This section provides a look at the key issues raised in each of the topics covered in this report, giving special attention to new developments and basing the analysis on what is requested in the resolved clauses of resolutions.

Environment

Climate change has jumped to the top of the proxy season agenda this year and is the biggest single topic. Climate-related concerns undergird a growing number of proposals that seek consistency between corporate policy and political influence, too. Resolutions about environmental management also implicitly address the climate, but so do new human rights resolutions about environmental justice. In all, there are 145 proposals about the environment, up substantially from 91 last year.

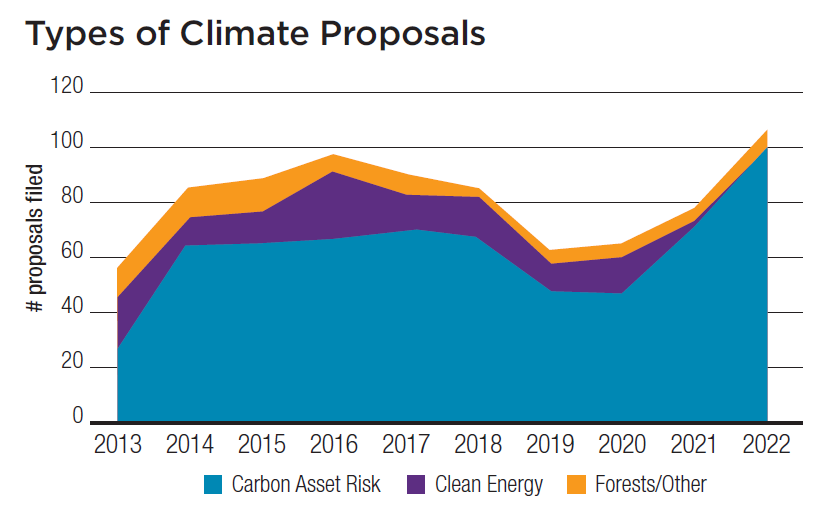

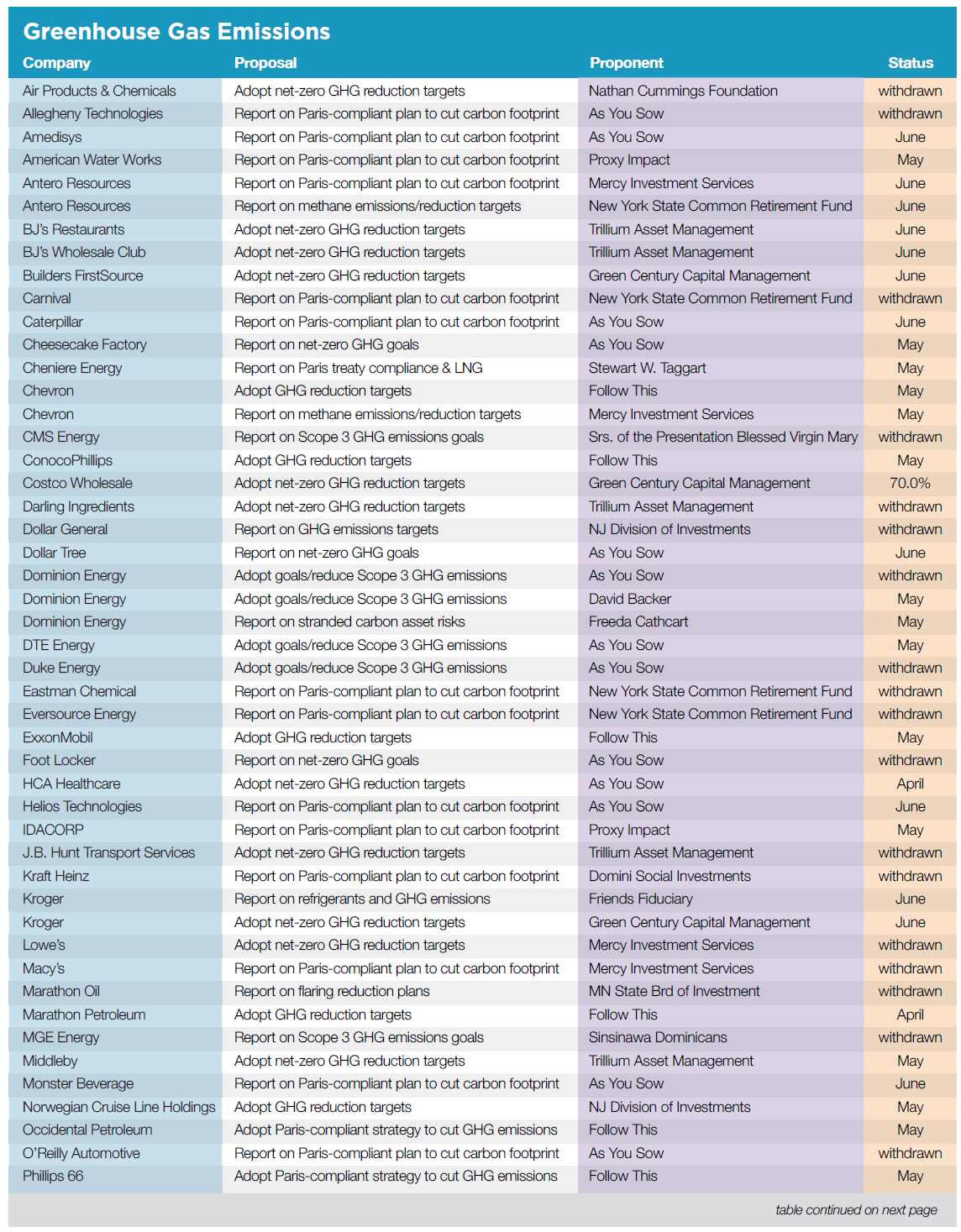

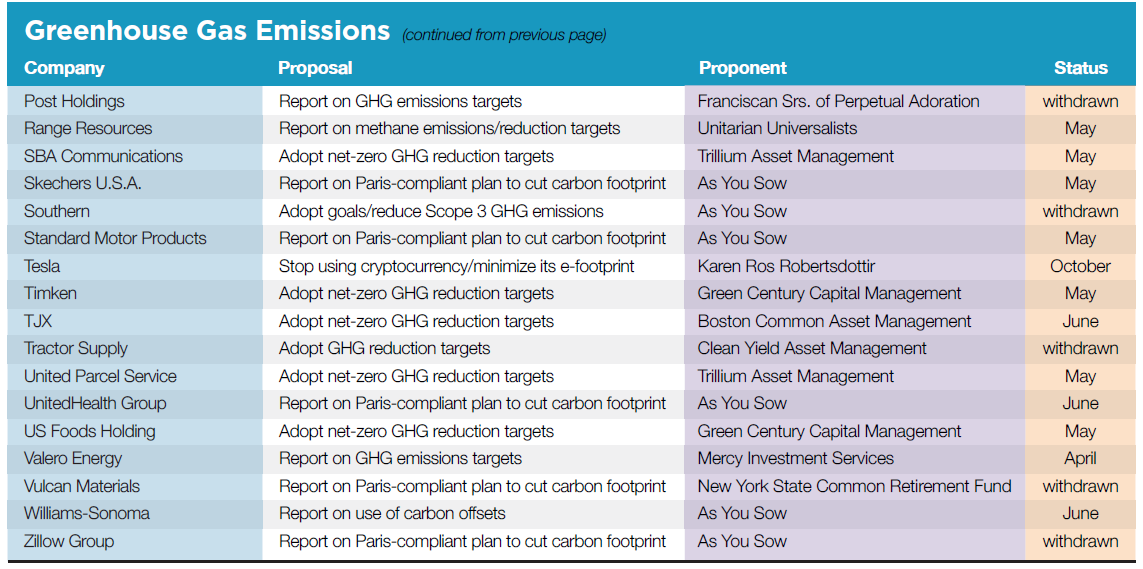

Climate change: The number of proposals specifically on climate change has nearly doubled to 110, up from 79 last year and well above this decade’s previous peak of 83 in 2018. An additional 20 proposals raise questions about climate-related political influence, plus two on board oversight. A striking change is the near-total focus on greenhouse gas (GHG) emissions targets, with most proposals asking for a transition to net-zero status by 2050. Only eight ask about deforestation and water.

Carbon asset risk—Sixty-eight of the 101 resolutions about carbon asset risk address emissions (up from 29 at this point last year). More than two dozen ask companies to set goals, with a new focus on all types of GHG emissions, including those that come directly from company operations (Scope 1), indirectly from energy purchases (Scope 2) or indirectly from other value chain activity—mainly from the use of products and services (Scope 3). The latter make up the bulk of most companies’ carbon footprints. The way opened for this return to specificity about emissions and goals timing when the Securities and Exchange Commission (SEC) rescinded three Staff Legal Bulletins from the Trump era last November. Many of the proposals are at companies that have never been asked before about climate change.

Proponents are starting from a position of strength established last year when average support for climate proposals topped 50 percent for the first time. Building on this momentum, the 2022 season began with a bang when Costco Wholesale investors gave 70 percent support for setting net-zero GHG goals.

At Williams-Sonoma, a new resolution raises concern about the company’s apparent reliance on carbon offsets to reach its net-zero goal, something that does not pass muster for those advocating for “science-based” targets. Methane emissions from up and down the natural gas value chain underscore the its heavy carbon impact, prompting withdrawals and early commitments for better accounting and reporting at Dominion Energy, Duke Energy and Southern.

An Icelandic investor raises an entirely new subject, the inordinately heavy carbon footprint of cryptocurrency—caused by its high energy demand for computation—in a resolution at Tesla, although it faces a challenge at the SEC.

