repressive governments, too. In an early win for proponents, Apple will provide by year’s end more information on why it removed or rejected apps. (As with guns, a mirroring proposal noted below says the problem is U.S. domestic repression that abrogates free speech rights.)

Sustainable Governance

Improvements in board diversity and ubiquitous sustainability reporting continue to erode proposals on sustainable governance; the total is down 70 percent from just four years ago. Eighteen proposals in 2023 ask about board diversity and specific types of oversight and 17 more are on high-level sustainability approaches. Outside the scope of this report, though, is a growing tendency for investors to vote against directors, a routine matter for each annual meeting. Majority Action is a key promoter of this tactic, but some, such as Proxy Impact, have voted against directors on all-white boards for several years.

Board diversity and oversight: Proposals about board diversity are not yet public but five others ask about specific types of oversight, with a new proposal at HCA Healthcare in which the Illinois Treasurer wants an assessment of staffing levels because they are well below the health care sector average.

ESG pay links: Seven proposals ask companies to consider ESG pay links in compensation arrangements, reprising earlier proposals at a new recipients. A new proposal at Molina Healthcare asks for a report on links between incentive pay and maternal morbidity metrics.

Investment practices: As You Sow is pressing ahead with its idea that corporate employee retirement plans should include options for climate-friendly investing. It has resubmitted proposals at three companies from last year and filed at two new targets—Campbell’s Soup and Netflix.

Anti-ESG

While much recent public controversy about sustainable investment has centered around climate change and fossil fuel companies, almost all the shareholder proposals from organizations opposed to ESG investment considerations instead concentrate on social policy. There is simply not much support for shareholder proposals with right-wing ideas, however; votes average 4 percent or less. In mid-February last year, Si2 had identified 27 anti-ESG proposals and for 2023 there are at least 40, a big jump that suggests last year’s surge will be surpassed.

Proponents include longtime players such as the National Center for Public Policy Research (NCPPR) and the National Legal and Policy Center (NLPC); they are joined this year by purveyors of “biblical investing” and individuals with close ties to rightwing organizations like the Alliance Defending Freedom and Consumer’s Research. These groups are actively discouraging consideration of ESG factors in state investments, supporting a wave of statehouse bills nationwide, although a recent analysis in The Washington Post suggest a backlash to such efforts has begun.

Human rights and diversity: Proposals in 2023 reprise concerns about ties to the Communist Party in China, which as noted above is a shared concern with progressive groups; early votes will occur at Apple, Starbucks and Walt Disney but six more also are pending—all from the NLPC.

NCPPR and its allies continue to assert that corporate efforts to improve diversity, equity and inclusion discriminate against white people or those with conservative political views, with seven proposals; four more contend additional liberal business bias. One suggests AT&T’s decision not to renew its contract with the news outlet One America News was politically motivated. Another says Meta Platform’s content moderation has a liberal bias informed by Biden administration interference. In the same vein, more new proposals allege major banks inappropriately worked with the Biden administration or state governments to close accounts and violate individuals’ constitutional rights to bear arms and/or exercise free speech.

Political influence: A new proposal questions the benefits of external partnerships and asserts ties with leading business and foreign policy organizations such as the World Economic Forum, the Council on Foreign Relations and the Business Roundtable. It says such ties are inconsistent with the fiduciary duty to maximize shareholder profits.

Climate change: Three proposals question the benefits of corporate efforts to combat climate change, saying it is a futile waste of money.

Sustainability: Procedural filing errors have blocked consideration of a new proposal filed at Levi Strauss and Warner Brothers Discovery that claimed corporate support for civil rights groups encourages crime and “civilization-destroying developments.”

Health: A new proposal at Eli Lily from NCPPR seeks a report on how the company’s public statement in support of abortion rights undercut its diversity policy and respect for those who oppose abortion.