Another new proposal asks insurers and banks to stop all financing and underwriting of fossil fuels; additional proposals also seek related reports. Also in the financial sector is another new angle, a request at credit ratings firms to extend the timeframe for considering the impact of physical risks. S&P Global agreed timing for ratings is a valid concern and made changes, prompting James McRitchie to withdraw. Another early win for proponents has occurred at Dominion Energy; the New York City Comptroller’s Office asked the utility to align its capital expenditures with its GHG emissions targets and the company agreed to do so.

Audits—A key concern for financial analysts and investors is whether information reported by companies is accurate and last year proponents started asking for formally audited climate reports, producing high votes of 47.8 percent at Chevron and 49.4 percent at ExxonMobil. This year, more such proposals have been filed at a total of nine banks, utilities and energy companies. The SEC’s new mandatory climate reporting rule, expected this spring, may address this issue for all public U.S. companies.

Strategy—Two new proposals seek to address expected social inequities as the world warms and economic disruption affects the most vulnerable. One at Chevron asks about financial and ecosystem risks and threats to indigenous peoples in the Arctic, while another asks Marathon Petroleum to explain its compliance with the Just Transition guidelines issued by the International Labour Organization, including impacts on workers and communities.

Environmental management: After gradually diminishing from a high of nearly 50 proposals 10 years ago, the number of environmental management proposals has risen again, to 35, with more likely.

Plastic—Most proposals are about plastic, asking companies to make less, use less and rethink one-time applications to address a growing crisis; the Pew Charitable Trusts estimates that plastic flows into oceans may triple by 2040, with many consequent ills for human and animal life. Last year, Green Century celebrated when Coca-Cola announced it would cut virgin plastics use by 3 million tons by 2025, but it is back with a request for more refillable containers.

Repair—The “right to repair” is raised in a new proposal still pending at Alphabet; the aim is to make it easier and cheaper for consumers to repair equipment and reduce waste. Microsoft announced last October it would allow independent repair of its products in response to an As You Sow proposal, and Green Century heralded Apple’s similar announcement early this year, which prompted it to withdraw its proposal.

Chemicals—New proposals about chemical footprints ask consumer goods companies to report; resolutions are pending at Bed Bath & Beyond, Burlington Stores and Dollar General.

Agriculture—Four proposals ask companies to consider their contributions to antimicrobial resistance, which last year persuaded Yum! Brands to issue a report. Four more, mostly at new recipients, ask about pesticide risks from the food supply chain. Yet another agricultural issue—farm animal welfare—is raised in a proposal from the Humane Society of the United States that contends Wendy’s is not doing enough to ensure hogs in its supply chain are well treated. A similar resolution will appear at McDonald’s. (Outside the scope of this report is a related effort by billionaire investor Carl Icahn to elect dissident directors at McDonald’s, including Leslie Samuelrich of Green Century, over concern about pigs suffering in the supply chain.)

Mining—Green Century wants a report from Chemours about the wisdom of acquiring a titanium mining project on the edge of the Okefenokee Swamp, in a new proposal seeking a report on financial and reputational risks.

Social Issues

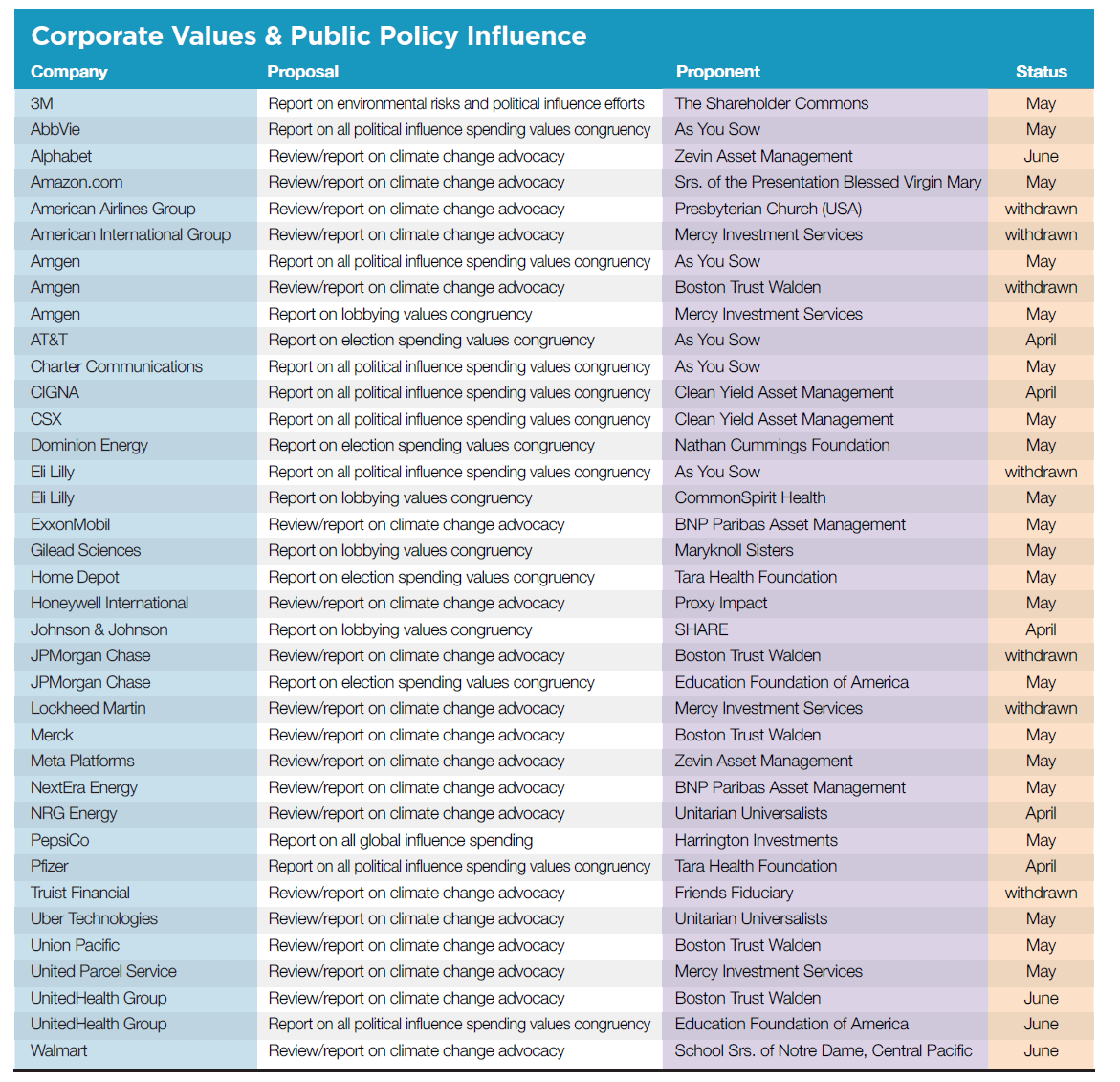

Corporate political influence: The array of proposals asking companies how they oversee and spend in the political arena is shifting. While still primarily focused on governance and disclosure, they increasingly question which issues companyconnected money supports. Climate-related lobbying proposals are Exhibit A for this phenomenon, but many new variants this year request reports on how companies address other conflicts between stated policies and the aims of politicians they help elect, and the nature of their lobbying that occurs well after elections are over.

While companies routinely assert their spending is bipartisan, Si2’s research (noted in last year’s Proxy Preview) finds this is largely not accurate when it comes to expenditures at the state level, where spending closely tracks dominant parties; preferences also vary considerably at the national level. With the United States increasingly bifurcated into hostile political camps, companies face increasingly fraught challenges, which the Center for Political Accountability (CPA) has explicated in several recent reports. Evidence suggests most large companies are unlikely to sustain their initial pledges to cut off funding for members of Congress who voted to overturn the 2020 election. But the attack on the U.S. Capitol on January 6, 2021, continues to resonate and it is abundantly clear that pressure will intensify about support for politicians, committees and groups who voice highly contested positions. Intense battles over abortion rights, LGBTQ protections, voting rights and a host of other contentious topics await any company that spends.

Filings and new angles—Two dozen proposals ask for CPA’s election oversight and disclosure approach, while 37 seek the same for generalized lobbying, plus the 20 noted above that focus on climate-related lobbying. Even more significant, though, are the 19 proposals that ask about inconsistencies between stated corporate values and the views held by recipients of company-connected money. In addition to reproductive rights (raised by Rhia Ventures and allies), the proposals ask about civil rights, healthcare access generally and environmental policy. A brand-new issue comes from Harrington Investments, which wants PepsiCo to report on spending outside the United States on elections, lobbying and philanthropy, given its concerns about food policy in Mexico, although PepsiCo has a pending SEC challenge.