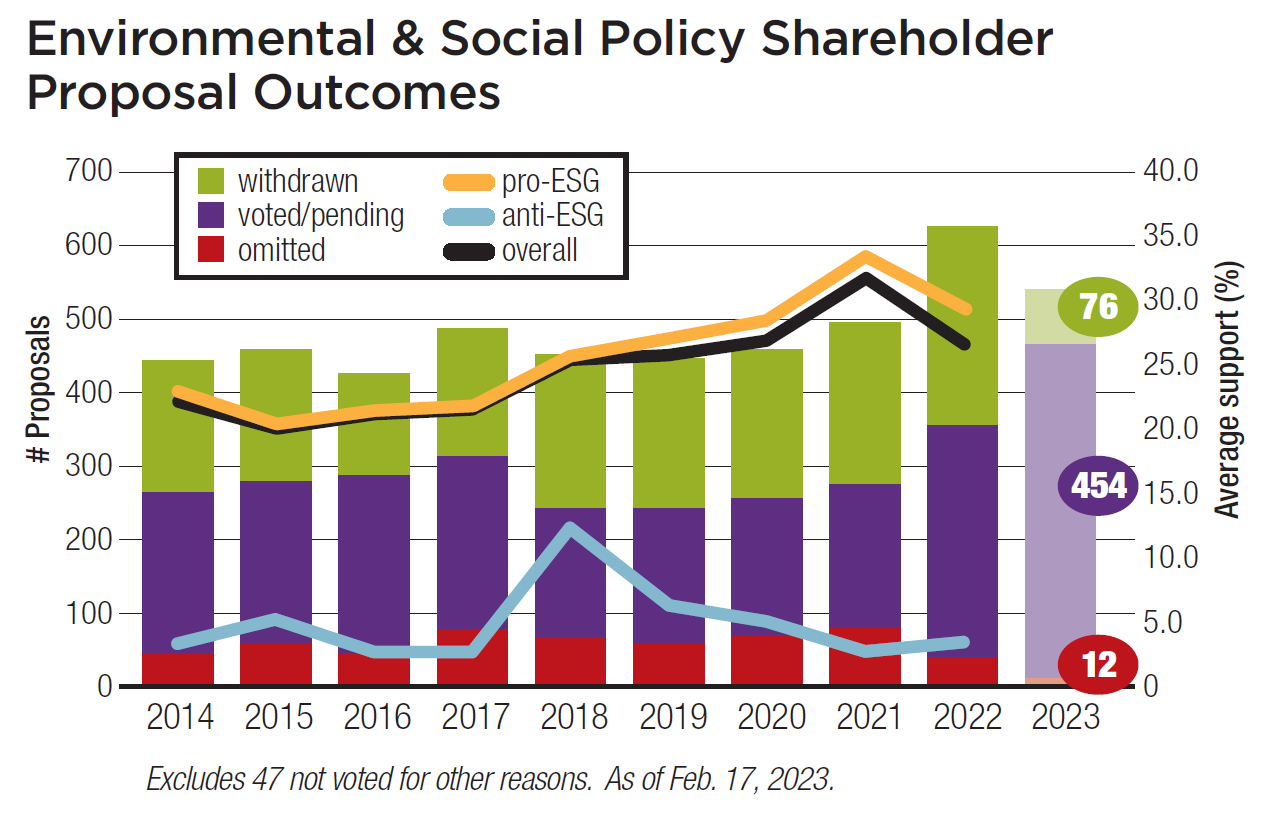

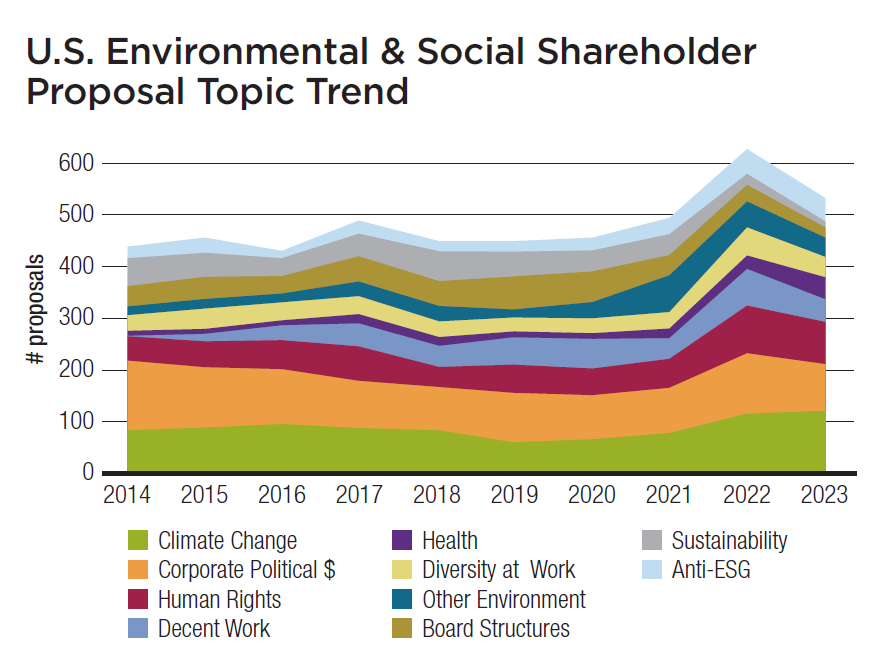

Proposal Trends

The charts below illustrate long-term trends for proposal filings. The first shows the dominance of political influence and climate change, a recent rise for human rights, growth for decent work, workplace diversity and health—and falling numbers for boardspecific and sustainability. Anti-ESG proposals have grown but remain a minor part of proxy season and support for them has not risen.

The second illustrates shifts in the types of shareholder proponents who are lead proposals filers. (Because many faith-based investors of the Interfaith Center on Corporate Responsibility co-file with other proponents and may not be lead filers, the chart significantly undercounts their participation.) The growth in foundation filers is primary attributable to As You Sow.