Years of proposals at ExxonMobil culminated last year in two majority votes—64.2 percent in favor of a proposal sponsored by BNP Paribas Asset Management seeking more disclosure on climate lobbying and 56.1 percent in favor of the general lobbying proposal from the Teamsters. On February 18, 2022, the company released a new report that is in “direct response” to the Teamsters proposal and “a significant step in our ongoing efforts to improve transparency and build trust among our stakeholders. We believe this establishes a new standard in reporting.” It plans another report soon on climate lobbying. The extent to which other companies emulate Exxon is one of the key questions for this proxy season.

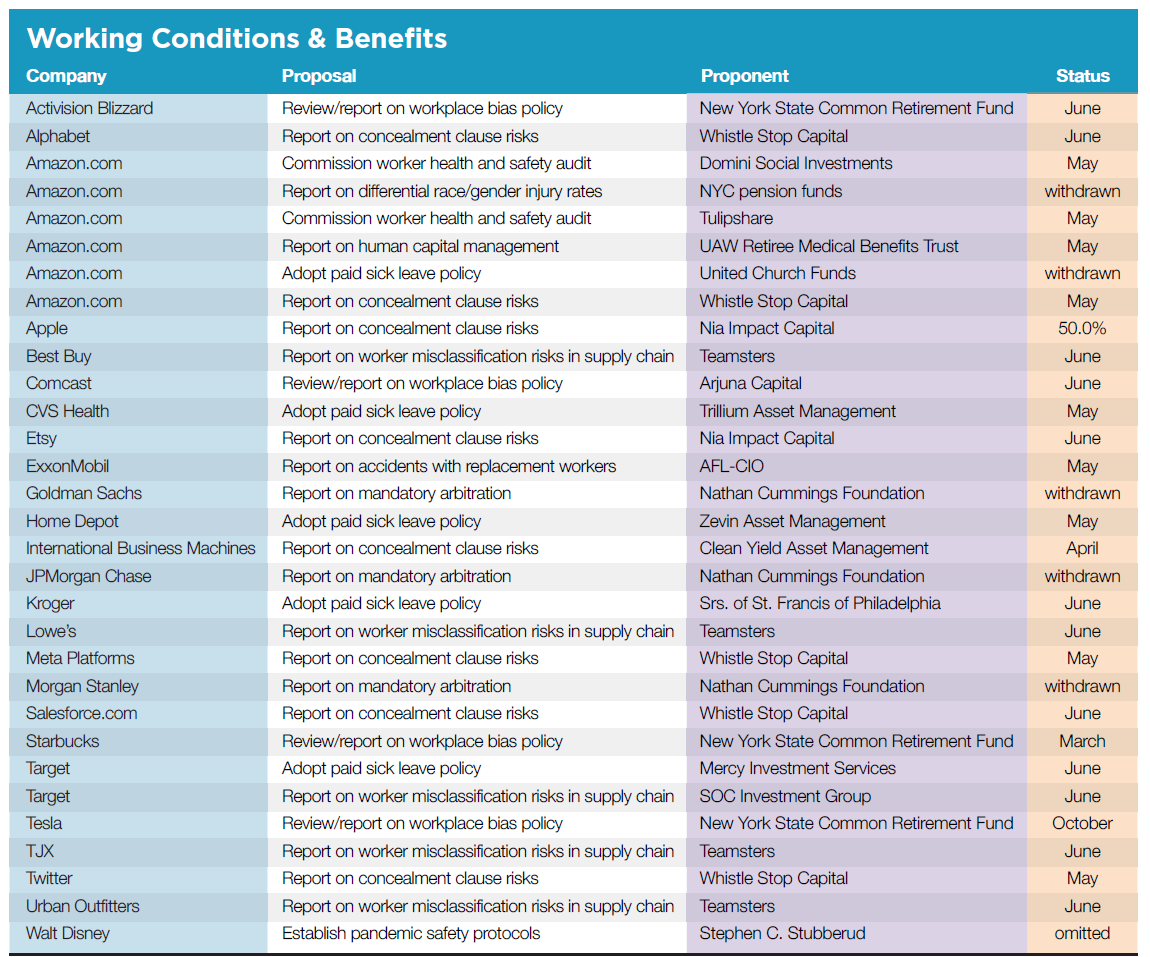

Decent work: Just over half of the 65 proposals about decent work address differential compensation and discriminatory pay gaps, while the rest ask for more disclosure about working conditions, including anti-bias policies, worker safety and benefits.

Executive pay differentials—James McRitchie poses a new resolution at 13 companies about employee stock ownership regarding CEO pay differentials, but also asks about such ownership by job category. He posits that companies and investors benefit from an “ownership culture,” and so far has reached six agreements. Faith-based groups have new resolutions about low wages at four retailers and restauranteurs, and The Shareholder Commons suggests companies should examine their short-term financial priorities and report on wage inequality.

Race/gender—As in the past, resolutions from Arjuna Capital and Proxy Impact seek median gender/racial pay data and seven of nine are at new recipients. Further, a resubmission from the Franciscan Sisters of Perpetual Adoration asks Walmart to report on pay and racial justice. (It earned 12.7 percent last year.)

Working conditions and benefits—New angles abound in the 31 proposals on working conditions. Eight ask about concealment clauses that can hide malfeasance, the first earned 50.4 percent on March 4 at Apple. The Teamsters want reports on worker misclassification in the supply chain, pointing to potential liability given a new California law about port workers that is fueling a unionization drive. The New York City Comptroller asks Amazon.com about differential injury rates for people of color and women, while other proponents want it to release an audit of worker health and safety. The AFL-CIO wants to see safety figures for replacement workers at ExxonMobil and an individual seeks stringent pandemic safety protocols at Walt Disney. Five companies also have paid sick leave proposals.

Nearly all the new resolutions face challenges at the SEC, which historically has been skeptical that such workplace issues transcend ordinary business. The November SEC Staff Legal Bulletin 14L suggests fewer proposals will be omitted on these grounds if they raise public policy issues, though, and the outcome of challenges to the decent work resolutions may show how far the Biden administration’s SEC will go.

Diversity in the workplace: Shareholder proponents responded last year to the Black Lives Matter movement by filing dozens of resolutions seeking more diversity data. They withdrew many after company commitments and that seems likely again. The number has dropped back from the 70 filed last year but is still high, with 48 resolutions filed.

The spotlight remains on disclosure. In 2021, the New York City Comptroller filed a slew of requests for EEO-1 data— a snapshot of employee information broken down by standard job categories, race, gender and ethnicity, and it has done so again in 2022. As You Sow and allies such as Nia Impact Capital and Whistle Stop Capital this year also are continuing to ask—at two dozen companies—for granular information on diversity and inclusion program performance. NYSCRF combines pay and diversity data disclosure in several categories in a new proposal at Electronic Arts, Monster Beverage and Take-Two Interactive Software, invoking data companies must provide under a new California reporting mandate.

Other proposals ask about diversity in the executive suite (withdrawn by Trillium Asset Management at Ormat Technologies) and racism in the workplace (pending at Intel and PayPal). The AFL-CIO has a new resolution asking Amazon.com about the pandemic’s impact on diversity, but it faces an SEC challenge. The company has received so many somewhat similar proposals that this, like others, may be winnowed out on the grounds they are duplicative.

Ethical finance: Two proposals on ethical finance are being challenged—one on tax compliance metrics at Amazon.com (referencing the Global Reporting Initiative standard articulated in 2019) and another on the ethics of canceling users’ access to the PayPal platform. Both face uncertain SEC outcomes.

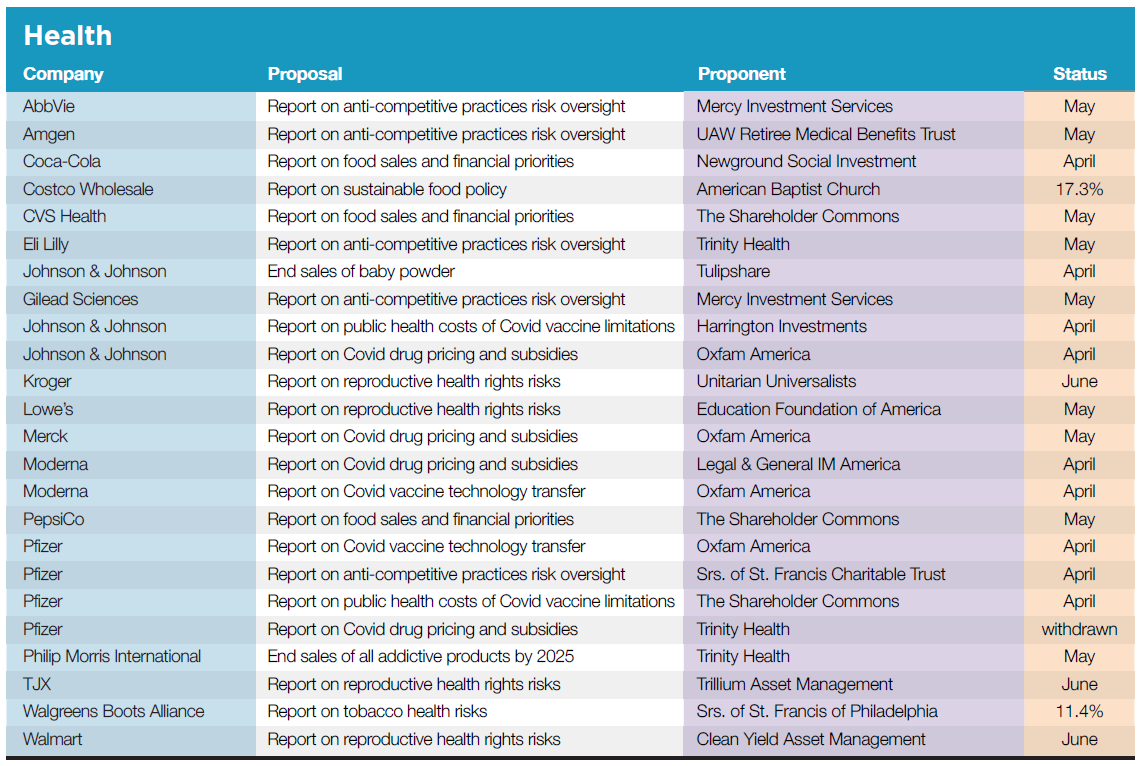

Health: Shareholder proponents are reprising longstanding criticism about how pharmaceutical companies price their drugs and other treatments, focused on Covid-19 and fair access, but also on the perennial question of high prices. In addition, another set of proposals seeks disclosure about public health, including most prominently reproductive health access for employees given growing U.S. restrictions on abortion, and tobacco. Rhia Ventures is coordinating the reproductive health proposals, in additional to those noted above about corporate influence spending. In all, just five of 24 proposals filed are resubmissions that went to votes last year.

New angles—Oxfam America has a new resolution at Moderna and Pfizer about sharing intellectual property and technical knowledge to expand access to Covid-19 vaccines and treatments in low- and middle-income countries, where the coronavirus pandemic continues to hit hard and both vaccines and treatments remain scarce. The Shareholder Commons suggests the public health costs of not sharing know-how will negatively affect long-term investors and wants a report at Johnson & Johnson and Pfizer. Both these proposals have survived SEC challenges. In addition, members of the Interfaith Center on Corporate Responsibility newly ask five drug companies to report on the risks of monopolistic behavior, what they call “anti-competitive practices.” There are new angles about food, public health and financial priorities at Coca-Cola, CVS Health and PepsiCo, too, but all the companies have lodged SEC challenges.

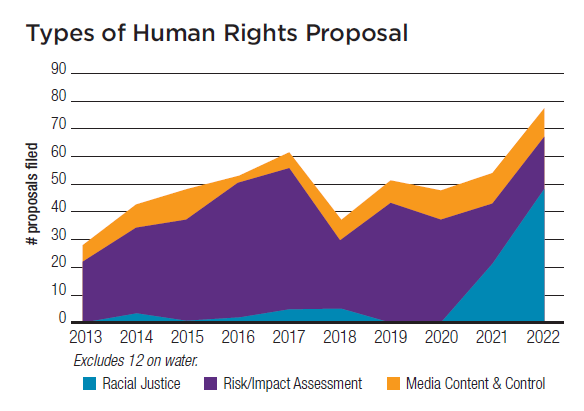

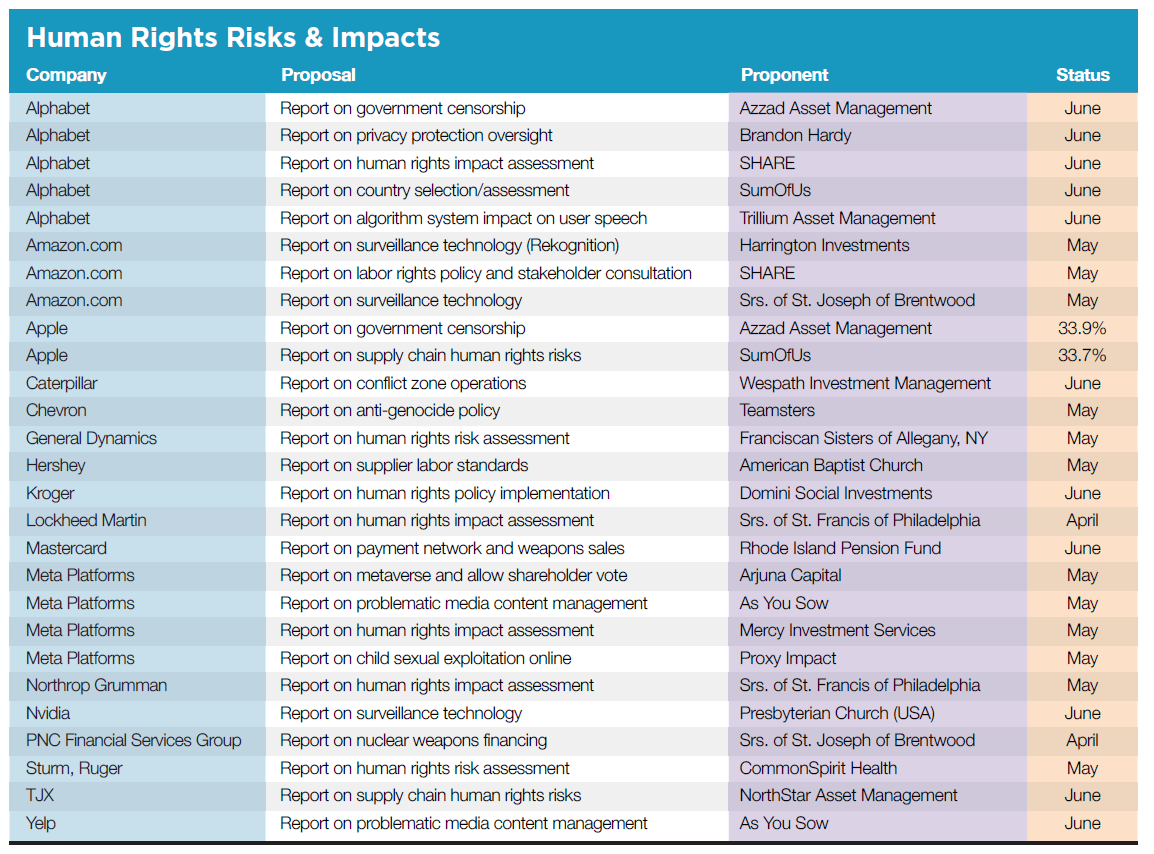

Human rights: One reason for the surge in filings this year is the 40 percent increase in those about racial justice; additional resolutions also reprise longstanding questions about corporate policies and disclosure on human rights at home and abroad.

Racism—The proponents highlight systemic racism and company connections to it, pointing to new commitments but also deep underrepresentation for people of color in upper-level jobs and continued problematic behavior. They argue addressing racism creates both profit and justice. Proposals name specific stakeholder groups to consult and all seek external expertise and advice. All but six of the 2022 proposals are at new recipients. Last year, most of the racial justice proposals went to financial firms the proponents considered systemically important, but the campaign has branched out to encompass retailers, food purveyors, healthcare companies, industrial and materials firms, the tech sector and utilities. The proposals come from a mix of proponents, coordinated in large part by the labor-affiliated SOC Investment Group (formerly CtW).

Five new proposals discuss “environmental justice,” seeking risk and impact reports from 3M, American Water Works, Chemours, Chevron, Honeywell International and Kinder Morgan. Another asks Citigroup and Wells Fargo for an evaluation of their policies on Indigenous peoples and project financing. Parnassus Investments want a report from Cerner on how its algorithms may slant healthcare delivery, while Arjuna Capital is trying again to question providing insurance to police involved in racist acts, at Travelers (it was omitted last year at Chubb).

Risks and reporting—Only 15 resolutions voice longstanding requests for assessments of human rights policies and risks, but there are a couple of new angles. China’s oppression of the Uyghur people is at issue in several proposals, with two votes at Apple on March 4 of about 34 percent; other proposals also ask about business connections with hotspots around the world. A new resolution at Hershey is about child laborers and cocoa in West Africa. Domini Social Investments seeks a report on pandemic safety protections for farmworkers in the Kroger supply chain. Finally, the Canadian Shareholder Association for Education and Research (SHARE) asks Amazon.com about respecting labor rights. Otherwise, proponents raise persistent concerns at weapons makers and tech firms.

Media—All the major social media platform companies face resubmitted proposals about surveillance, censorship and content management. SHARE and Trillium Asset Management each have new questions about Alphabet’s plan to revamp its Search function, and its algorithms, and face SEC challenges. Meta Platforms has a resubmitted proposal by Proxy Impact about online child sexual exploitation on the Facebook, Messenger and Instagram platforms, while Arjuna Capital wants both a report and a shareholder advisory vote on the company’s “metaverse” concept.

Weapons—A resubmitted proposal asks PNC Financial about financing nuclear weapons (it earned 7.9 percent last year), while a new proposal from the Rhode Island Pension Fund is focused on Mastercard’s payment system that may be used for selling untraceable “ghost guns,” in a new proposal that faces a challenge at the SEC.

Sustainable Governance

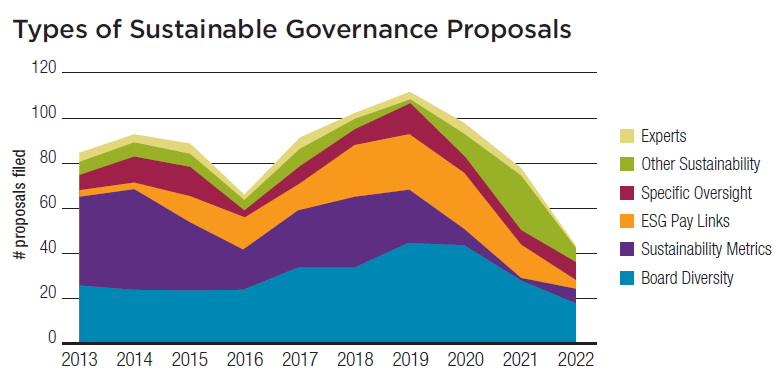

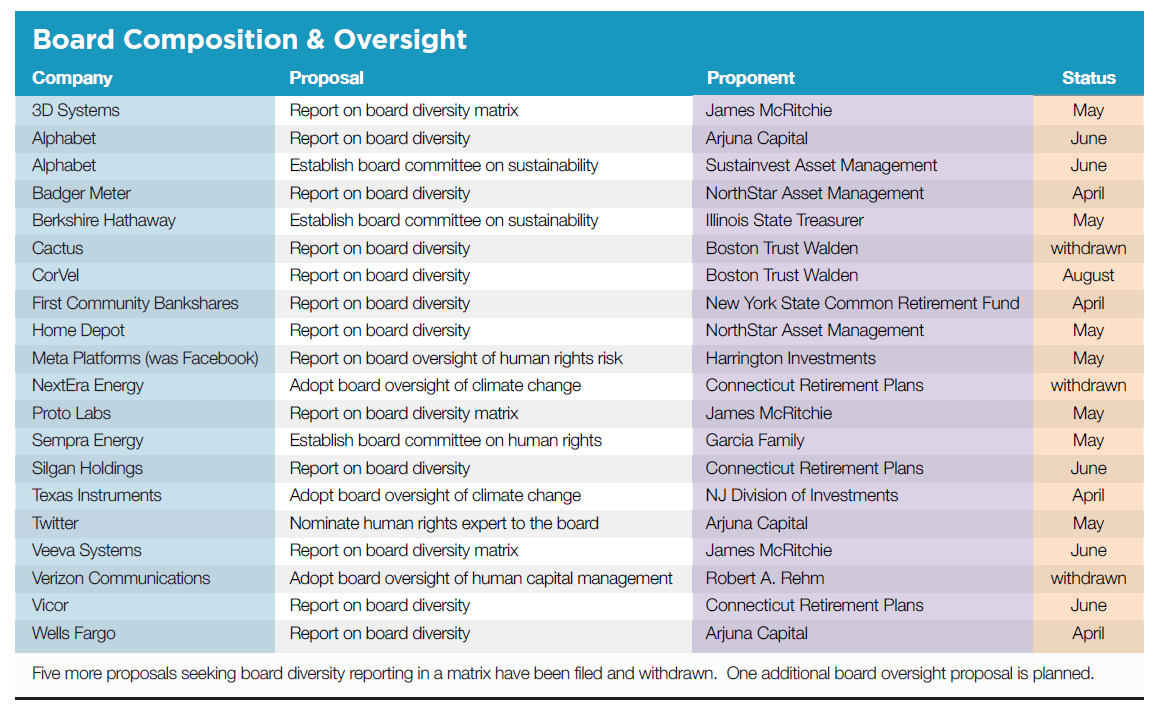

Proposals seeking generalized reports on sustainability and specific policies on board diversity are drying up as companies act on both fronts. This year, 19 proposals ask about board composition (mostly diversity), eight seek specific types of board oversight (including one on climate change pending at Texas Instruments), and 14 more raise broad concerns about corporate governance arrangements and reporting to investors. But the total number of proposals filed on these topics has dropped to 34, down from 78 last year and a high of 112 in 2019.

What’s not happening is notable—just three resolutions seek sustainability reports (only one is still pending) and only one asks for reincorporation as a social purpose company (it has earned 3.1 percent at Apple). Last year’s “public benefit” corporation proposals earned scant support, so the organizer for that effort, The Shareholder Commons, is taking a different approach, emphasizing various forms of systemic investment risks.

Furthermore, recent developments in financial regulation and investor practice show how well accepted the idea of board diversity has become. Both the leading U.S. proxy advisory firms recommend against electing directors when board diversity is lacking, a new mandate on including at least one woman on the board in California is law (despite a court challenge), and last August the Nasdaq exchange attained approval from the SEC for its new rule that requires its listed companies to have at least two diverse directors or explain why they do not, with reporting in the matrix format long espoused by shareholder proponents. Still, while women now are gaining ground on corporate boards, most big companies are far away from reflecting the increasing ethnic and racial diversity of the United States.

New angles—The Shareholder Commons has new resolutions at four companies about how investment stewardship and social media firm financial priorities affect society, capital markets and long-term investment return. Finally, As You Sow faces a challenge to its new request at Amazon.com and Comcast for low-carbon employee retirement plan options.

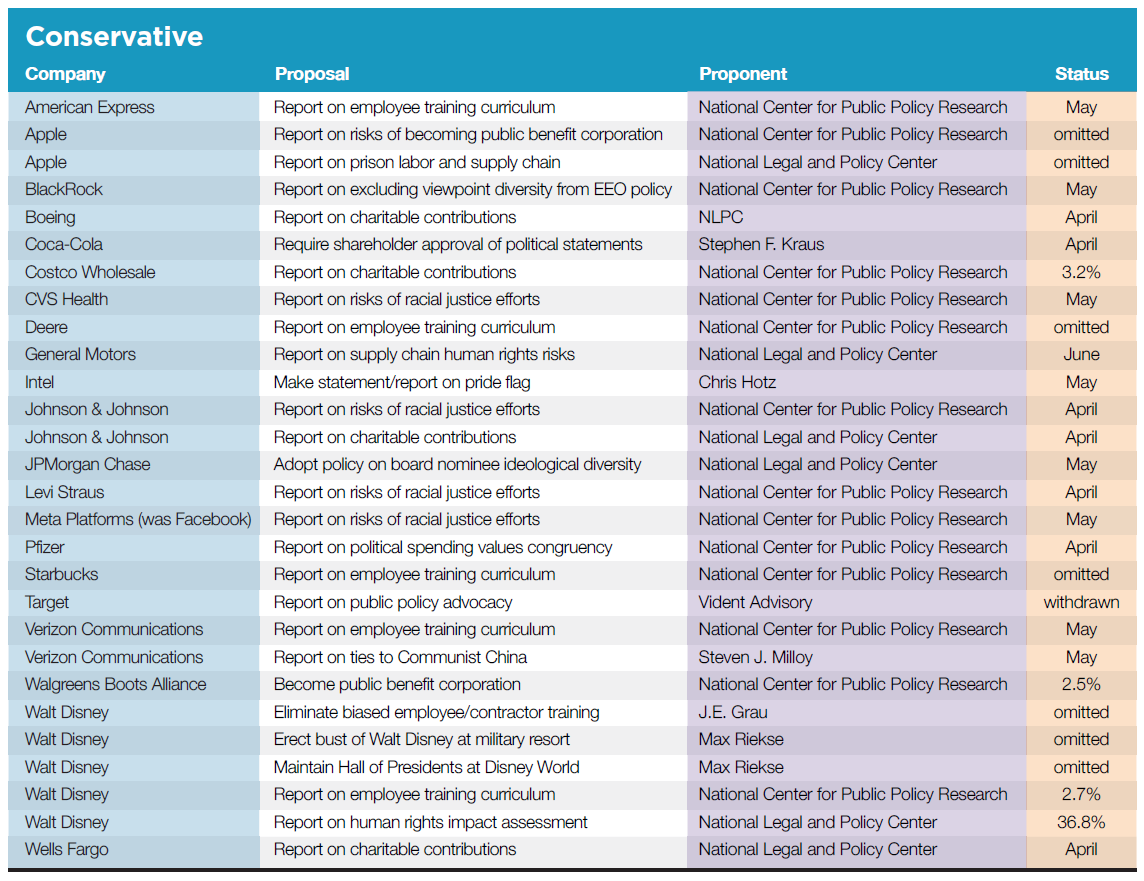

Conservatives

The field of proposals from politically conservative groups, chief among them the National Center for Public Policy Research (NCPPR), continues to focus heavily on social policy. It is joined this year by the National Legal and Policy Center (NLPC). Resolutions from these and similarly minded proponents seek action that is the mirror image of what all the other proposals request, aside from doing business in China.

At least 27 proposals have been filed thus far, evenly split between diversity (nine), corporate political influence and charitable giving (nine) and human rights (eight), with one about the risks of reincorporation as a public benefit corporation omitted.

New angles—NCPPR wants at least five companies to report on their employee training curriculum, arguing that diversity training disadvantages White people. After failing to make it past the SEC for a few years, the NLPC also has hit upon language that the commission finds acceptable; it wants detailed semi-annual reports on any charitable contributions of $1,000 or more. Costco Wholesale investors gave the idea 3.2 percent support in January and it is pending at three more companies.

NCPPR has copied verbatim the resolved clause of the election spending values congruency proposal submitted last year by Tara Health at Pfizer and sent it in early—while advocating against the causes Tara supports, chief among them reproductive health rights. The company has told the NCPPR resolution pre-empts the one from Tara and this argument could prevail.

Using the same copycat approach, NCPPR has a new resolution very similar to the racial justice audit proposals, but outside the resolved clauses warns of excessively “woke” corporate behavior, reiterating the view stated in the training resolutions that White people face discrimination and corporate America lacks sufficient representation from ideological conservatives. The proposal faces SEC challenges from three more companies, but may pre-empt the ICCR-sponsored proposal at Johnson & Johnson.

Proposal Trends

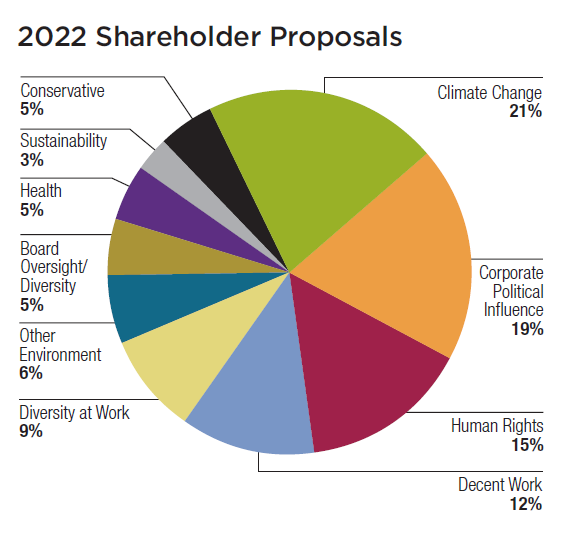

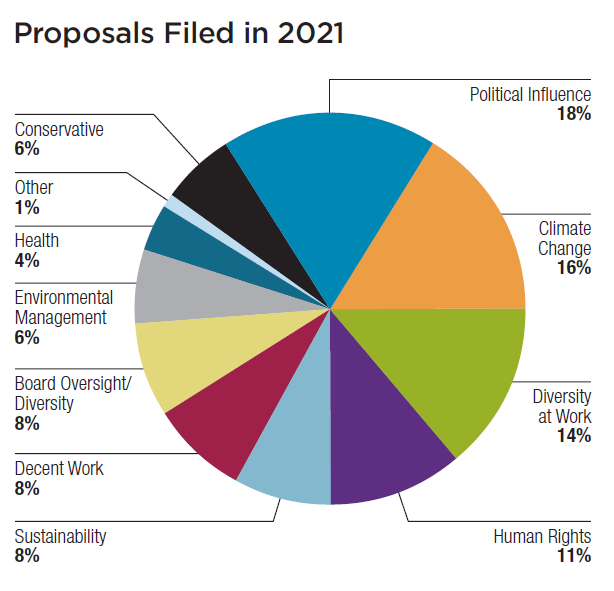

The charts below illustrate long-term trends for proposal filings. The first shows the dominance of political influence and climate change, a recent rise for human rights, growth for decent work and workplace diversity, and a drop-off in board oversight and diversity, as well as a decline for overarching sustainability proposals.

The second illustrates shifts in the types of shareholder proponents who are lead filers of proposals. (Because many faith-based investors of the Interfaith Center on Corporate Responsibility co-file with other proponents and may not be lead filers, the chart undercounts their participation.)